Macquarie Bank reduced a variety of its term deposit products by as much as 15 basis points on selected term deposit products ranging in length from one month to five years.

NAB-owned digital bank UBank cut rates on its one-month to 12-month term deposits, with the highest rate change being a 20 basis point decrease.

This is just the latest in a string of rate movements from major providers, with NAB also dropping interest rates by up to 20 basis points last week.

Over the past few weeks, ANZ & Commbank have dropped rates, as have Greater Bank, Heritage Bank and The Mutual.

UBank: key changes

A lot of UBank’s changes were made to SMSF deposits, which we haven’t included in this table.

Some of the changes on common term lengths can be seen below.

| Term | Old interest rate | Change | New interest rate |

| One month | 2.1% | -0.2 | 1.9% |

| Three months | 2.7% | -0.1 | 2.7% |

| Six months | 2.75% | -0.1 | 2.65% |

| Nine months | 2.75% | -0.1 | 2.65% |

| Twelve months | 2.75% | -0.1 | 2.65% |

Macquarie Bank: key changes

Macquarie Bank had more changes made to its term deposit products than UBank.

Now, customers can actually get a higher rate with shorter term deposits than they can with long term deposits, which is unusual.

| Term | Old interest rate | Change | New interest rate |

| Six months | 2.75% | -0.05 | 2.70% |

| Nine months | 2.75% | -0.05 | 2.70% |

| One year | 2.80% | -0.1 | 2.70% |

| Three years | 2.70% | -0.15 | 2.55% |

| Five years | 2.70% | -0.15 | 2.55% |

How do these term deposits compare to the rest of the market?

The answer to this question depends on the term being looked at, but both UBank and Macquarie’s rates are still fairly competitive – less so than they were before slashing their rates.

Both institutions now boast interest rates of 2.75% p.a. and 2.80% p.a. for one-year term deposits respectively.

But some other providers offer rates as high as 2.85% p.a. on one year deposits.

For five-year term deposits, Rabobank is offering (at the time of writing) interest rates as high as 3.20% p.a., compared to Macquarie’s 2.70% p.a.

Why get a term deposit at all?

Compared to other investment options, such as shares and property, a term deposit could offer more stability.

Deposits generally have a near-guaranteed rate of return compared to riskier investments, even if these returns are low, and are protected by a government guarantee worth up to $250,000 per institution.

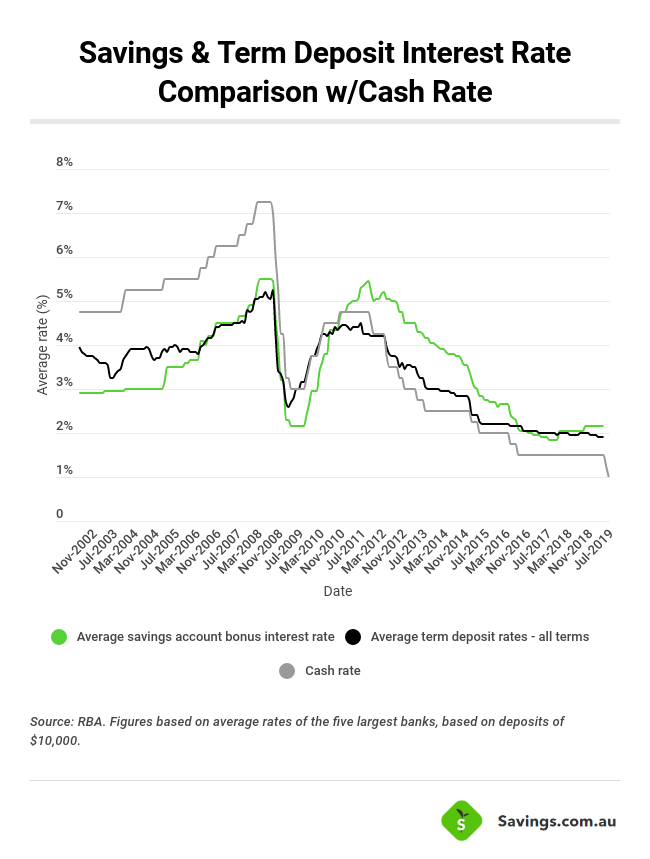

But interest rates are heavily influenced by the cash rate, which is at an all-time low at the moment.

Term deposit rates generally move with the cash rate, as seen in the graphic below.

According to the chief economists from both NAB and Westpac, the cash rate could fall not once but twice by the end of 2019.

Should the cash rate fall by 50 basis points, the average deposit interest rate would also likely fall by a similar amount.

But term deposit rates are fixed, meaning they don’t change at all until the end of the chosen term.

By locking in a term deposit now, customers could avoid these potential drops in interest rates (but can also miss out on future rises).

Bea Garcia

Bea Garcia

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly