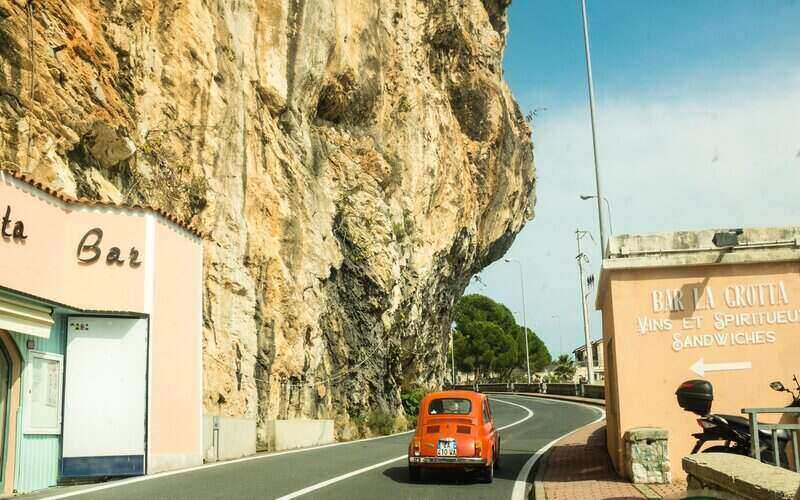

Technology has disrupted almost every customer journey across a wealth of industries, and the automotive sector is no exception. From researching online, to Toyota’s immersive AR shopping experience, it is little wonder Gumtree research shows that two in five Australians are considering taking the final leap into digital - purchasing a car directly online.

Dealers are already embracing technology in a significant way, with 58% spending the majority of their budget online to reach customers. Yet there is still a disconnect between the kind of services customers expect and want from a dealer, and a dealer’s willingness to provide them.

Reshaping the challenging car shopping journey

Gumtree Cars research highlights that there is a gap in several areas of the car shopping journey. While free servicing for 12 months is the promotional offering consumers find the most appealing, that’s not commonly offered by dealerships. The research also revealed a buyer-seller disconnect when it comes to discounts around vehicle accessories, on road costs, as well as financing.

The good news for car dealers is many Australians still look to them when securing car finance. Dealer finance may offer lower rates than car loans through a traditional bank, but these rates may only be available on specific makes and models and are usually only available for new cars. However, a survey by analytic software firm FICO found Australians are reluctant to shop around when looking for a car loan, with 52% only considering one lender.

The power of direct

Despite these challenges, the connection between car dealer and customer remains important. The 2019 FICO survey also revealed more than a third of Australians (35%) expect to get vehicle finance through their dealer. Recent scrutiny from the Royal Commission into Banking and Financial Services, and ASIC’s guidance on financing means that dealers need to innovate in order to restore trust and transparency between themselves and their customers, and to offer a better service.

Despite this, the research found 67% of customers agreed that they felt in control of the car finance process, and nine in 10 reported getting a great or good deal on their most recent car loan.

One stop shops

Globally, we’ve seen innovative digital start-ups are reshaping and speeding up the challenging car shopping journey through alternative finance options. Boston Consulting Group, for example, found that “aggregator platforms are developing direct-to-consumer channels that will allow buyers to shop online for loans and get them approved before going to the dealership.”

At the same time, dealerships have also been realising that the sooner the deal is made, the better it is for everyone involved, and consequently are taking proactive steps to streamline the financing process. Ford’s Ready.Shop.Go. in the USA is one example of an online platform that allows prospective customers to find a car, view pricing and incentives, schedule a test drive, apply for financing, estimate trade-in values and then lock in a deal for up to 48 hours.

Turning the finance model on its head

The current financing process can often slow things down considerably and take the enthusiasm out of a new car sale. However, the advent of digital tools in this auto finance space has the potential to make this pain point a thing of the past. New direct-to-consumer channels are letting buyers shop online for loans and get them approved before going to the dealership, while lending platforms are providing new financing options that range from personalised interest rates to variable terms.

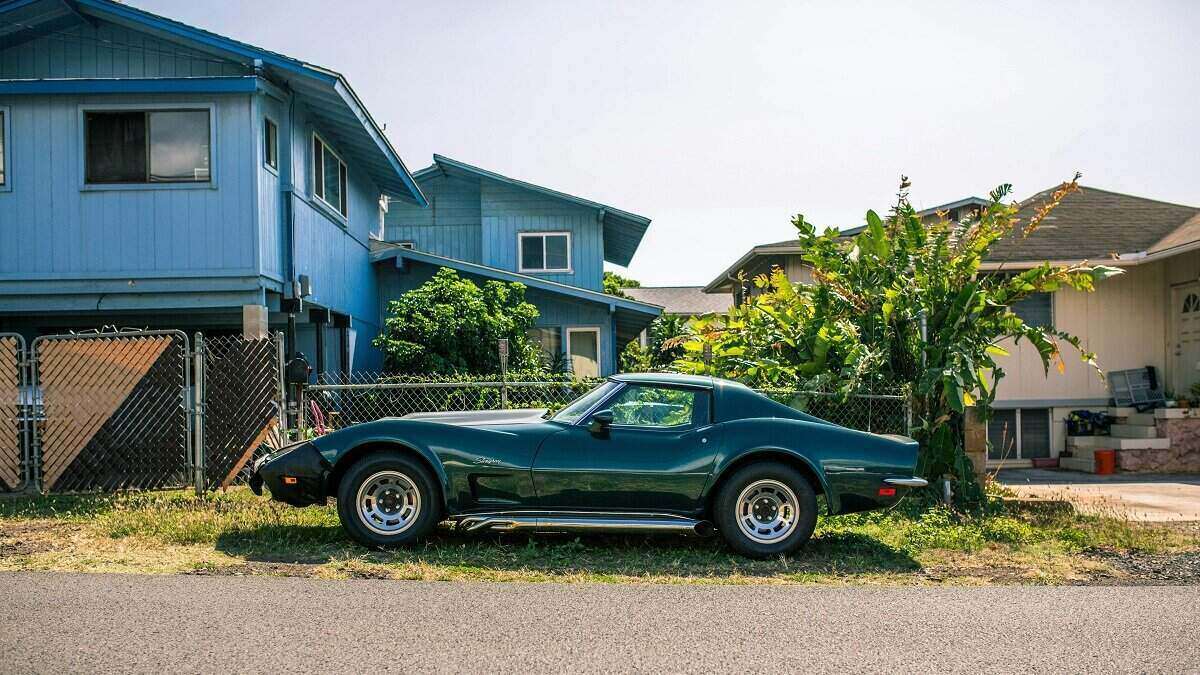

Digital start-ups and third party sites like Gumtree have been seizing opportunities around the new car buying process, by becoming a virtual extension of the dealership. However, savvy dealers are stepping up, too. We’ve seen a trend of more and more dealers turning financing from an afterthought into a key part of the overall customer service experience, with pre-approval and tailored interest rates set before the customer makes their purchase, speeding things up.

By changing their business model to offering finance upfront, dealers are utilising the opportunity to get to know the customer and establish trust and loyalty before the sales process even begins. Switching to an online financing model has the benefits of building a dealer-customer relationship without the pressure of an immediate sale, freeing up staff to concentrate on espousing the benefits of particular models and also matching customer expectations of the seamless digital journeys customers experience in their everyday life. All this activity will translate into a more transparent and streamlined car-buying process that eliminates obstacles such as insufficient information and long wait times.

As a car-buying consumer, it’s important to stay on top of the changes happening in the digital automotive space - and not just when it comes to financing. Consumers buying cars online will increase the scale and visibility of inventory, whilst promoting competition - providing a win-win for both buyers and sellers.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury

Brooke Cooper

Brooke Cooper