Xinja broke headlines last week after it introduced an unconditional 2.25% p.a. ongoing savings account interest rate, making it a market leader in a time of record-low savings account interest rates.

In the last week, Xinja has seen more than $30 million of inflows since its 'Stash' account was introduced.

“We are offering a market-leading rate without the usual restrictive conditions," Xinja chief Eric Wilson said.

"And we are offering a new way to bank.”

Xinja said the Stash account is a 'true alternative' to the big four banks.

It found its customers have an average of $6,500 in their Stash accounts, and half of the account holders have come from the big four - ANZ, Commonwealth Bank, NAB, and Westpac.

"We're committed to the long game of staying lean and reducing costs and overheads to do the best by our customers," Mr Wilson said.

"Having happy customers will go a long way to helping us break the high-cost, high profit model of Australian banking."

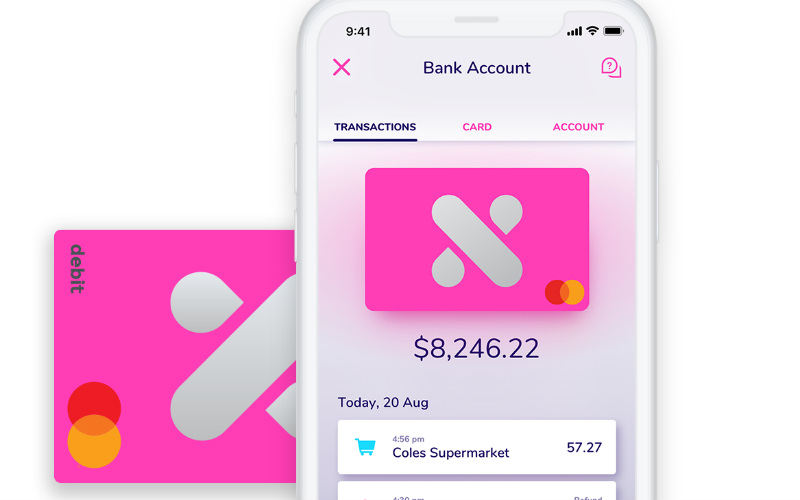

Xinja's Stash account offers a 2.25% p.a. base rate of interest.

Unlike other savings accounts in the market, customers do not have to deposit a minimum amount per month or make a certain number of card transactions to earn this rate.

The 2.25% rate applies to amounts up to $245,000, which is just shy of the government's deposit guarantee, which covers up to $250,000 per account.

Neobanks compared

Neobanks are typically online-only, and often on a cloud-based operation.

“It’s important that the technology delivers on what we believe in,” Mr Wilson said.

“We are built for purpose. We believe that a bank should work for its customers and that Aussies can make better choices about money.

"If we make it fun, we’re hopeful people will engage and make better decisions.”

Other neobanks in the Australian market include 86 400, Up Bank, and Judo Bank.

Xinja said it will offer personal loans and home loans soon, but not credit cards "because the only way to make money off credit cards is when your customers stuff up," Mr Wilson said.

.jpg)

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Aaron Bell

Aaron Bell

Alex Brewster

Alex Brewster