But according to Simon Pressley, Head of Research at buyer’s agency Propertyology, many people have “dead wrong” assumptions on who the average real estate investor really is.

“For too long, property investors have been categorised as a group of disparately wealthy individuals who are hoarding far more than their fair share of real estate,” Mr Pressley said.

“They’re, apparently, motivated to grow outrageously wealthy through acquiring multiple properties at the expense of lower-income and younger homebuyers.

“This sort of thinking has pervaded and directly influenced public policy for years.”

According to Mr Pressley, Propertyology found the average Aussie property investor will probably:

- Own just the one property (maybe two)

- Have an income “definitely” below $100,000 per year

- Be decades away from retirement (and well below 50)

“Of most importance, the majority of investors are people who elect to not live in the moment and spend everything that they earn, instead choosing to make some financial sacrifices during their 40-ish year in the workforce to improve their position for those post-work years,” he said.

“I think the world would be a better place if less people were dependent upon the public purse.”

Looking to invest in property? The table below showcases some of the lowest rate investment home loans on the market (variable, interest-only repayments).

Stats broken down

Propertyology looked through recent ATO statistics to get a clearer picture of just who is investing in property in Australia.

How many properties?

Propertology’s analysis shows 90.2% of Australia’s 2,150,000+ property investors held only one or two properties.

That’s 1.95 million people.

The remaining 212,000 investors own between three and six properties, with just 20,000 holding upwards of six.

This means less than 1% of Australians fit into the ‘fat-cat’ property investor category.

“So the next time a politician suggests that by imposing additional taxation on the investor community they are going after so-called ‘fat-cats’ holding huge portfolios of multiple assets, take a moment to remember these policies are, in fact, unfairly hurting ‘mum-and-dad’ individuals holding just an asset or two,” Mr Pressley said.

Are property investors rich?

Propertyology found the assumption that property investors are rich is an “unfounded generalisation”.

“Keeping in mind the gross average [full-time] wage in Australia is around $82,000 per year, we took a look at exactly how many investors were earning around average or below-average taxable incomes,” he said.

“Property investment is hardly the realm of the mega-income earner according to these factual results!”

Of the 1.5 million property investors (71%) that own just the one property, nearly half (43% of them) had an annual taxable income below $50,000 a year.

Of one-property investors, 77% earn below $100,000 a year, although this data doesn’t seem to account for household income, where two or more incomes can be combined to create greater investment power.

Meanwhile of the two-property investors, 39% of them earn below $50,000 a year and 73% earn less than $100,000 a year.

Extrapolated across all property investors:

- 45% of individuals (not households) earn below $50,000 per year

- 78% of individuals (not households) earn below $100,000 per year

Are they mostly baby boomers?

Spending any length of time greater than five seconds on the internet, watching TV or just existing means you’ll undoubtedly hear some kind of argument about ‘baby boomers vs millennials’ or how ‘baby boomers have wrecked the economy and are worse than Hitler’.

But the assumption that property investors are predominately in these older demographics is a bit of a myth.

In fact, the numbers show there‘s a fairly even split between those over 50 and those under that age:

- 6% of investors are under 30

- 21% are 30-39 years old

- 25% are 40-49

So 51% of all investors are actually under 50, while 49% have already hit the half-century – a pretty even split.

“Most pundits might be surprised to learn that there are plenty of sub-50 active investors looking to build for future retirement,” Mr Pressley said.

How many are negatively geared?

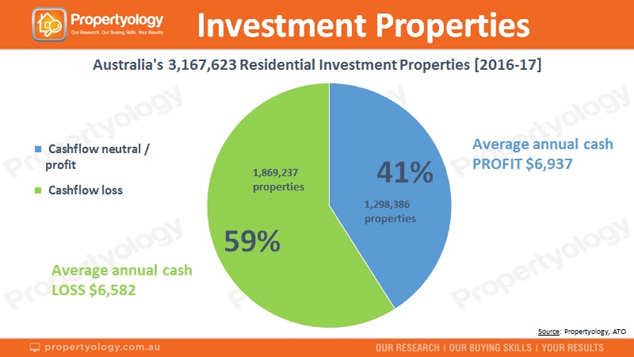

Propertology’s analysis shows the majority of investment properties (59%) are loss-making, with an average annual net loss of $6,582 per property.

The remaining 41% which receive rental income are either cash flow neutral or cash flow positive, with an average annual profit of $6,937.

Although most investors are claiming the tax benefits of negative gearing – something that was almost scrapped – Mr Pressley said these investors provide a useful benefit to the economy.

“Property investors also provide the flow-on benefit of helping provide housing options to a large swath of the population who, for a variety of reasons, choose to live in rented accommodation,” he said.

“Only 1.2% of Australia’s housing stock is funded by governments – our taxes can only be spread so far.

“Mum-and-dad investors have supplied almost all of the 3,167,623 residential rental properties in Australia – about one third of Australia’s total dwelling stock.”

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly