According to a snapshot poll conducted by the Australian Taxation Office (ATO) on October 14, more than 40% of Australians who intended to self-lodge their tax returns still hadn't done so, just two weeks before the 2019-20 deadline for tax lodgements on 31 October.

That's despite early tax returns increasing by 12% on July 1 compared to the same time last year.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest non-introductory interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

Australians who don't use a registered tax agent for their tax returns have until October 31 to lodge each year, before interest starts accruing on the amount owed according to the ATO.

🙋Quick poll to see how you’re going! Have you lodged your 2019–20 tax return yet?

— ato.gov.au (@ato_gov_au) October 14, 2020

With so many Australians still apparently yet to lodge their tax returns, co-founder and CEO at TaxFox Maz Zaman believes Australians should be given additional time to do so this financial year because of the wide-reaching impacts of the pandemic.

"2020 has been a year of hardship and financial struggle for Australians with many losing employment, switching jobs and adapting to new working conditions, all of which impact tax affairs," Mr Zaman said.

"We've seen a number of initiatives such as the extension of JobKeeper and JobSeeker extended with these same issues in mind, and it only makes sense for this consideration and support to also be applied to tax.

"In particular, there are the more than four million (and growing) Australians who self lodge every year, and are now faced with significant changes to their claims requiring extra research and a new understanding of the system."

Tax Fox co-founder and CEO Maz Zaman. Image supplied.

According to Tax Fox, self-preparers already lose out on significant savings compared to those who use agents, with those aged 30-34 claiming $1,000 less.

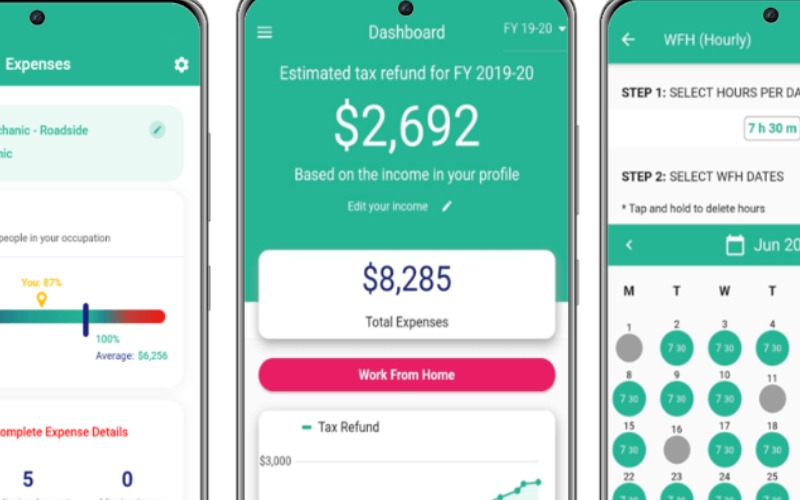

The deluge of Australians working from home this year as well (46% of Australians in fact) likely means many are set to be able to claim much more this financial year.

"With the impact of coronavirus, it's likely a significant number of self-filers are entitled to much more this year than they are used to claiming," Mr Zaman said.

"Not to mention, the ATO’s delay in the pre-filling data fields for online returns, which would have also impacted self lodgers who were trying to get ahead at the beginning of tax season.

"It's for these reasons we're calling on the ATO for an extension of the Oct 31st self-filing deadline.

"Self lodgers rushing this week deserve additional time to lodge their returns and get the refund they are truly entitled to, and put that money back to use in the economy."

[Read: ATO reveals tips to make your tax return easy this year]

Disclaimers

Savings.com.au does not provide tax advice. This material has been prepared by Savings.com.au and is for informational purposes only, and is not intended to provide, and should not be relied on for tax advice.

For tax advice relevant to you, visit the ATO or consult an independent tax advisor.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

William Jolly

William Jolly