According to the report by the Centre for Independent Studies (CIS), the single biggest influence on a comfortable retirement is whether or not one owns their own home.

The report’s author Simon Cowan made a connection between the introduction of compulsory super in the 1990s and falling homeownership rates.

Mr Cowan pointed out millennials are the first generation to enter the workforce with roughly 10% of all their income going towards their retirement, and since 1991, the biggest falls in homeownership have been among the 25-34 and 35-44 age groups.

There are other factors at play, mainly skyrocketing house prices in recent years, but with the superannuation guarantee rate set to rise to 12% from 2025 onwards, that’s less income going towards a house deposit.

According to the Grattan Institute, this increase will strip up to $20 billion from workers’ salaries each year.

“There is little doubt that the massive increase in the deposit required to purchase a home substantially delays property ownership for first-time buyers,” Mr Cowan said in the report.

“This means that people will be older when they pay off their mortgage, in some cases substantially so.

“For some, this hurdle will never be overcome.”

Mr Cowan argues that mandatory super payments make the task of saving up for a house deposit even more difficult for first home buyers.

“In effect, this means that, though it is likely that homeownership is more important than accumulating superannuation, the system prioritises superannuation above homeownership,” he said in the report.

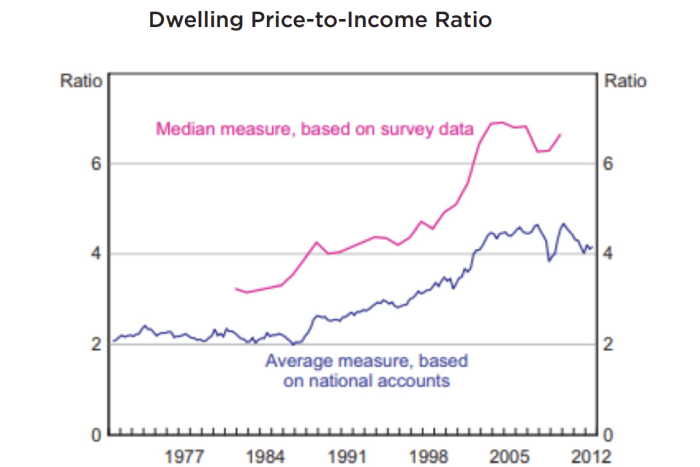

The dwelling price-income ratio has significantly increased since the 70s, and with superannuation coming into effect in the 90s, workers are spending more of their take-home pay towards housing.

In Sydney, this ratio has increased by more than 70%.

Older homeowners experiencing mortgage debts

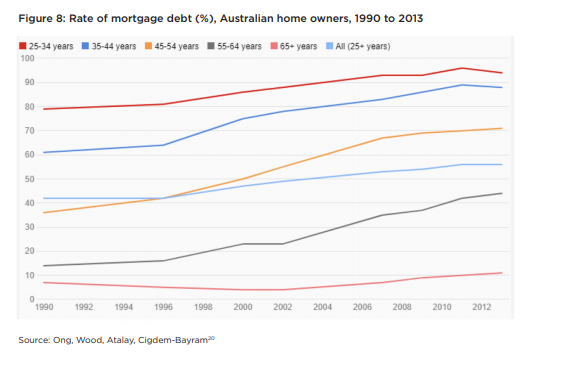

Having to pay off a mortgage – or still paying rent – in retirement is not ideal, but the number of people still doing this in older age groups is increasing.

The percentage of homeowners with mortgage debt has increased for all groups over the last 20 years, but the biggest increases have been in the 55 to 64 age group and the 45 to 54 age group.

“You can be comfortable in retirement without a super balance, but it’s far harder to do so if you don’t own your home,” Mr Cowan said.

This trend would suggest that as more people start buying their homes later on in life, the more people there will be who are still paying off a mortgage in or near retirement.

Low income and part-time workers struggling the most

For someone on a high income who can save for both retirement and a house, the current system might seem fine.

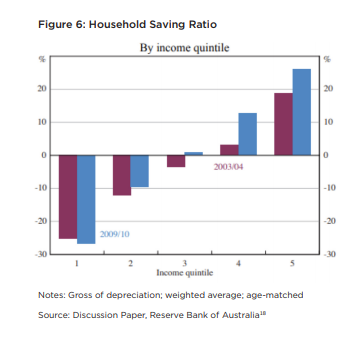

According to research, higher-income households (in the fourth and fifth income quintiles) voluntarily save more than 10% of their income, while lower-income households often have negative saving rates.

Superannuation currently presumes few people save for retirement if not compelled to do so, but Cowan argues that saving for a house deposit is saving for retirement, and Australians need no compulsion to buy houses.

“A voluntary system, or at a minimum one that has a far higher threshold for compulsory participation, would give millennials and low-income workers greater flexibility in their savings choices,” Mr Cowan said.

“This would be a welcome improvement to the current compulsory super system.”

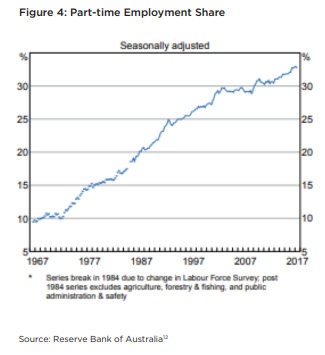

This would also benefit part-time workers, who have almost doubled since the 1980s.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Hanan Dervisevic

Hanan Dervisevic

Denise Raward

Denise Raward