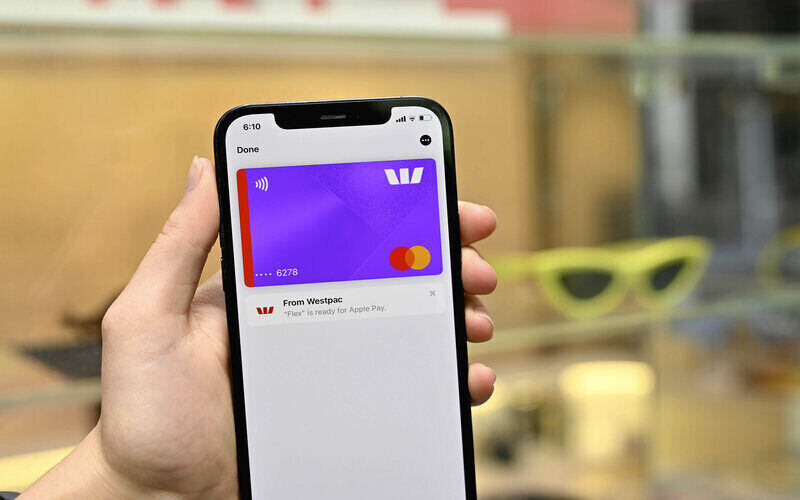

'Flex' is a digital card, allowing customers to access $1,000 credit with no interest on purchases, no late payment fees and no foreign currency fees.

Customers will be charged a flat $10 monthly fee, however that fee is waived if payment of the amount owing from the month prior is made on time.

Repayments are automatically direct debited from the account customers nominated during application.

If customers miss a minimum repayment, there is no late fee, but the card will be suspended until you make that minimum repayment.

Westpac's move follows NAB and CommBank, which also launched 'zero interest' credit cards in 2020.

Westpac consumer research of 2,038 Australians aged over 18 shows that younger Australians are less likely to use a traditional credit card and more likely to use mobile to complete their banking tasks than any other generation - Gen Z 85%, Millennials 77%, Gen X 58%, Baby Boomers 20%.

The data also highlights that Generation Z and Millennials are conducting almost all their banking tasks online and are more likely to seek out banking tools and features to manage their cash flow and repayments.

Westpac chief executive of consumer and business banking, Chris de Bruin, said the product is designed for younger Australians.

"It’s easy to use and understand, and customers will be able to use Flex to make purchases in store or online just like a regular card," Mr de Bruin said.

"Flex caters for the 'on-demand' generation who want convenience and control, without the complexity.

"Customers will be able to choose the cycle their repayments fall on, whether it's twice a month or monthly, and we will send proactive reminders via the app and SMS to help them keep on track with repayments."

The 'Flex' lowdown

Features:

-

$1,000 credit limit;

-

$10 monthly fee, or no fee when you clear your previous month's balance on time;

-

No interest;

-

No cash advances or balance transfers.

Repayments:

-

Choice of repayment frequency - once or twice monthly;

-

$40 minimum repayment monthly or the full amount owing for each statement period.

Applications:

-

Instant digital card access on approval (physical card optional);

-

No document upload required.

"The Flex application process will use real time, digital data assessment to review a customer’s financial position to make sure they can meet their repayments. Through using this technology, we have the ability to assess a customer's financial position quickly while at the same time taking steps to ensure we are lending responsibly," Mr de Bruin said.

Image provided by Westpac

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

Jacob Cocciolone

Jacob Cocciolone