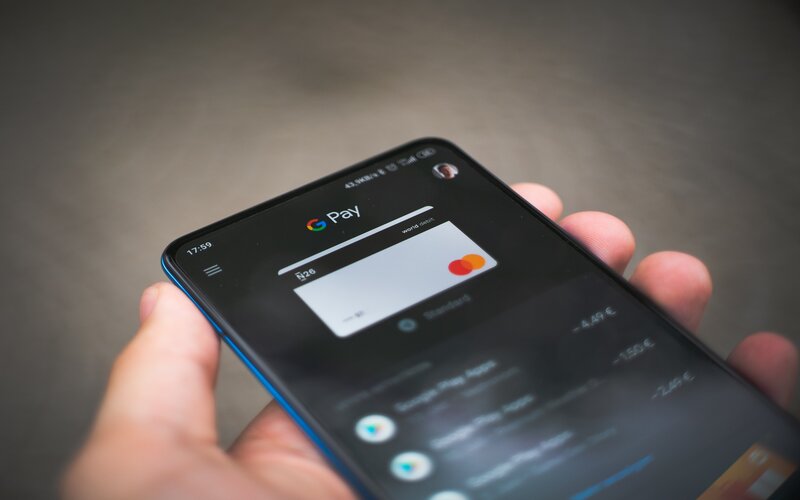

Mastercard's New Payment Index detailed more than 80% of Australians have utilised technologies including digital wallets, QR codes, Buy Now Pay Later (BNPL), cryptocurrencies and biometrics in the past year.

The index based on a survey of 1,000 Australians revealed a further 51% of Aussie consumers increased their usage of at least one digital payment method throughout the same period.

Mastercard notes the index analyses consumer attitudes, preferences and behaviours around emerging payment methods and determines consumer motivations and considerations in adopting digital payments.

Richard Wormald, Mastercard Australasia Division President, said while the pandemic accelerated the adoption of new payment technologies, Mastercard’s research shows that Australians have consistently demonstrated a willingness to embrace innovative digital payment options.

"The survey findings also reinforced the need for businesses to provide choice to meet consumer needs and expectations, both online and offline," Mr Wormald said.

The index revealed in Australia, most consumers rely on financial technology to accomplish everyday financial tasks, with bill payments at 78% and banking at 75% emerging as top use cases.

Further, 42% of Aussies know about open banking, while 53% have connected multiple accounts for banking activities.Respondents detailed three key reasons for connecting multiple bank accounts, including:

- Faster transactions, 42%.

- More convenience to track and manage bill payments, 40%.

- The ability to easily track transactions between accounts, 34%.

Security remains most significant factor for digital payments

When it comes to money, Aussies are a secure bunch with the index revealing security to be the largest influence on payment choice at 56%.

In terms of biometrics, payments made with facial recognition and fingerprints are growing, with 63% of Aussies preferring these means to remembering PINs or passwords.

Despite this preference, hesitancy remains with 74% concerned about which entities have access to this data.

These new findings come after it was revealed three in four Australians having experienced a spike in attempted scams over the last year, with the money lost to scams coming in at $366 million.

Under the Consumer Data Right with open banking, Aussie consumers have greater access to and control over their data providing greater clarity when comparing and switching between products and services.

The CDR also provides consumers control over what data is shared, for how long, with whom and for what purposes through consumer privacy and security protections.

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

Image by Mika Baumeister via Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

William Jolly

William Jolly