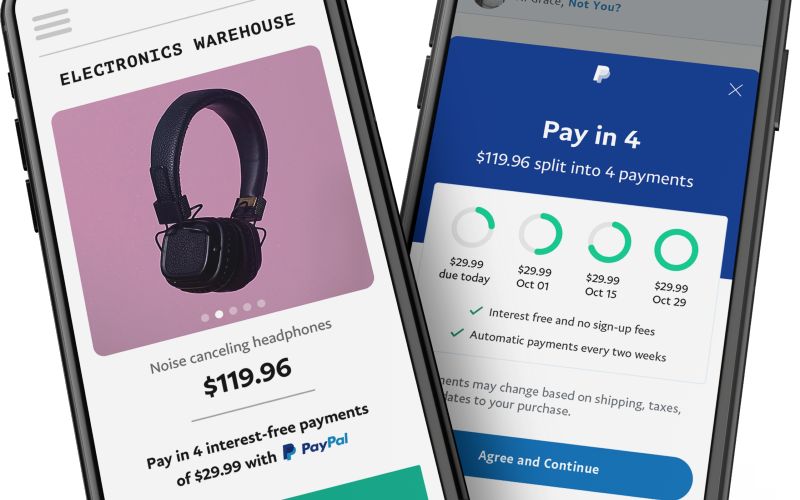

The survey of 1,000 Australians comes from buy now pay later (BNPL) provider Openpay.

Nearly three quarters of respondents also think paying off a BNPL plan on their debit card can improve their credit score, while 62% think the same for paying-off via credit card.

Openpay chief operating officer Theresa Abela called the relationship between credit checks and BNPL platforms a "grey area".

"Credit checks and credit scores are a confusing element of (the) financial system for everyone, particularly when you add cash flow management solutions such as buy now pay later to the mix alongside traditional forms of credit," she said.

"Not all BNPL providers approach credit checks the same way, so if you have a plan with another provider and you aren’t aware if you've consented to a credit check, make sure you ask the question, so you aren't surprised when the time comes to check your credit score.

"BNPL providers need to take some ownership of this grey area and educate consumers about their product, particularly if they want the industry to continue growing."

Payments expert Grant Halverson told Savings.com.au that banks and financial institutions "have done a very bad job" in educating consumers about credit reporting.

"The real issue is Australian are not well versed in positive credit reporting full stop ... this allows myths and misunderstanding to flourish," he said.

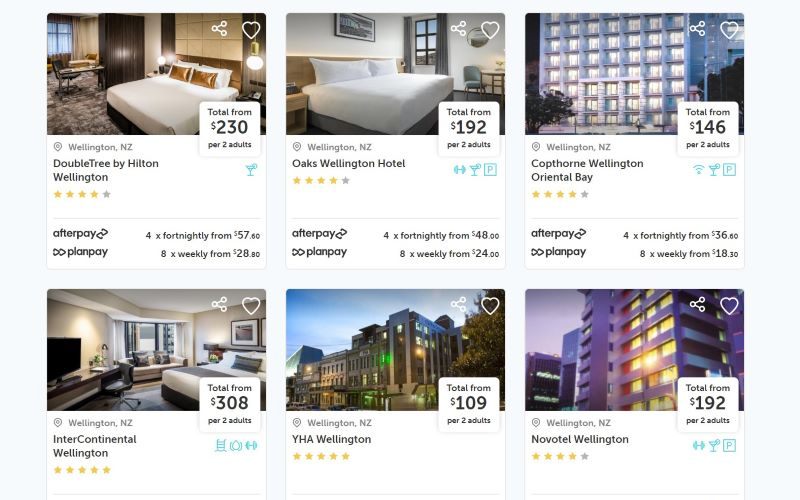

"BNPL is split on the issue of credit reporting - the largest Afterpay is not involved - while those BNPL that offer interest bearing products do undertake credit reporting on new apps only - and don't follow the other lending requirements - while others like Latitude do the full requirements.

"So BNPL apps send very confusing messages to consumers - so rather than helping, BNPL is hindering."

At the end of April, credit reporting agency Equifax reported consumer demand for BNPL is plateauing (up 4% quarter on quarter), while demand for credit cards dropped 28.9% in the March quarter.

“Changing consumer behaviour is pushing credit cards out of favour,” said Kevin James, an Equifax general manager.

Photo by Nicolas Flor on Unsplash

.jpg)

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper

Emma Duffy

Emma Duffy