Treasurer Josh Frydenberg unveiled today the Federal Government intends to implement a plan to overhaul Australia's payments system and regulate financial technology organisations.

Speaking to the Australia-Israel Chamber of Commerce and Industry, Mr Frydenberg said the comprehensive payments and cryptocurrency asset reform plan would place Australia amongst a handful of lead countries globally.

"For consumers, these changes will establish a regulatory framework to underpin their growing use of crypto assets and clarify the treatment of new payment methods,” Mr Frydenberg said.

"The government will begin consultation early next year on establishing a licensing framework for digital exchanges, allowing the purchase and sale of crypto assets by consumers within a regulated environment."

Australia's payment systems have not seen changes in regulations since the 1990s and with the emergence of digital payment platforms, CEO of Consumer Action Gerard Brody says this is a real opportunity to improve consumer protection.

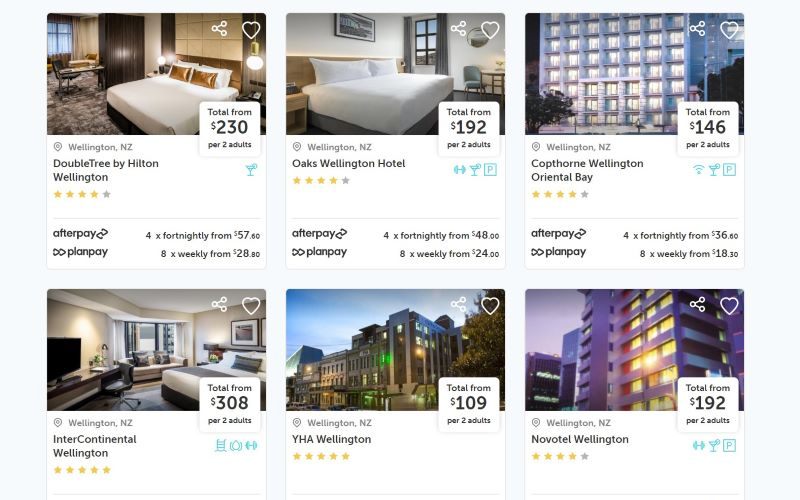

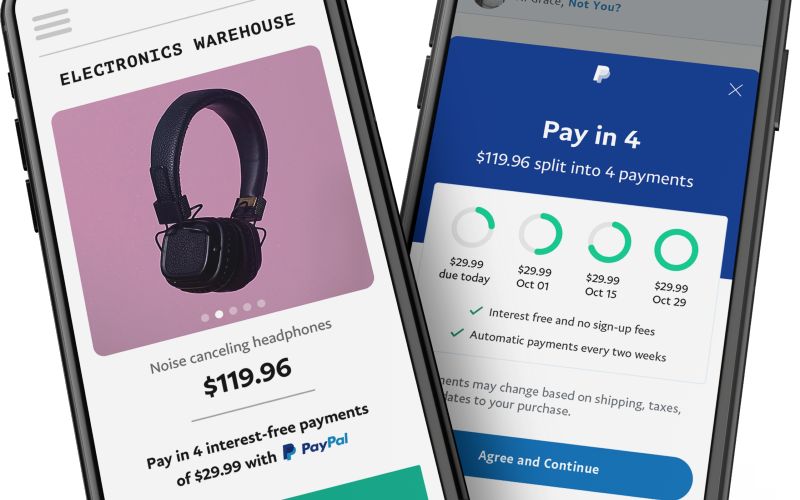

"Today’s announcement foreshadows consultation on regulatory arrangements for Buy Now Pay Later (BNPL) in 2022," Mr Brody said.

"This is an opportunity to ensure BNPL is regulated effectively and consistently with other credit products, to address the significant risk of debt and financial stress associated with these products."

"There is no doubt that crypto exchanges need to be regulated more akin to banks—these entities are now holding significant sums of peoples’ money and investments, and there needs to be accountability."

Uncertainty remains over eliminating scams

Data from the ACCC's Scamwatch detailed a 53.4% increase in reports of investment scams.

ACCC Deputy Chair, Delia Rickard, said more than half of the $70 million in losses were to cryptocurrency, specifically through Bitcoin.

"Cryptocurrency scams were also the most commonly reported type of investment scam, with 2,240 reports," Ms Rickard said.

Mr Brody says scam losses through cryptocurrency platforms are a huge and growing problem, yet there remains a cloud of uncertainty as to how the Federal Government will deter scammers following legislation.

"It’s less clear how these changes will protect against scam losses," Mr Brody said.

"Australia is falling behind international jurisdictions in terms of how we protect people from scams, with the gap appearing to be a lead regulator with responsibility for consumer protection and outcomes in the payment system."

Image by Executium via Unsplash.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper

Harrison Astbury

Harrison Astbury

Emma Duffy

Emma Duffy