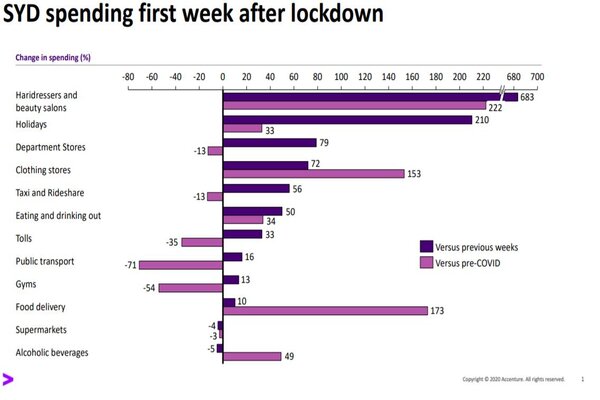

Services such as hairdressers and beauty salons were sorely missed, recording the most significant spike across spending categories compared to the lockdown average and a ‘normal’ average of January 2020.

Nature is healing, with spending on toll roads up by 33%, spending on taxis and rideshares up 56%, and spending on public transport up 16%.

Holiday planning was also back on the agenda, with residents increasing their spending on future holidays by more than 200% in the first week after lockdown.

Spending categories benefiting from restrictions easing

|

Category |

Freedom week vs lockdown average (prior 4 weeks) |

Freedom week vs ‘normal’ (average of Jan 2020) |

|

Hairdressers and beauty salons |

+683.4% |

+222.2% |

|

Department Stores |

+78.9% |

-12.6% |

|

Clothing stores |

+71.9% |

+153.2% |

|

Holidays |

+210.4% |

+32.9% |

|

Tolls |

+32.9% |

-34.7% |

|

Taxi and Rideshare |

+56.1% |

-13.1% |

|

Public transport |

+16.2% |

-70.8% |

|

Eating and drinking out |

+50% |

+33.8% |

|

Gyms |

+13.4% |

-54.1% |

Source: illion and Accenture

illion’s Director of Data and Analytics, Nicholas Robinson said that Sydney's first week of freedom appeared to have followed a fairly 'logical' process.

"Haircuts and preening on Monday and a trip to the department stores to continue the tidy up on Tuesday," Mr Robinson said.

"On Wednesday we hit the pub, and on Thursday, food delivery was required for obvious reasons."

Accenture managing director, Dr Andrew Charlton, said the most interesting component of this spending data, is seeing how quickly retail spending shot up despite online shopping still readily available.

"It’s clear to see people still love going into bricks and mortar retail," Dr Charlton said.

Source: illion and Accenture

Spending categories not expected to benefit from restrictions easing

|

Category |

Freedom week vs lockdown average (prior 4 weeks) |

Freedom week vs ‘normal’ (average of Jan 2020) |

|

Alcoholic beverages (bottle shops and liquor stores) |

-5% |

+49.2% |

|

Food delivery |

+10.3% |

+173% |

|

Supermarkets |

-4.2% |

-3% |

Source: illion and Accenture

Decreases were noted in spending across bottle shops and liquor stores, dropping by 5% in the first week after lockdown.

Food delivery spending remains more than 170% above its pre-COVID level whilst spending on alcoholic beverages remains around 50% above pre-COVID levels.

"One unexpected winner coming out of lockdown was food delivery having already seen an astronomical rise during lockdown, is now showing that it now may be a hard habit to now break," Dr Charlton said.

Image by April Pethybridge via Unsplash

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

William Jolly

William Jolly

Alex Brewster

Alex Brewster