This is effective on purchases made from 21 October.

The timing of this announcement comes as Australians open up their wallets following an end to lockdowns and the return of 'freedom'.

Klarna states that having a flat and consistent late fee means the maximum additional cost to shoppers per order is $9 - as the company is based on the business model of 'paying in four instalments'.

|

Total order value |

Late fee per installment |

Maximum late fee per order (across 3 late repayments) |

|---|---|---|

|

Up to $49.99 |

$0 |

$0 |

|

$50+ |

$3 |

$9 |

Source: Klarna

What else is changing?

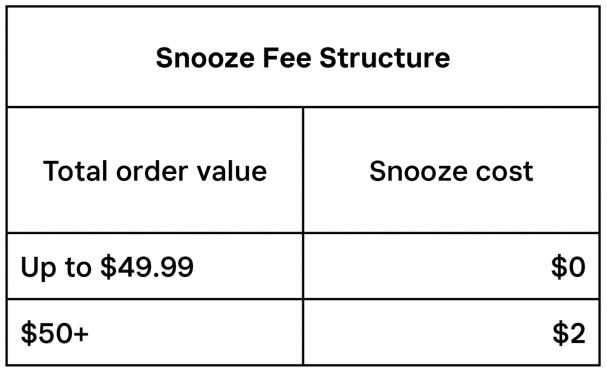

Klarna is also changing its 'snooze' function, which provides customers with an additional 14 days in order to make one of their four instalment repayments.

There are now no fees on snoozed repayments for purchases less than $50, while purchases over this amount have a snooze fee of $2.

Source: Klarna

Advertisement

In the market for a personal loan? The table below features unsecured personal loans with some of the lowest interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Secured Type | Early Exit Fee | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.28% p.a. | 6.28% p.a. | $389 | Fixed | Unsecured | – | $0 | $0 | $23,356 |

| Promoted | Disclosure | ||||||||

5.76% p.a. | 5.76% p.a. | $384 | Fixed | Unsecured | $0 | $0 | $275 | $23,066 |

| Promoted | Disclosure | ||||||||

6.45% p.a. | 6.45% p.a. | $391 | Fixed | Unsecured | $0 | $0 | $0 | $23,451 |

Head Image Supplied

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly