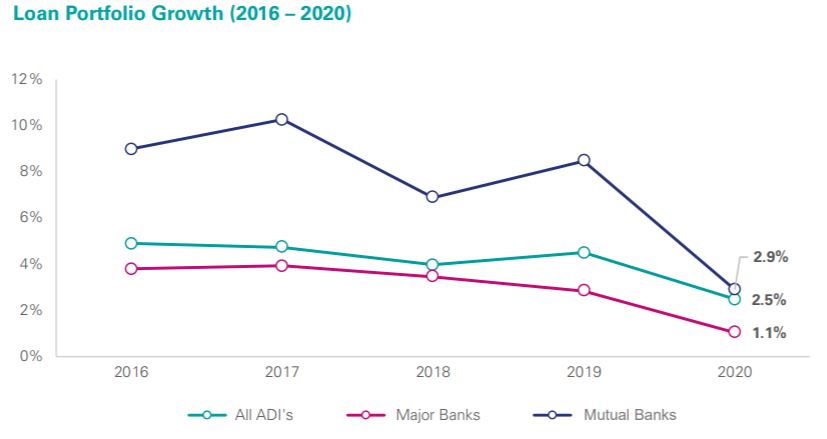

According to KPMG Australia’s Mutuals Industry Review for 2020, 47 of the industry's biggest mutual banks recorded a 3% increase in residential lending and a 7% increase in deposits from 30 June 2019 to 2020.

That's above the benchmark set by the majors, which grew respective lending and deposit books by 2.5% and 3.3%.

Comparatively, this time last year the mutuals' reported 7.3% growth in lending and 8.5% in deposits, highlighting the scope of the impact from the pandemic.

The table below displays some of the lowest-rate variable, owner-occupied home loans on offer from the top 10 customer-owned banks.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.18% p.a. | 5.63% p.a. | $2,739 | Principal & Interest | Variable | $350 | $0 | 90% | |||||||||||||

5.49% p.a. | 5.51% p.a. | $2,836 | Principal & Interest | Variable | $0 | $210 | 70% | |||||||||||||

5.49% p.a. | 5.50% p.a. | $2,836 | Principal & Interest | Variable | $0 | $180 | 90% |

| ||||||||||||

5.54% p.a. | 5.57% p.a. | $2,852 | Principal & Interest | Variable | $0 | $799 | 70% | |||||||||||||

5.49% p.a. | 5.53% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| ||||||||||||

5.59% p.a. | 5.65% p.a. | $2,867 | Principal & Interest | Variable | $0 | $0 | 80% | |||||||||||||

5.79% p.a. | 5.82% p.a. | $2,931 | Principal & Interest | Variable | $0 | $null | 80% | |||||||||||||

8.26% p.a. | 8.32% p.a. | $3,760 | Principal & Interest | Variable | $0 | $750 | 95% | |||||||||||||

8.46% p.a. | 8.53% p.a. | $3,830 | Principal & Interest | Variable | $0 | $799 | 80% |

"The 2020 financial year will be summarised as a challenging year for business, communities and individuals – and the Mutuals were no exception," KPMG Head of Banking Australia Ian Pollari said.

"The past year has also been categorised by low interest rates, and hence a flow-on impact to net interest margins – essentially the life-blood of the Mutuals’ financial performance, and increased levels of provisioning.”

However, he said the mutuals were well-positioned to meet the challenges.

"The success of Mutuals lies in their strong customer bond and affiliation as “purpose-driven organisations”, providing value to the community and members alike.”

Source: KPMG

Biggest mutuals see very strong growth

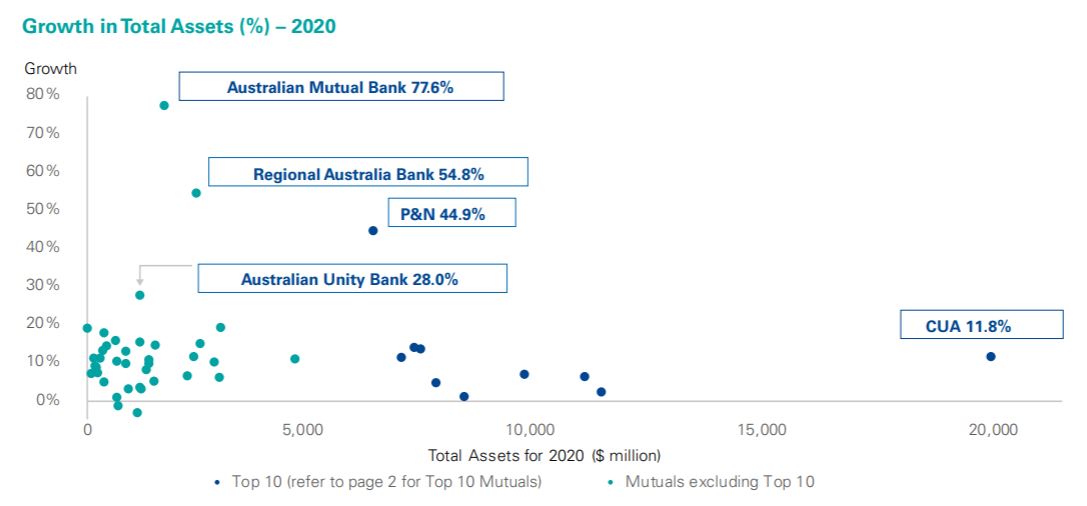

Some mutual banks recorded some above-average growth in terms of total assets under management, with the largest one, CUA, recording a 12% increase year-on-year.

P&N Bank, the 10th largest mutual bank, recorded a sizable 45% annual asset growth following a merger with credit union BCU, while Australian Mutual Bank, formerly Endeavour Mutual Bank, recorded the highest growth at 77.6% after a merger with Sydney Credit Union.

Source: KPMG

The 10 biggest mutual banks were unchanged from 2019, and all recorded positive annual growth.

Banks such as Newcastle Permanent, Heritage Bank,Teachers Mutual Bank and Bank Australia were all included in the top 10.

Mutuals' mortgage deferrals down

The mutuals performed quite well when it came to home loan deferrals, although it should be noted they still account for a small portion of the market.

According to KPMG's report, customer-owned banks only had 5.52%, or $5.56 billion of COVID-related mortgage deferrals come June 2020, at a time when as many as one in 10 mortgages had frozen repayments.

While some banks,including majors like Westpac, still have as many as a third of loan deferrals being extended, one of the leading mutual banks by assets, Heritage Bank, reported that just 5% of loan deferrals continued past the initial assistance period.

"We take our responsible lending obligations very seriously and our arrears rates traditionally sit at around one third of the industry average, so we know the credit quality of our customer base is very strong," Heritage CEO Peter Lock said.

KPMG noted that the mutuals' 'customer bond' was a reason for its strength in terms of low deferral numbers.

"The ability of the Mutuals to respond quickly, and in a one-to-one manner with respect to loan repayment deferrals, has been, and continues to be, a strength of the sector in these challenging times," the report said.

"Clearly, prolonged exposure to deferrals is not sustainable and assisting customers return to a repayment plan will be an important focus for the Mutuals as the sector shifts from ‘response’ to ‘recovery’ following COVID-19."

KPMG's National Sector Leader, Mutuals, Brendan Twining said the pandemic escalated customers' need for such interaction with their bank.

"Without doubt, technological change that was originally thought to take two-three years to implement, was – in many cases – achieved in less than two-three months and at lower cost," he said.

“Going forward the challenge will be to continue to maintain this momentum, both with respect to the operational changes made, identifying and transforming additional aspects of the business, as well as cultural change."

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury