Retirement planning can be a daunting task, ensuring you have enough funds to live comfortably in the second half of life without the burden of running out. Pension may be the main source of income for majority of retirees, but for those who crave a sense of something more, it’s important to plan how to manage your finances now in order to ride them into the sunset.

The average retirement age in Australia

Australia has no definitive retirement age which means if you are in the workforce you can keep working until your heart so desires. It is important to note that when it does come time to retire, ‘retiring comfortably’ enables a healthy retiree, if they so choose, to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of household goods, private health insurance and domestic and international travel, just to name a few.

Retirement and Intentions statistics released by the ABS in 2020 identified the average retirement age as 55.4 years, yet most Australians intend to retire at age 65.5 years.

Of those intending to retire, the ABS reported the main factor influencing their decision about when to retire was financial security.

|

|

2016-17 |

2018-19 |

Change |

|---|---|---|---|

|

People aged 45 years and over |

|||

|

Retirees |

3.5 million |

3.9 million |

+0.3 million |

|

Proportion retired |

38% |

40% |

+2 pts |

|

Average age of retirement |

55.2 years |

55.4 years |

+0.2 years |

When to start thinking about retirement

Retirement shouldn’t leave you pulling at hairs trying to navigate how to manage your money for the next phase of your life. National Seniors Australia says it's important to get the ball rolling with savings and superannuation as soon as you enter the workforce to maximise potential benefits and avoid potential woes later in life.

Association of Superannuation Funds of Australia (ASFA) noted within their Quarterly Report for September 2021 that the minimum cost of a comfortable retirement for singles who own their own home is $45,239 annually and $63,799 annually for couples.

These figures serve as a guide given as people age, their spending requirements change as they are often unable to engage in the same types of activities and require greater levels of care and support.

QSuper Chief Operating Officer Karin Muller spoke with Savings.com.au to help us find out why Australian’s should start thinking about saving for retirement as soon as they enter the workforce.

“The earlier the better if you want to take advantage of the magic of compound interest over time,” Ms Muller said.

“It’s important though to first understand what you want from your retirement, and that is going to depend on your personal circumstances - there are plenty of free, online tools such as the Federal Government’s MoneySmart retirement planner calculator that can help you work out what you need and whether you are on track to achieve it.

“Sound financial advice is important, if you don’t think you’ll have the savings to live the lifestyle you want, you can grow your balance faster by making small contributions on top of what your employer pays.”

Can you leave it too late to start?

As the saying goes, ‘it’s never too late’, but when it comes to retirement, ‘too late’ can be the difference between retiring comfortably or retiring modestly.

With the average life expectancy of Australians continuing to grow, we appear to only be living longer, meaning we need more funds to ensure they last.

Director of financial services firm Crystal Wealth Partners Louise Lakomy said given we are living longer, this might mean delaying retirement and working a little longer or taking advantage of tax concessions to put more into your super before you retire.

“Long term investments are also important to consider going into retirement - maintaining your portfolio and assessing your risk tolerances are key to ensuring your savings don’t dry up,” Ms Lakomy said.

“Instead of converting all your accounts to bonds or cash, holding equities for income can provide a consistent income stream that allows for that extra holiday or pays for the utilities really set you up for the long haul.”

Advertisement

Looking to invest in property through your super? The table below features SMSF home loans with some of the most competitive interest rates on the market.

Lender | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | More details | ||||||||||||

| FEATURED | loans.com.au – SMSF 70

| ||||||||||||

loans.com.au – SMSF 70

| |||||||||||||

| Variable | More details | ||||||||||||

Reduce Home Loans – Capitalizer SMSF 70 Metro | |||||||||||||

| Variable | More details | ||||||||||||

Firstmac – SMSF 70 (Refinance Special) | |||||||||||||

| Variable | More details | ||||||||||||

Liberty Financial – Liberty Residential SMSF (LVR < 80%) | |||||||||||||

| Variable | More details | ||||||||||||

La Trobe Financial – SMSF Residential | |||||||||||||

| Variable | More details | ||||||||||||

Yard – SMSF Loan (Principal and Interest) (LVR < 80%) | |||||||||||||

| Variable | More details | ||||||||||||

| FEATURED | loans.com.au – SMSF 80

| ||||||||||||

loans.com.au – SMSF 80

| |||||||||||||

- Available for Purchase and Refinance. No application fee and no settlement fee

- No monthly, annual or ongoing fees

- Access your SMSF loan via our easy-to-use online app Smart Money

Accessing your superannuation

In order to access your superannuation, you generally need to have reached your preservation age and be retired (although there are some hardship scenarios which may allow you to access super early). If you have reached your preservation age and aren’t ready to give up work just yet, you may wish to access a portion of your super through a ‘transition to retirement’ pension. A ‘transition to retirement’ pension enables you to access some of your super (up to 10% per financial year) through regular payments, even if you’re receiving an income from an employer or business.

|

Before 1 July 1960 |

55 |

|

1 July 1960 – 30 June 1961 |

56 |

|

1 July 1961 – 30 June 1962 |

57 |

|

1 July 1962 – 30 June 1963 |

58 |

|

1 July 1963 – 30 June 1964 |

59 |

|

From 1 July 1964 |

60 |

If you’re aged between 60 and 64 and stop working for any amount of time, you’re considered retired for the purposes of accessing your super - even if you have no intention of retiring completely! This means you can cash out the super you’ve accumulated to date, even if you begin working again under a different employment arrangement.

From the moment you turn 65, there are no requirements or special conditions to meet in order to gain full access to your super.

Savings, super and the perfect blend

Savings and super are two primary financial assets that will help fund your comfortable retirement - but with rising costs of living you’ll need to give them a boost in order to get there.

Savings

Savings accounts and term deposit interest rates continue to remain at historical lows in 2021 thanks to the low cash rate, meaning those thinking about their retirement are searching for other avenues to generate income from their wealth such as the share market and ETFs.

The higher end of the savings account scale gives you interest rates of about 2% per annum. Comparatively, global shares have returned an average of 7.2% over the past 10 years, while Australian residential property has averaged returns of 8%.

If you wanted to reach the ASFA target of $545,000 for comfortable retirement as a single person with a sole savings account bearing an interest rate of 2%, you would need to commence saving at age 25.

According to Moneysmart’s savings goal calculator, starting at age 25 with $10,000 means it would take you:

-

40 years, saving $704 per month

-

30 years, saving $1,057 per month

-

20 years, saving $1,778 per month

-

10 years, saving $3,970 per month

These calculations assume retirement at the age of 65.

Saving $704 per month or $176 per week is quite substantial for the everyday Aussie, without factoring in other expenses including rent or mortgage repayments, utilities and everyday living expenses.

Of course, these figures are without the biggest contributor, superannuation - which for most people is a far more effective retirement savings vehicle. It's mandatory, passive, more tax effective and in most years will give higher returns.

Super

The amount of super you need to retire will depend on your desired retirement lifestyle. Generally, the greater the number of years in retirement, the more super you will need. The average 35-39 year old has $56,715 in super - nearly $500,000 less than needed, although time is on their side. With the COVID pandemic allowing Australians to withdraw up to $20,000 from their super, some may have considerably less. Closer to the 65-85 age bracket, 50-54 year olds have around $135,000 on average, so they have 10 or so years to accumulate another $400,000.

|

Age |

Average balance (men) |

Average balance (women) |

|

15 to 24 years |

$6,318 |

$6,100 |

|

25 to 34 years |

$41,661 |

$31,618 |

|

35 to 44 years |

$100,323 |

$69,252 |

|

45 to 54 years |

$196,407 |

$129,086 |

|

55 to 64 years |

$332,662 |

$245,126 |

|

65 to 74 years |

$404,458 |

$378,600 |

|

75 years and over |

$366,200 |

$270,300 |

Source: ABS

Let’s say you are 25 and earn a yearly salary of $55,000. Instead of buying a $5 coffee every morning before work, taking that weekly coffee bill of $25 and contributing it to your super can result in an approximate increase to your superannuation of $82,800 by the time you turn 67.

Websites like Super Guru from ASFA show the estimated super balance a person should have at each age to achieve the savings required for a comfortable retirement.

|

25 years old |

$24,000 |

|

30 years old |

$61,000 |

|

35 years old |

$102,000 |

|

40 years old |

$154,000 |

|

45 years old |

$207,000 |

|

50 years old |

$271,000 |

|

55 years old |

$345,000 |

|

60 years old |

$430,000 |

|

65 years old |

$523,000 |

Source: Super Guru by ASFA

A Treasury report from 2020 claimed Australians are dying with majority of their superannuation nest eggs in tact. These claims were disputed earlier this year by ASFA, noting 80% of people aged 60 and over who died in the period 2014 to 2018 had no super at all in the period of up to four years before their death. This shows in the long run, it is critical to plan to have an excess of super than too little to maximise a comfortable retirement.

The perfect blend

Younger generations will likely have more super by the time they retire since they've been able to utilise it for longer, but no matter your age, ideally you'd want to have a combination of the following to make your funds last:

-

Regular savings

-

Superannuation

-

A diversified investment portfolio (including bonds, shares, ETFs)

Tips to make your nest egg go the distance

Sharing some tips to make savings and superannuation last, Karin Muller says for many Australians the biggest challenge is having the confidence to know they won’t run out of money in retirement.

Karin Muller’s top tips:

-

Making extra contributions throughout your working life is a great way to boost your retirement savings, and small amounts can make all the difference over time. For example, contributing just $20 per week from your take home pay over 30 years can add almost $50,000 to your income in retirement and if you are going to make personal after-tax contributions, setting up a regular automatic BPAY transfer is an easy option.

-

You can also make extra contributions from your pre-tax income by salary sacrificing or, if you’re on a low income or not working, get your spouse to make after-tax contributions on your behalf.

-

Finding lost and unclaimed super and consolidating your accounts to take advantage of the compound interest on a larger balance and fewer fees will also give your retirement savings a boost.

-

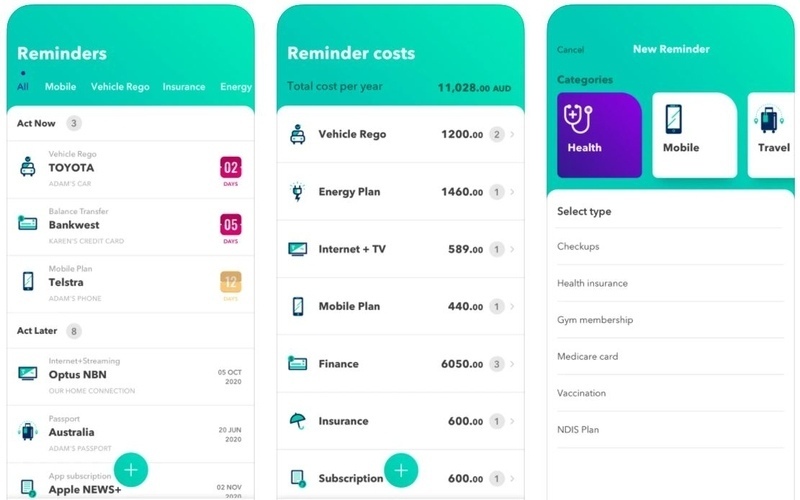

Fintech solutions are also providing new and innovative ways for Australians to make extra contributions to their super. A great example is Super-Rewards, which is a cash-back program where money gets added to your nominated super account when you shop with certain stores and brands. It’s a clever way to help you save more super simply by doing your everyday spending. And best of all, the extra contribution is not coming from your own pocket.

Savings.com.au's two cents

You don't need to be a millionaire to retire comfortably or even have hundreds of thousands as specified by ASFA - you do however need to have to have a plan in place to achieve your nest egg goals. You can get away with less than this as long as you know how much you normally spend on a weekly basis and with some left over for both investing and saving for rainy days or emergency expenses.

If you want to play it safe, those seeking a comfortable retirement need roughly (in today’s dollars):

-

$545,000 (if single)

-

$640,000 (if in a couple)

But to afford a modest retirement (where spending on luxuries like leisure activities, dining, housing goods, fashion and travel is limited), ASFA estimates a balance of $70,000 is suitable for both couples and singles. This is considered “better than the Age Pension, but still only allows for the basics.”

Whether you plan on living in sheer excess, comfortably or frugally once you ditch the 9-5, make sure you do so without a mortgage hanging over your head.

Related article: Should you pay off a mortgage with super before you retire?

Making extra contributions to your savings and super by cutting back on weekly expenses such as a coffee every morning, an extra drink at the bar or even cancelling unused subscriptions and putting that money towards an investment portfolio, can all go a long way to helping you save to retire comfortably.

Article originally published by William Jolly, 7 March 2019, and updated 29 November 2021.

Image by Marc Najera via Unsplash

Brooke Cooper

Brooke Cooper

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly