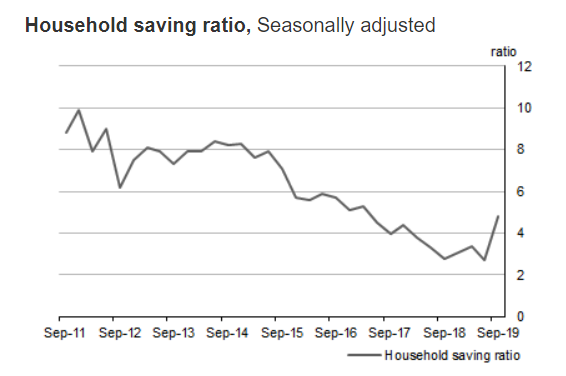

Australia’s household savings ratio – the rate of household savings from household net disposable income – shot up to 4.8% over the September quarter, according to the Australian Bureau of Statistics (ABS).

This is sharply higher than the 2.7% it was in the June quarter, and is the highest it has been in over two years.

Source: ABS

The ABS report attributed the sharp rise to the 2.5% growth in household disposable incomes, which was driven by a fall in income taxes – largely a result of the government’s low and middle income tax offset of up to $1,080.

This vastly outpaced household consumption spending growth, which was only 0.1%.

“The reduction to tax payable did not translate to a rise in discretionary spending, which led to a visible impact to household saving,” said ABS Chief Economist Bruce Hockman.

Treasurer Josh Frydenberg admitted as much on ABC’s 7.30 interview with Leigh Sales last night.

“You point out at the start of your answer that disposable income’s up, but that goes back to my point, which is people aren’t spending it, because they’re worried, they’re uncertain, they’re using it to put into their savings.”

Leigh Sales

“Well, they’re doing what the Government is doing, and that’s paying down their debt. And in fact, 70 per cent of people with mortgages are more than a month ahead of their prepayments…”

Josh Frydenberg

“But that doesn’t stimulate the economy.”

Leigh sales

“But it’s not my job to tell Australians how to spend their money, my job is to give them more money to spend or to save.”

Josh Frydenberg

Treasurer @JoshFrydenberg answers questions on the latest national accounts figures, whether there were any deals to pass the government's #Medevac Bill and the controversy surrounding @AngusTaylorMP. #abc730 #auspol pic.twitter.com/JO6mYJeOPF

— abc730 (@abc730) December 4, 2019

The sharp rise in saving occurred despite the Reserve Bank of Australia’s June and July cash rate cuts, which were expected to stimulate the household consumption.

As a result of the cuts, interest rates on many savings accounts fell by 50 basis points, sometimes more, leaving fewer options for those hoping to earn a real return (that is, more than inflation) on their savings.

According to the data, the economy grew by 0.4% over the quarter and 1.7% throughout the year.

Household consumption expenditure increased by 0.1% in the quarter, with the consumption of discretionary goods and services falling by 0.3%.

Shadow Treasurer Jim Chalmers said the numbers released by the ABS yesterday were “humiliating” for the government.

“After the release of last quarter’s figures Morrison claimed that the economy “would improve in the next quarter”, but quarterly growth has actually slowed,” Mr Chalmers said.

“These growth figures are well below average, well below forecasts and well below what is needed to get wages growing again.”

“Weak growth like this is the inevitable consequence of a Government with a political strategy but not an economic plan.”

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

Rachel Horan

Rachel Horan