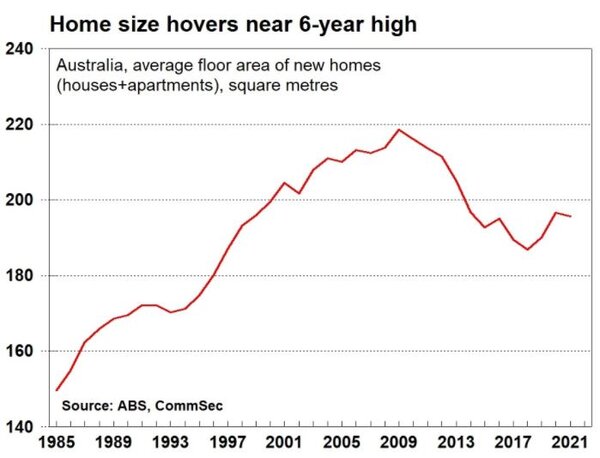

Despite the average size of homes trending down, the average size of new apartments is at an 11-year high this year.

Still nearing a six-year high, the average free-standing house size in Australia is currently 229.3 square metres, down 2.9% from its seven-year high last year.

The average new home (houses and apartments) has also gone down by 0.4% to 195.8 square metres.

But the average size of new apartments built over 2020/21 is at an 11-year high of 138.3 square metres.

According to CommSec economists, the desire for extra space brought on by Covid might be reflected in the bigger apartments being built.

Leading the charge for biggest houses built is the ACT with the average house size of 259.3 square metres.

For apartments, Victoria took the cake with an average size of 156.8 square metres.

But neither is home to the biggest overall homes; Western Australia took first place with the average home size of 214.8 square metres.

Queensland was 'notable' for building bigger houses and apartments over the past year, with the average home up 5.5% reaching an eight-year high of 205.8 square metres.

Source: CommSec

Australia and the US building biggest homes in the world

It's often said that if the United States does it, Australia will shortly follow; this is true for building big houses.

Australia and the US continue to build some of the biggest houses in the world, but the average size of new homes fell in both countries over the past year.

The average home size completed in the US was 192 square metres, making US homes smaller than the average Aussie's abode, but still 'notably bigger' than most other countries.

Despite our homes being bigger in size, new research from Roofing Megastore revealed that Australia and the US are among some of the most affordable countries to buy a home in the world.

The US is the third most affordable country to buy a home, as the average annual salary is 15.01% the cost of a home that is 100 square metres in size.

Australia came in further down the list as the 15th most affordable country to buy a home, with the average annual salary 8.4% the cost of a 100 square metre home.

Temporary loan deferrals up by over $1 billion this month

Despite the number of hardship deferrals being on the decline according to research from Aussie, the number of deferred loans increased over the past month.

As at 30 September, there's a total of $13.1 billion worth of loans on temporary repayment deferrals, up from $11.9 billion last month, according to the Australian Prudential Regulation Authority (APRA).

Of this, $11.5 billion is for deferred housing loans, making up 0.8% of all housing loans outstanding.

This comes as the average home price increases another 1.5% over the past month according to CoreLogic data.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Luke van Zyl on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Rachel Horan

Rachel Horan