Lloyd Edge, founder of buyers agency Aus Property Professionals, said the current property market is showing resilience to rising interest rates, much more than economists predicted after forecasting a 20% plunge.

"This is because it is really the high value houses that are being hit the hardest with the lower end of the market not seeing too much change," Mr Edge said.

"In this way, the higher value properties are absorbing the hit to the market.

"The reason for this being that the lower end of the market is still in high demand for first home buyers who are competing with investors for these lower value properties."

Mr Edge also noted that lenders are more critical of borrowers' capacity to pay back a loan in the context of rising interest rates.

A borrower's is typically assessed using APRA's serviceability buffer - currently 3%.

"When the borrowing capacity of a buyer falls, this will create more demand for properties at the lower end of the property market which is the on-flow effect of rising interest rates and the reason we aren’t seeing property prices crashing - so it isn’t good news for first home buyers just yet," Mr Edge said.

"An example of this is that year to September 2022, home prices at the top end of the market lost 3.8% of their value compared to properties in the cheapest 25% of the market which saw their prices 12.8% higher over the same comparable period."

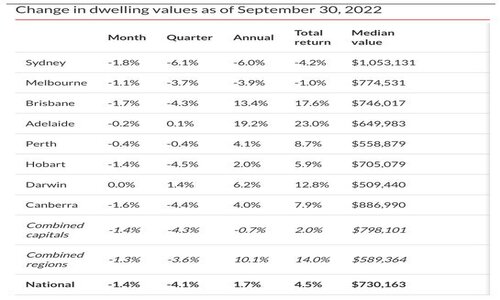

Recent data contained in CoreLogic’s national Home Value Index (HVI) revealed housing values fell 1.4% in September, with Sydney and Brisbane being the capitals hit with the largest declines.

Source: CoreLogic.

According to CoreLogic’s research director Tim Lawless it is probably too early to suggest the housing market has moved through the worst of the downturn.

"It’s possible we have seen the initial shock of a rapid rise in interest rates pass through the market and most borrowers and prospective home buyers have now ‘priced in’ further rate hikes," Mr Lawless said.

"However, if interest rates continue to rise as rapidly as they have since May, we could see the rate of decline in housing values accelerate once again."

What will the future hold for buyers?

According to Mr Edge, there might not be much short term relief for buyers with more interest rate hikes likely to be on the table.

"It will come to a point where some first home buyers can no longer afford to enter the market, and this will bring the demand down for properties in the lower end of the market and this should bring some relief to those prices," Mr Edge said.

"Until then, we aren’t expecting a huge decline in prices at the lower end of the market."

ANZ economists previously forecast the cash rate to reach 3.35% by year’s end, but now expect the RBA cash rate target to peak in May 2023, at 3.60%.

Chief Economist of PRD Real Estate Dr Diaswati Mardiasmo said it's almost a catch-22 for first home buyers at the moment.

"On one hand, higher cash and interest rates does mean a lower borrowing power, which means you might not have a higher purchasing price than before - but on the other hand, there is a possibility that the area you are interested in might experience a decline in price," Dr Mardiasmo told Savings.com.au.

"To navigate this, it is key for the first home buyer to really know what they want, and how elastic their demand is.

"If their demand is highly elastic, then they can further navigate by calculating the offset between lower borrowing power and purchase price.

"Say with future interest rates rises, your borrowing power declines by 5% - and the areas that you are looking to buy into are declining in median price say by 7-8% - then you are still coming out on top."

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Thirdman via Pexels.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Alex Brewster

Alex Brewster

Dominic Beattie

Dominic Beattie