Whether you’re a newbie to the micro-investing space or a seasoned pro, having the right platform tailored to your investing goals is one of the primary keys to success. One platform worth considering is Syfe.

Syfe at a glance

- Founded in Singapore in 2019, Syfe operates across Singapore, Hong Kong and Australia.

- Invest in US shares and ETFs from $1.49 and ASX shares and ETFs from $4.99.

- ‘Smart Baskets’ feature gives investors the ability to buy multiple ETFs in one order at significantly reduced brokerage.

What is Syfe?

Syfe is a digital investment platform tailored to help investors build their wealth in a way that best suits their financial position.

Founded in Singapore in 2019, Syfe now also operates in Hong Kong and Australia, and has about 100,000 users.

Speaking to Savings.com.au, Syfe General Manager and Country Head for Australia Tim Wallace (pictured above) said there was a real opportunity to bring sophisticated investment tools and strategies normally reserved for those either with high net worth or institutional investors to everyday retail investors.

“No matter what geography you're in, whether you're an Australian or Singaporean, when it comes to investing, people are faced with information overload and competing priorities when it comes to saving and investing,” Mr Wallace said.

“People ask, do I put my money in my mortgage offset or bank account, or do I get it to work by investing it?

“These are real questions that people ask themselves every day. Even when folks have the desire to grow their wealth, there's barriers to entry, like lack of time, patience, lack of knowledge.

“Compounding this is that, there's really a lack of existing solutions that fail sometimes to solve the friction and problems that people face to grow their wealth. The net result being that a large portion of society really is not optimising their investments and savings based on their own circumstances.

“Syfe exists to solve that.”

What separates Syfe from the micro-investing pack?

With a seemingly endless number of options to choose from in the micro-investing space, Syfe aims to differentiate itself from the likes of Superhero, Selfwealth and CommSec through simplicity.

“Investors are faced with an abundance of options, when it comes to which investment platforms to use and invest through,” Mr Wallace said.

“Choice can be a great thing, because it really gives investors the power to pick what works for them. It can also get really confusing and overbearing on figuring out where to start actually, for a lot of people.

“A key mantra for us at Syfe is to simplify that complexity. So from when an investor is thinking about who to use, right through to when they're actually placing their trades, we want to make that investor experience simple but powerful and efficient.”

Mr Wallace said Syfe’s key differentiators include low cost access to Australian and US markets - from as little as one share in Australia and $1 in the US - and investment tools like ‘Smart Baskets’ (explained below).

“It’s quite a sophisticated offer, but done very simply. It gives people the power to diversify very easily alongside free insights, like analysts' recommendations on stocks, market news and educational content.

“The sum total of all of those components does separate us in the market, and really provides investors of all levels with some great tools and capabilities to get the most out of building wealth.”

What portfolios does Syfe offer?

Syfe does not offer customers the opportunity to invest in default premixed portfolios like a range of other micro-investing apps, instead serving as a platform or intermediary source for investors.

“Syfe Australia doesn't offer things like managed investment schemes or managed funds that we operate yet, however, we do offer investors access to exchange traded funds, or ETFs on the Australian and US markets,” Mr Wallace said.

“So they are effectively portfolios in their own right, that are listed on stock exchanges.”

Syfe features and fees

‘Smart Baskets'

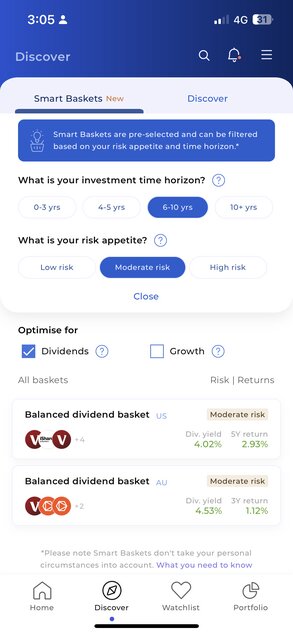

Syfe’s ‘crown jewel’ setting the platform apart from other micro-investing apps is a feature called ‘Smart Baskets’ (pictured below).

“The ‘Smart Baskets’ feature allows investors to purchase multiple ETFs in one order at a significantly reduced brokerage rate,” Mr Wallace said.

“So where normally you may have previously required multiple orders to do this, we've simplified it down into one. These orders are pre-built by our wealth professionals, that users can filter based on their investment time horizon and their desired risk tolerance.

“By combining a number of ETFs, you can get the power out of what each specifically focuses on, further diversifying against the things that you want to achieve. That capability, combined with the ability to filter the amount of time that you want to invest over and risk tolerance is something unique to the Australian market given its simplicity but also power.”

Fees

For investing in the Australian market, Syfe charges a brokerage fee of $4.99 per trade under $20,000. Trades over $20,000 are charged 0.025% of the trade value.

For example, if you made a $25,000 trade, you would pay $6.25 in brokerage.

Syfe notes there are no other costs associated with trading on the ASX with Syfe, such as market data fees and contract fees.

Here’s how Syfe stacks up to some of competition in the micro-investing space:

- CommSec Pocket: $2 per trade for investments under $1,000; or 0.2% of trade value for amounts over $1,000.

- Stake: US & ASX - $3; Account fees: 0.7% conversion fee for AUD to USD, with a minimum conversion fee of USD $2.

- Douugh: $2.99 monthly fee for portfolio balance of $50 USD; $2.99 fee for unlimited share trading.

- Kwala: $0 brokerage; $2-4 per month fee, minimum investment $10.

How to achieve a diversified portolio

To achieve a diversified portfolio, Mr Wallace says there’s no silver bullet, given each investor has different goals and timelines.

“By investing in in a mix of things, investors can reduce their exposure to any one investment or industry,” he said.

“As a result, this can improve the chances of achieving more consistent returns.

“The saying don't put all your eggs in one basket, that is what diversification at its core is all about.”

Mr Wallace noted the first step to achieving a diversified portfolio, no matter whether you are a seasoned pro or investing for the first time, is goal setting.

“This a personal reflection on things like your own capability to invest, why you're investing, the strategy that you want to follow, how tolerant you are to risk against that strategy, how long you want to invest for, and then the specific goals you're trying to achieve,” he said.

“As an example, somebody investing over a shorter term time period, say three years, will have or should have a different approach to someone investing over, say 30 years. While both should be diversified, again, the specific things that they invest in, and the risk they take, will likely be different over those two different time time horizons.

“So when it comes time to invest, fortunately today, investors have fantastic tools at their fingertips, which enable them to diversify both quickly and also quite efficiently. Exchange traded funds (ETFs) invest in a broad range of asset sectors in a single purchase. There's never been an easier time or more cost effective time for investors to be able to get the benefits of diversification without having to select dozens of individual stocks.”

Despite a seemingly endless number of options to choose from, Mr Wallace said this can leave investors with more questions than answers.

“The confusion investors face is that they know they should invest in ETFs to achieve diversification, but there's so many of them either on the US market or the Australian market that a paralysis of choice exists.

“I think for many people, that can actually lead them to not even invest, because they don't understand what they're actually doing.

“Through Syfe’s ‘Smart Baskets’ feature, users can can filter based on their own preferences, time horizon and risk tolerance, focused on market or income or growth, and really pick the right pre-built package of orders for them, which we feel is quite powerful in this age to have a lot of choice.

Mr Wallace said another factor to consider as a powerful add-on to diversification is consistent investment.

“If consistent investment is done regularly, over time, it does enable an investor to take advantage of the peaks and troughs that naturally occur in the market and potentially reduce their risk of investment over time,” he said.

Tips to get started with micro-investing

To help you get started on your micro-investing journey, Mr Wallace outlined a few pointers to keep front of mind.

“The first thing is there's there's never a perfect time to get into the market. Even the best stock pickers in the world struggle to time this,” he said.

“What's most important for the majority of us is now that you're in the market, you're consistent with your investment, and you're true to your investment strategy.

“Micro-investing is a really great way for investors to get started, not only to learn and build confidence, but also to invest at a level that's comfortable for their own circumstances. That said there's no tried and true definition of micro-investing.

“Investing by and large is you ultimately wanting a platform that enables you to invest how you like, whether that's small and consistent or large and infrequent. So Syfe was built with that in mind.

“We wanted to reduce those barriers to entry that a lot of investors face, including this perception that you need a lot of money to start investing.

“Vast majority of folks think you need like a minimum of $1,000 bucks to get the ball rolling - there's even a large portion that think you need a minimum of $10,000 to start investing.

“Syfe enables investors to buy into the US market from as little as $1 and the Aussie market from as little as one share. This, combined with our low cost brokerage is a fantastic way for investors to get started, get consistent and build their wealth long term.”

Images supplied.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Alex Brewster

Alex Brewster

William Jolly

William Jolly