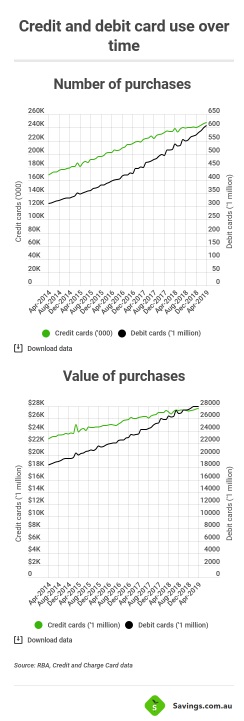

Monthly data from the Reserve Bank for April shows the number of purchases made on credit cards are up nearly 4% on the same month last year, while debit card use has surged by more than 13%.

The final figures saw just under 248 million and 605 million purchases made using credit and debit cards respectively.

Much has been made of the rise of ‘credit card killers’ like Afterpay and Zip over the last couple of years – these two services alone have nearly 1.6 million users in Australia, with many of them preferring alternative payment methods such as these to credit cards.

Yet it appears the prominence of buy now, pay later payments isn’t slowing down our use of plastic (and metal) cards just yet. with the total value of all these purchases also increasing by:

- 2.14% for credit cards (to more than $27.5 billion)

- 8.70% for debit cards (to more than $27.8 billion)

Interestingly we also seem to be more responsible with how we use our credit cards as well, with the total value of credit card balances accruing interest (aka debt) down 2.50% from around $31.9 billion in April 2018 to $31.1 billion in April 2019.

In part, this could be because we’re making bigger credit card repayments, with the value of repayments rising more than 1% in the same time frame from $29.4 billion to $29.7 billion.

The number of cash advances on credit cards – which attract hefty interest charges – also fell by more than 13% over the year, with the value of these advances falling even more by 16.5%.

ATM use falls

Given our preference for card payments over cash, it’s unsurprising to see ATM usage decline over the past 12 months.

While international ATM withdrawals are still up (8% year-on-year), Australians aren’t withdrawing from ATMs in their own backyard as much as they used to, with the number of domestic withdrawals falling by 5.30% over the year to 45.3 million in April 2019.

Withdrawals made at a customer’s own institution’s ATM network are falling even faster, with the latest data showing a near 13.5% annual decline.

It’s not just ATMs that are becoming outdated either. Remember cheques? Their usage year-on-year is down 15.7% over a year, while five-year numbers are down a massive 60.5%.

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

William Jolly

William Jolly