That's according to data published by the Australian Competition and Consumer Commission's (ACCC) Scamwatch, which found reported cases were almost a third higher in 2020 than in the same period last year.

Leanne Vale, Financial Crimes Director for the Customer Owned Banking Association (COBA), said the data may suggest criminals were targeting younger generations with more sophisticated schemes.

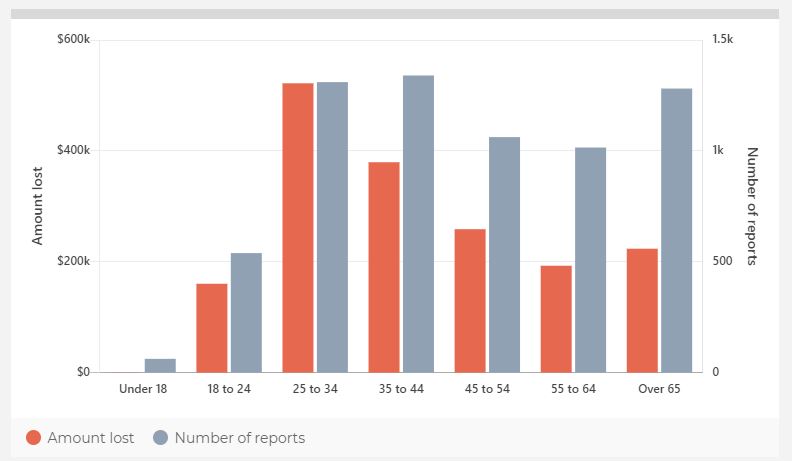

“Historically, Australians over 65 report the most cases, but we are now seeing younger age groups of 25 to 34 and 35 to 44 move to the fore, suggesting a generational shift in this criminal activity,” Mrs Vale said.

“This change reflects broader societal trends for digital technology. Unfortunately, it is easy to focus on the benefits and overlook the pitfalls of sharing information so readily."

Need somewhere to store cash and earn interest? The table below features introductory savings accounts with some of the highest interest rates on the market.

Provider | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Savings Accelerator

| |||||||||||||

Disclosure | |||||||||||||

Savings Accelerator

Disclosure

| |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

| FEATURED | High Interest Savings Account (<$250k)

| ||||||||||||

Disclosure | |||||||||||||

High Interest Savings Account (<$250k)

Disclosure

| |||||||||||||

| 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| FEATURED | Save Account

| ||||||||||||

Disclosure | |||||||||||||

Save Account

Disclosure

| |||||||||||||

| 0 | 1000 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| FEATURED | Savings Maximiser

| ||||||||||||

Disclosure | |||||||||||||

Savings Maximiser

Disclosure

| |||||||||||||

| 4 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Hi Saver | |||||||||||||

| 4 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Bonus Saver | |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Online Saver | |||||||||||||

| 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Up Saver Account | |||||||||||||

| 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||||

Qsaver | |||||||||||||

| 0 | 100 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver Account | |||||||||||||

| 0 | 100 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver | |||||||||||||

| 3 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Maxi Saver | |||||||||||||

| 0 | 100 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver Account | |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Netsave Account | |||||||||||||

| 0 | 200 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Growth Saver | |||||||||||||

| 4 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Simple Saver | |||||||||||||

| 0 | 1000 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||||

Virgin Money Boost Saver | |||||||||||||

| 0 | 2000 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

HomeME Savings Account (<$100k) | |||||||||||||

| 0 | 200 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Online Savings - Premium Saver | |||||||||||||

| 0 | 10 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

mySaver | |||||||||||||

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

Just over $2 million has been lost to identity theft so far in 2020, with almost 9,000 reported cases, mostly in New South Wales and Victoria.

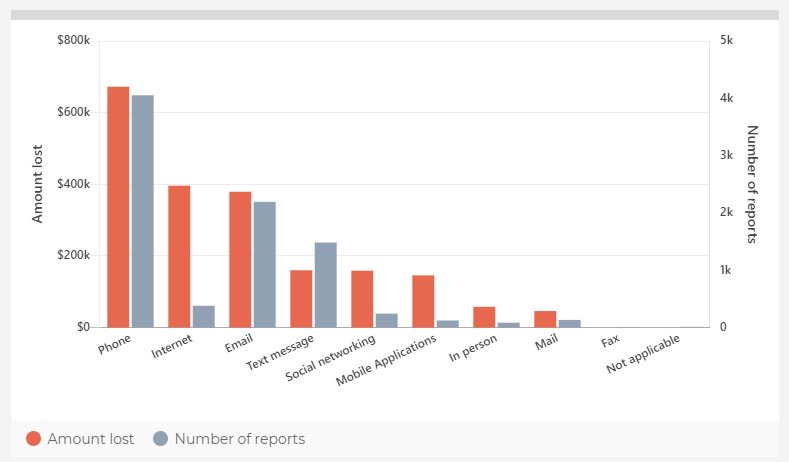

The large majority of that money lost came from phone scams, followed by internet and email, with females marginally worse affected than males.

Identity theft by age group

Source: ACCC

Mrs Vale said identity theft could be as simple as clicking on what looks like a personalised email.

"Within minutes your device has downloaded a virus that will access personal information such as bank statements, identity particulars and your address book," she said.

“Alternatively, the criminal starts with one piece of personal information and gradually builds up a profile by harvesting information from social media.

"In a digital world we tend to disregard traditional mail, but items such as superannuation statements and renewal of driver’s licence cards are pure gold for criminals."

Identity theft by delivery method

Source: ACCC

Mrs Vale added being a victim of identity theft could seriously hamper your ability to gain credit or make other important financial decisions.

“Losing control of your identity can start a downward spiral with many activities we take for granted severely impacted, whether obtaining a loan, buying a house, starting a business, or even starting a new relationship.

“It can take hundreds of hours to reclaim a stolen identity and recover from a blemished credit history.”

A former police officer and 30-year veteran working in the field of financial crimes detection and prevention, Mrs Vale provides the following advice:

“Don’t overshare on social media and use privacy settings wisely. Protect your devices and pay attention to security upgrade messages. Lock your email inbox, clean out the junk, and never click on unsuspecting links, even if they are addressed to you.”

In 2020 alone, Australians have lost over $89 million to scams, with almost 100,000 scams reported.

Investment scams have proven to be the most costly, totalling almost $35 million, followed by dating and romance scams.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly