Judo, one of Australia's newest banks, increased various term deposit rates by up to 8 basis points this week, including the rate of its one-year personal term deposit which now has an interest rate of 1.38% p.a.

However, Judo also cut various other rates by up to 10 basis points, such as the five year personal term deposit which fell from 1.50% p.a. to 1.40% p.a.

These changes come at a time when more than 30 different banks have slashed term deposit rates during August, some by as much as 90 basis points.

Want to earn a fixed interest rate on your cash? The table below features term deposits with some of the highest interest rates on the market for a six-month term.

These include bigger banks such as NAB (15 basis points) and Commonwealth Bank (5 basis points).

Judo Bank General Manager of Deposits Patrick Nolan said deposits were key to the bank's growth.

"To be able to fund Judo’s growth and therefore continue to support SMEs (Australian small and medium enterprises) across Australia, more term deposits will be required," Mr Nolan said.

"In addition, Judo is also keen to reward our customers for selecting one of the newest ADIs in Australia."

Term deposit rates as a whole are extremely low at the moment, and have fallen far since the Reserve Bank cut the cash rate for the first of five times in under a year back in June 2019.

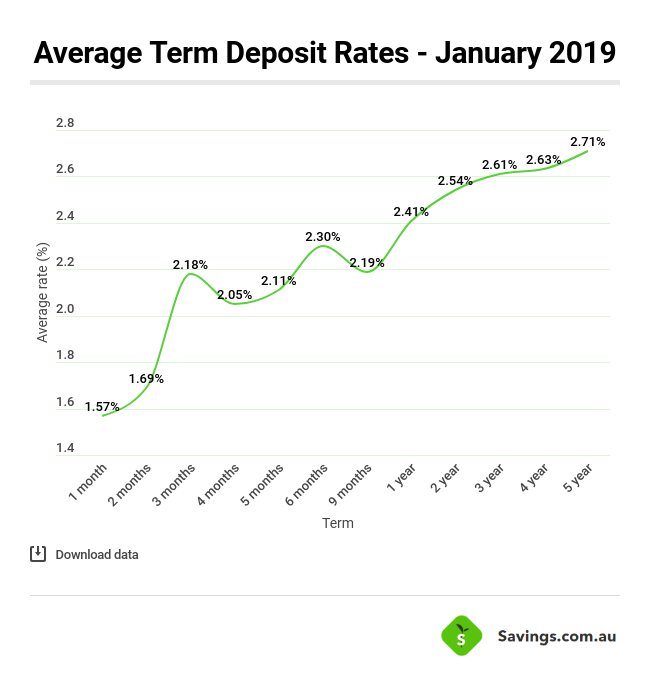

Prior to these cuts, the average term deposit rate across all terms offered on the market for a $10,000 deposit was around 2.30% p.a.

Now, after comparing the market again, the average term deposit rate across all terms sits at just 0.75% p.a, and no single term has an average interest rate of more than 1% p.a.

This means Judo's interest rates actually sit well above the market average.

Mr Nolan said customers should still consider putting their money in a term deposit.

"Rates may increase or decrease based on a number of different factors, however, regardless if you wish to deposit for three months (1.36%) or up to five years (1.45%), Judo is here to help and offer some of the most stable and consistent rates in the market," he said.

"Term deposits offer a guaranteed return, as your money is fixed in the term deposits. In these times of uncertainty, this is a small piece of certainty you can rely on."

You can see the difference between term deposit rates in early 2019 and now in the infographic below.

Other term deposit rate changes: August 2020

As mentioned, Judo isn't alone in making term deposit rate changes this month, as there were several dozen others.

Some of the banks to change term deposit rates in August include the likes of:

- ING: Decreased term deposit rates by up to 30 basis points

- UBank: Decreased term deposit rates by up to 15 basis points

- NAB: Cut term deposit rates by up to 15 basis points

- CBA: Cut term deposit rates by up to 5 basis points

- Newcastle Permanent: Decreased term deposit rates by up to 20%

- IMB: Cut term deposit rates by up to 15 basis points

- Suncorp: Cut and raised term deposit rates by up to 50 basis points

- Bendigo Bank: Cut term deposit rates by up to 10 basis points

- Macquarie Bank: Cut term deposit rates by up to 10 basis points

- CUA: Decreased term deposit rates by up to 25 basis points

Illawarra Credit Union meanwhile, while not a larger bank, made the biggest cut to term deposit rates by 90 basis points.

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Dominic Beattie

Dominic Beattie