According to new data, Sydney residents are not on track to meet the state's 2030 or 2050 net zero targets.

The committee for Sydney, an urban policy think tank led by an influential body of business leaders and infrastructure experts, has said radical action is needed to cut emissions.

The report titled Decarbonising Sydney proposes a rapid increase in the use of electric vehicles (EVs) and the closure of additional coal plants.

"If electric vehicles carry the vast bulk of achieving the 2030 target, 100% of passenger car sales will need to be EVs in 2027, leading to approximately 850,000 passenger EVs on the road by 2030." the report said.

The proposed plan also outlines no new gas appliances by 2030 and no new gas connections from 2035.

Sydney is currently the contributor of 36% of all NSW emissions; the plan would reportedly cut the city's emissions by 43% by 2030 and 80% by 2050.

Committee spokesman Sam Kernaghan said the city has plenty of work to do to reach the expected targets.

"NSW’s climate policies are leading the nation, but this research is a wakeup call that Sydney’s not on track for net zero," Mr Kernaghan said.

"To halve emissions by 2030, the only levers big enough to make a real difference are getting many more electric vehicles on the road, and reducing the carbon intensity of the energy we use.

"Both come with big social, logistical and political challenges, but the reduced energy bills that come with electrifying transport and buildings will be worth it."

The new report falls in line with the New South Wales Government's 2021 Electric Vehicle Strategy, targeting an all-electric passenger fleet by 2030.

Data modelling from the report found that by 2050, an EV could save a household on average, up to $1,250 per year in fuel costs.

Switching to solar panels could also save an additional $1,000 per year in energy bills and a home battery could reduce those bills by a further $850 per year.

The report revealed that a shift to public transport, cycling and walking, and newer forms of mobility via e-scooters and EV taxis will be essential in reaching NSW’s 2050 targets.

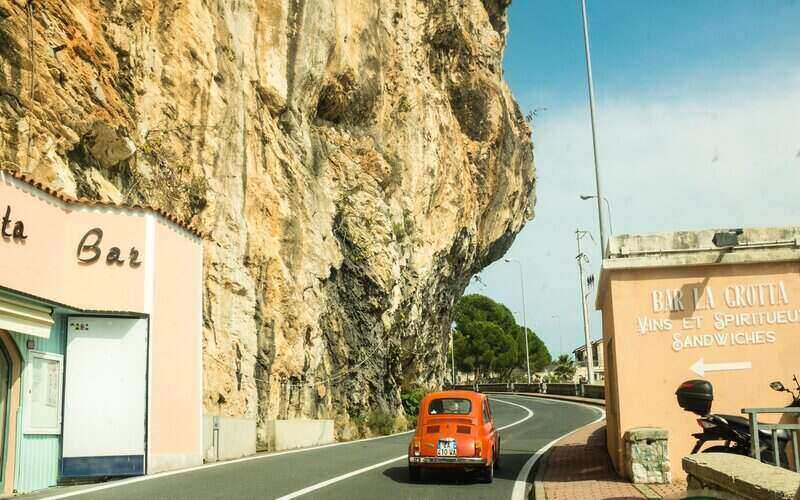

Image by Dan Freeman via Unsplash.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Alexi Falson

Alexi Falson

Denise Raward

Denise Raward