In an interview with the Guardian, Mr Jones reinforced the Labor Government's plan to crackdown on BNPL and cryptocurrency.

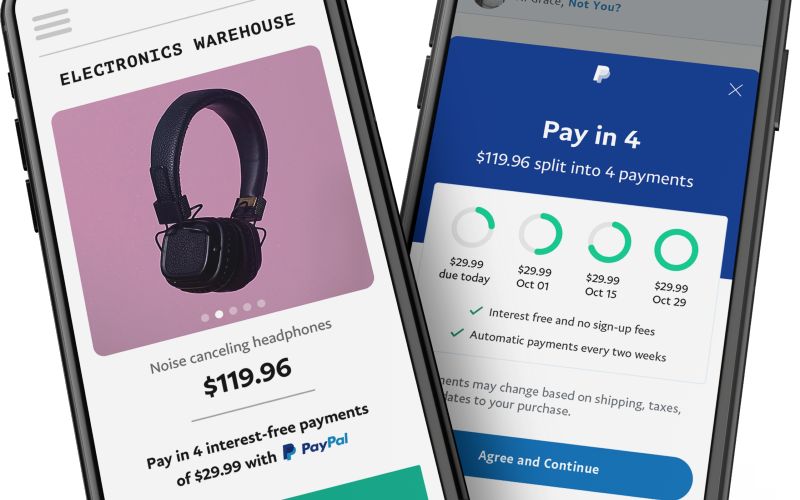

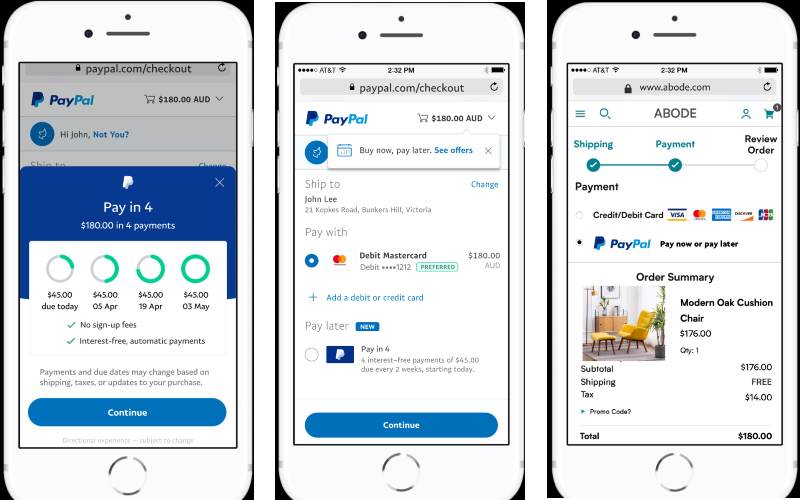

BNPL platforms are currently not regulated under the National Consumer Credit Protection Act of 2009 - like credit cards - because their terms are less than 62 days.

In March 2021, as then-Shadow Assistant Treasurer, Mr Jones MP welcomed the commencement of the new Australian Finance Industry Association’s Buy Now Pay Later Industry Code as a first step to an appropriate regulatory regime for the emerging sector.

The Code fulfils a 2019 recommendation made by the Senate Economics References Committee inquiry into credit and financial services.

According to the government, while many provisions of the Code have already been adopted by individual operators, the development of a new sector-wide Code will ensure consumers are better protected.

The Code ensures that all participants must have appropriate hardship measures, have suitability assessment processes and be members of the Australian Financial Complaints Authority.

“This Code represents a key step towards the development of an appropriate regulatory regime for the BNPL sector, and Labor welcomes this initiative," Mr Jones said.

“This is a genuine attempt by the industry to set sensible and fair rules around conduct in an emerging sector of the financial services sector.

“The financial services industry needs to show it has learned the lessons of the Banking Royal Commission and ensure that these Code provisions are rigorously enforced.”

Key consumer and community groups welcomed these comments.

A joint media release from Financial Counselling Australia (FCA), CHOICE, Anglicare Australia, the Consumer Action Law Centre (CALC) and the Financial Rights Legal Centre (FRLC) said BNPL and wage advance products are using a loophole in credit laws to bypass basic consumer protections – like assessing someone’s ability to repay or having hardship processes.

"The industry code has far too many gaps. It isn’t mandatory and there are many BNPL companies that haven’t signed up," said Gerard Brody, CEO of the Consumer Action Law Centre.

"There are only vague upfront assessment processes, that do not require the company to only provide loans that are affordable and suitable."

People in financial stress and who may be struggling with BNPL and wage advance debts can contact a free and independent financial counsellor on 1800 007 007 or visit ndh.org.au.

Image by Jonas Leupe via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper

William Jolly

William Jolly

Emma Duffy

Emma Duffy