Equifax’s latest Quarterly Consumer Credit Demand Index for the September 2020 quarter shows a near 30% decline in demand for consumer credit compared to September 2019.

The results show a decline in every category, except for home loans, which rose by 16.3% in the quarter compared to a year ago.

Thinking about refinancing to a low-rate, variable owner-occupier home loan? Below are a handful of low-rate loans in the market.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

According to Equifax's data, credit cards suffered the biggest drop of 39.5%, which is not unexpected given the well-publicised fall in credit card use over the pandemic months.

Buy now, pay later, despite reported increases in customers by the likes of Afterpay and Zip, as well as some recent negative press about customers missing repayments, also saw a 13.2% annual decline.

The final two categories - car loans and personal loans - fell by 15.3% and 32.3% respectively.

The Credit Demand index by Equifax measures the volume of credit applications for credit cards, personal loans, Buy Now Pay Later (BNPL), and auto loans.

Mortgage demand includes loans for new properties as well as refinancing.

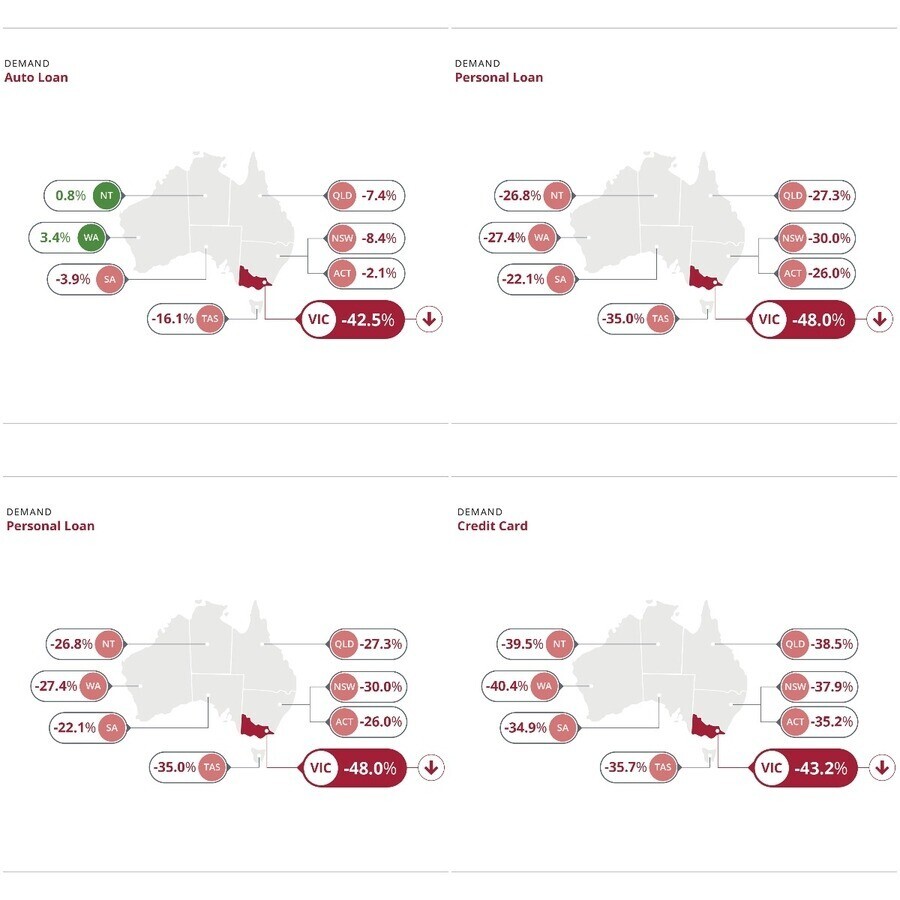

How each credit category performed in each state. Source: Equifax.

Why did credit demand fall so much?

Kevin James, General Manager Advisory and Solutions at Equifax, said government stimulus measures like JobKeeper and JobSeeker have reduced the need for Australians to rely on credit.

"This is particularly evident when looking at the volume of personal loan applications, which have dropped by around 30% for two consecutive quarters," Mr James said.

"As government stimulus starts to pull back, we anticipate personal loans may experience a revival, particularly among sub-prime borrowers who may not be eligible for other kinds of financing.”

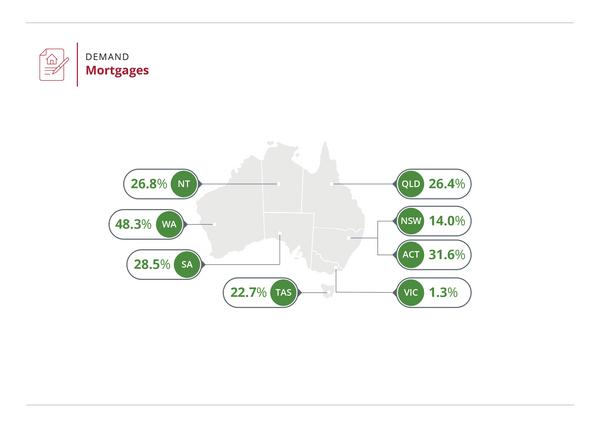

Mortgage demand and applications, on the other hand, increased in every single state, even Victoria, which saw a 1.3% annual increase (the smallest among the states) despite being in lockdown for weeks on end.

Mortgage applications rose by 16.3% on average, led by Western Australia at almost 50% (48.3%).

The ACT also recorded an impressive 31.6% spike, while NSW was up 14%.

According to Equifax, home buyer activity is expected to further strengthen over the next quarter provided the virus remains contained, and interest rates remain low, especially now that Victoria is moving out of stage-four restrictions.

"Historically, movements in Equifax mortgage application demand data has led movements in house prices by around six to nine months," it said.

See also: ANZ says House prices to rise 9% in 2021

Source: Equifax

Victoria actually had the largest decrease among all categories except buy now, pay later, which fell by 24.8% in Tasmania.

For the first time in more than eight quarters, the drop in demand for such platforms extended across every Australian state and territory.

“Despite the subdued interest in Buy Now Pay Later, there have been some interesting movements across generations. In the September quarter, baby boomers had the lowest share of enquiries for BNPL but the highest rate of growth," Mr James said.

"Generation Z accounted for a quarter of all enquiries even though they only made up 5% of the working adult population.

"And digital-savvy Gen Y has shown the largest shrink of any generation."

In Victoria, auto loans declined by more than 42%, and there was less demand generally in the eastern states.

In the market for a new car? The table below features car loans with some of the lowest fixed interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Vehicle Type | Maximum Vehicle Age | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.59% p.a. | 7.72% p.a. | $588 | Fixed | New | No Max | $8 | $400 | $35,295 |

| Promoted | Disclosure | ||||||||

6.28% p.a. | 6.28% p.a. | $584 | Fixed | New | No Max | $0 | $0 | $35,034 |

| Promoted | Disclosure | ||||||||

6.52% p.a. | 6.95% p.a. | $587 | Fixed | New, Used | No Max | $0 | $350 | $35,236 |

| Promoted | Disclosure | ||||||||

5.76% p.a. | 5.76% p.a. | $577 | Fixed | New, Used | No Max | $0 | $275 | $34,599 | |||||||||||

5.99% p.a. | 6.34% p.a. | $580 | Fixed | New | No Max | $0 | $250 | $34,791 | |||||||||||

6.25% p.a. | 6.52% p.a. | $583 | Fixed | New | No Max | $0 | $195 | $35,009 | |||||||||||

6.49% p.a. | 6.84% p.a. | $587 | Fixed | New, Used | No Max | $0 | $250 | $35,211 | |||||||||||

6.29% p.a. | 7.71% p.a. | $584 | Fixed | New, Used | No Max | $15 | $250 | $35,042 | |||||||||||

5.67% p.a. | 6.10% p.a. | $575 | Fixed | New | No Max | $0 | $0 | $34,524 | |||||||||||

7.99% p.a. | 8.99% p.a. | $608 | Fixed | New, Used | No Max | $9 | $265 | $36,489 | |||||||||||

7.99% p.a. | 8.27% p.a. | $608 | Fixed | New | No Max | $0 | $200 | $36,489 |

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

William Jolly

William Jolly