The 2021 Annual Property Investor Sentiment Survey from Property Investment Professionals Australia (PIPA) surveyed Australia's existing and aspiring property investors to reveal the mood, confidence and key trends underlying the Australian property investment market.

Last year's survey foreshadowed the booming property market, and this year's survey reveals investors believe prices will continue to rise.

PIPA Chairman Peter Koulizos said few people believed the positive investor sentiment in last year's survey.

"When we think back to last year, which was a time of much fear and uncertainty, it's clear that property investors and the market, in general, has weathered that turbulent period better than anyone dared to hope," Mr Koulizos said.

"That said, last year's survey did forecast the strong property price growth that we have since experienced, it's just that not many people believed us at the time."

When asked where property prices were headed in the next 12 months in their home state or territory:

- More than three quarters (76%) of respondents said prices were going to increase, up from 41% last year.

- Approximately one sixth (16%) thought they’d stay the same, down from 33% last year.

- Just 6% thought prices would decrease, down from 24% last year.

PIPA's survey collated responses from 786 property investors.

Key findings

Investors still believe it's a good time to invest

Nearly 62% of investors believe now is a good time to invest in residential property, which is down from 67% in 2020, and may be due to high property price growth as well as significant lockdowns taking place at the time of the survey.

Australia's property price growth of 16.4% for the year ending in June puts the annual pace at its most rapid since 2003 and the average house price at its highest since 2009.

CoreLogic estimates there were almost 600,000 residential properties sold in the past 12 months - the greatest number of annual sales since 2004.

This represents a 42% lift on annual sales numbers for the previous 12 months.

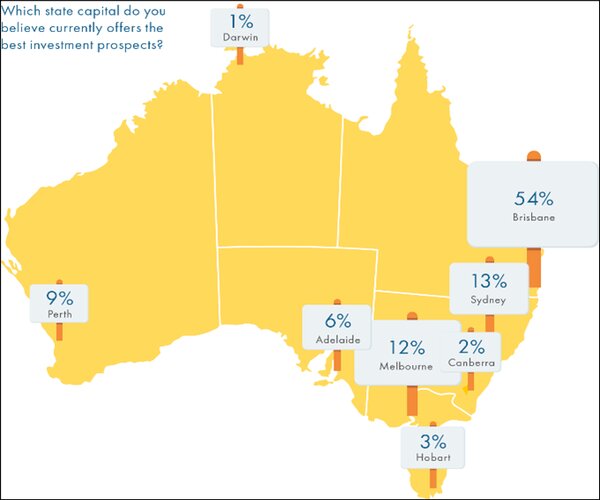

Sunshine State offers best investment prospects

Queensland has emerged as the winner by a serious margin with a staggering 58% of investors believing the Sunshine State offers the best property investment prospects over the next year – up from 36% last year. New South Wales was second at 16% (down from 21% in 2020) and Victoria was third at 10%, down significantly from 27% last year.

Source: PIPA

Regional and coastal markets in growing demand

While investors continue to tip metropolitan markets as offering the best investment prospects at nearly 50% (but down from 61% in 2020), regional markets are in favour with 25% of investors (up from 22%) as well as coastal locations with 21% of survey respondents (up strongly from 12% last year).

The regional boom over the past twelve months has been a clear indication that investors and home owners have looked to escape the cities.

Increased work from home flexibility and harsh lockdowns in major cities have both contributed to the trend.

Borderless investing continues to increase in popularity, with 44% of investors (up from 41% last year) investors looking to buy outside the state they live in.

Lending and the economy remain top concerns for investors

The two leading concerns of the investors surveyed were gaining access to lending and Australian economic conditions – the same situation as last year.

About 22% of respondents have found themselves in a position where they were unable to refinance an amount that they were able to borrow previously – the same as last year.

About 50% (up from 43% in 2020) said they were able to refinance.

About 14% of investors say that they have more money going out than coming into the household right now – the same result as last year.

Investors seeking out qualified advisers

The majority of (92%) investors continue to believe that any provider of property investment advice should have completed formal training or education. 35% of investors have sought the services of Qualified Property Investment Advisers or QPIAs.

About 39% said they had a hold and never sell approach, which is down significantly on the 51% last year.

About 35% said they were considering selling down some or all of their portfolio (up from 27% in 2020).

Image by Patrick Ryan via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan