As of May 15 last week, 25 term deposit providers had already dropped interest rates on some of their term deposit products, including the likes of

ANZ, ING, Citi, St. George and AMP.

In the nine days since, 22 have moved interest rates, with the majority cutting.

These include the likes of Commonwealth Bank, RACQ Bank, CUA, ME, Macquarie and Suncorp.

The number of providers cutting rates has ramped up following the RBA Governor’s announcement that interest rates will all but certainly be cut next month.

This would be the first interest rate cut since August 2016, and will leave the official cash rate at an unprecedented 1.25%.

This week’s term deposit rate changes

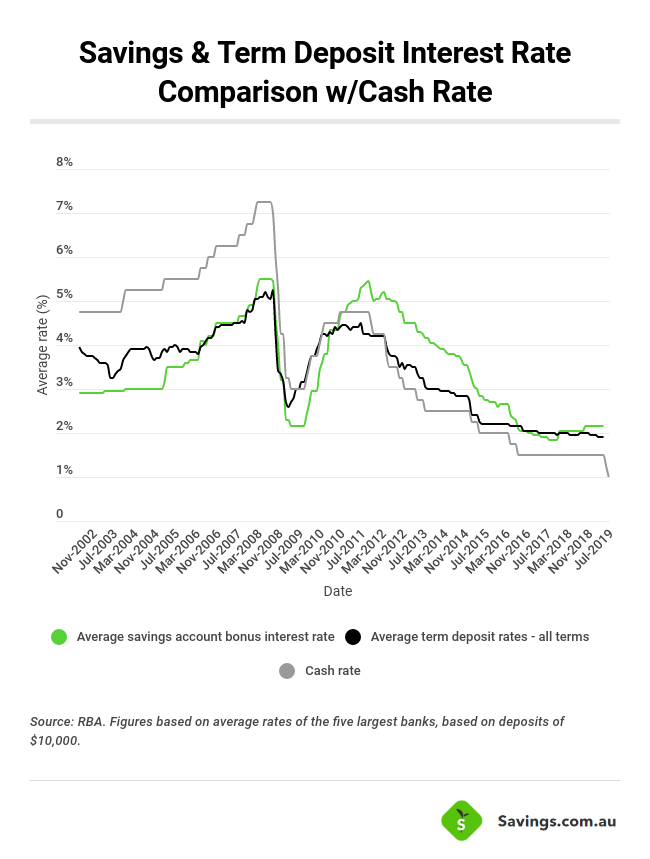

Given the relationship between the cash rate and average term deposit rates, it’s unsurprising many providers are passing on this expected rate cut.

People’s Choice Credit Union and P&N Bank term deposit rates

People’s Choice Credit Union was one of the few institutions to raise rates, increasing some term deposits by up to 15 basis points. However, it also lowered some term deposits (like its one and two-year terms) by up to 20 basis points, leaving it with a maximum interest rate of 2.65% p.a.

P&N Bank, one of Australia’s largest customer-owned banks, also dropped a number of term deposits by as much as 10 basis points.

QBank term deposit rates

QBank both increased and decreased some of its term deposit rates, with changes made to pretty much its entire product range.

QBank’s longer-term five-year deposits were cut by a maximum of 15 basis points, leaving it with a rate of 2.70%.

Heritage Bank term deposit rates

Heritage Bank made sweeping changes to its range of term deposit products, with many terms lowering rates by as much as 15 basis points.

However, a select few terms like its five-month product had its rate increased by 25 basis points, giving it a short-term interest rate of 2.45%.

Commonwealth Bank term deposit rates

The biggest institution to change term deposit rates this week, Commonwealth Bank, dropped various term deposit rates by up to 30 basis points.

CommBank also dropped interest rates earlier this month by 10 basis points. Its five-year term deposit now has an interest rate less than 2.00%.

Bankwest term deposit rates

Some of the biggest changes this past week were made by Bankwest, with interest rates on a host of products increased or decreased by up to 50 basis points.

The majority of these changes were still decreases however, with Bankwest now offering a maximum interest rate of 2.30% (on its six-month products).

RACQ Bank term deposit rates

RACQ Bank decreased its term deposit rates by as much as 45 basis points, making it one of this week’s biggest movers as well.

ME term deposit rates

ME, a provider of some of Australia’s highest term deposit interest rates, decreased numerous term deposit rates by up to 20 basis points.

ME now only offers rates as high as 2.45%.

CUA term deposit rates

Credit Union Australia, one of the largest customer-owned institutions, is another provider to drop rates by as much as 20 basis points.

These changes apply to the majority of its products – the five-year term deposit from CUA was lowered by 10 basis points to a new interest rate of 2.35%.

Gateway Bank term deposit rates

Gateway Bank lowered numerous term deposit rates by as many as 41 basis points.

Most of the changes however were between 20 and 30 basis points – its five-year deposit had its rate lowered by 28 basis points to 2.4%.

Suncorp Bank term deposit rates

Suncorp dropped many of its term deposit rates, by as much as 25 basis points.

Of the term deposits affected, Suncorp now has an interest rate of 2.55% on its five-year product.

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy