The Australian Securities and Investments Commission (ASIC) analysed the markets during the COVID-19 period and found a 'substantial increase' in retail activity across the securities market.

It analysed retail trading figures using a focus period from 24 February to 3 April, and compared it to a benchmark period from 22 August 2019 to 21 February 2020.

For reference, the ASX 200 peaked on 21 February, closing at 7162.50.

Average daily turnover in the retail broking sector increased from $1.6 billion in the benchmark to $3.3 billion in the focus period - more than double.

Key results ASIC found were:

- The proportion of retail traders flocking the day trading markets increased from 10.62% to 11.88%.

- Market-wide, daily securities market turnover increased from $15 billion to $28 billion.

- An average of 4.675 new identifiers appeared per day in the focus period.

- For active investors in both the benchmark and focus periods, average time between trades on any one stock decreased from 4.5 days to one day.

In addition to increased trading, there was also a sharp increase in the number of retail investors in the market - up 3.4 times.

ASIC's analysis found that in the focus period, on more than two thirds of the days where retail investors (average punters) were net buyers, prices declined the following day.

The inverse also happened - on more than half the days where retail investors were net sellers, their share prices 'more likely' increased the next day.

This means retail traders couldn't catch a break or effectively 'time the market' a lot of the time, resulting in money lost.

Coincidentally, Australians have also saved themselves $1.5 billion in gambling losses since the Federal Government shut down pubs, clubs and other gambling venues on 23 March.

Need somewhere to store cash and earn interest? The table below features introductory savings accounts with some of the highest interest rates on the market.

Provider | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Savings Accelerator

| |||||||||||||

Disclosure | |||||||||||||

Savings Accelerator

Disclosure

| |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

| FEATURED | High Interest Savings Account (<$250k)

| ||||||||||||

Disclosure | |||||||||||||

High Interest Savings Account (<$250k)

Disclosure

| |||||||||||||

| 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| FEATURED | Save Account

| ||||||||||||

Disclosure | |||||||||||||

Save Account

Disclosure

| |||||||||||||

| 0 | 1000 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| FEATURED | Savings Maximiser

| ||||||||||||

Disclosure | |||||||||||||

Savings Maximiser

Disclosure

| |||||||||||||

| 4 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Hi Saver | |||||||||||||

| 4 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Bonus Saver | |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Online Saver | |||||||||||||

| 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Up Saver Account | |||||||||||||

| 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||||

Qsaver | |||||||||||||

| 0 | 100 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver Account | |||||||||||||

| 0 | 100 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver | |||||||||||||

| 3 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Maxi Saver | |||||||||||||

| 0 | 100 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver Account | |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Netsave Account | |||||||||||||

| 0 | 200 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Growth Saver | |||||||||||||

| 4 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Simple Saver | |||||||||||||

| 0 | 1000 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||||

Virgin Money Boost Saver | |||||||||||||

| 0 | 2000 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

HomeME Savings Account (<$100k) | |||||||||||||

| 0 | 200 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Online Savings - Premium Saver | |||||||||||||

| 0 | 10 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

mySaver | |||||||||||||

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

Time in the market, not timing the market

ASIC's analysis found the average retail investor was not proficient at predicting short-term market movements.

"While markets generally recover over the long run and tend to grow with economic fundamentals, short-term trading and poor market timing can be a major risk for investors in volatile markets," the report said.

"Therefore, retail investors should be wary of trying to ‘play the market’ for short-term price movements by day trading.

"Even market professionals find it hard to ‘time’ the market in a turbulent environment, and the risk of significant losses is a regular challenge.

"For retail investors to attempt the same is particularly dangerous, and likely to lead to heavy losses – losses that could not happen at a worse time for many families.

"Retail investors chasing quick profits by playing the market over the short term have traditionally performed poorly – in good times and bad - even in relatively stable, less volatile market conditions."

Many Australians are either knowingly or unknowingly exposed to the sharemarket through their superannuation fund.

There, the aim is to grow funds year-on-year over the long term, and the funds are usually highly diversified, meaning they choose shares from a large basket of companies, rather than a single company.

Many super funds also have a 'lifecycle' strategy, which decreases your exposure to shares as you approach retirement, and instead focuses on 'safer' assets such as treasury bonds and cash.

A similar share trading approach is applied to Exchange Traded Funds (ETFs), which consist of a wide variety of companies.

ETFs tend to mirror the entire ASX and international markets, focus on sector-specific stocks such as minerals or technology, or invest in stocks with high dividend yields.

Source: Know Your Meme

Risky derivatives also seeing their time in the sun

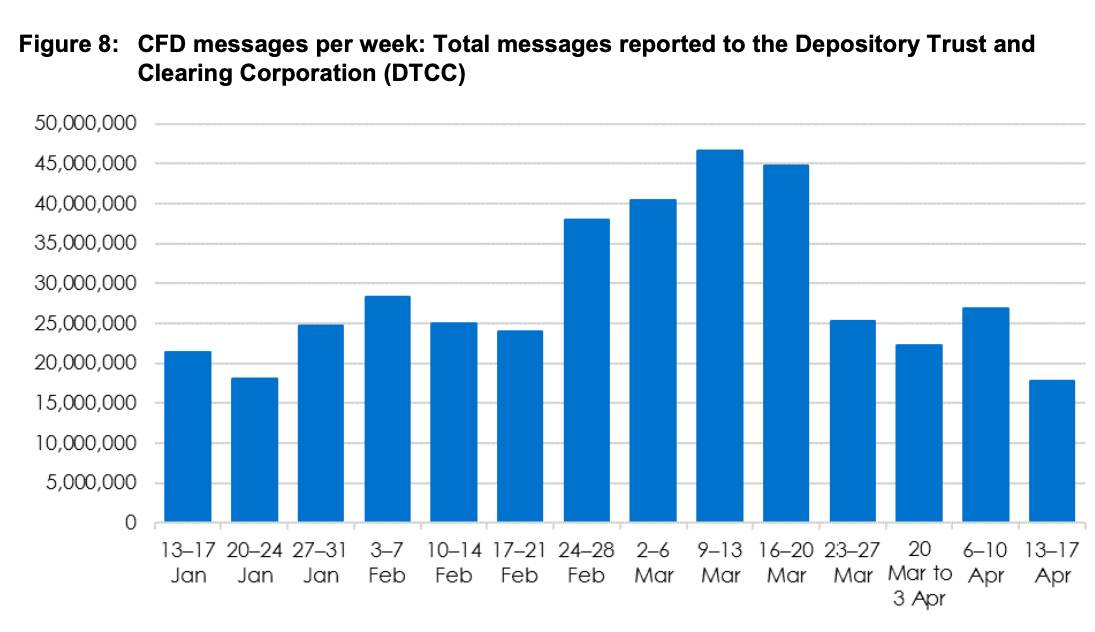

ASIC found derivatives markets - particularly CFDs - saw a sharp rise in trade volume in the focus period (pictured below).

CFD stands for 'contract for difference' and it provides the ability for a trader to profit from effectively betting on price movements, rather than the underlying asset itself - hence the 'derivative' moniker.

While CFDs can magnify profits, they can also magnify losses.

For example, a $1,000 CFD investment could expose you to $20,000 in shares (a 20:1 ratio), and a 5% fall in the share price could actually result in a loss of 100% of the investment amount ($1,000).

In ASIC's analysis of the week commencing 16 March, retail client losses amounted to $428 million (or $234 million net) based on results from 12 providers, or 84% of the CFD market.

Approximately 2% also lost more than they invested, to the sum of $4 million in the aggregate, meaning they lost their initial investment and still owed $4 million to CFD issuers.

On top of that, ASIC's analysis found even higher ratios in the CFD derivatives market than the example provided above.

"We commonly see CFD leverage ratios of up to 200:1 for CFDs over securities market indices, and up to 500:1 for CFDs over currency pairs," the report said.

"This means that, for example, at a leverage ratio of 500:1 a retail client with an initial investment of $1,000 may open a CFD position with exposure of $500,000.

"Between 16–20 March 2020, the Australian– US dollar fix rate (WM/Reuters) fell 5.2%, the equivalent of 26 times the minimum initial margin for a currency CFD with 500:1 leverage (a $26,000 fall in the example)."

However, ASIC also noted that many CFD issuers have reduced their maximum leverage ratios during this period of "significant market volatility".

More broadly, retail CFDs are effectively banned in the United States as the law prohibits retail CFD trading unless they are on an exchange - there is no such exchange in that country.

Source: ASIC

.jpg)

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Hanan Dervisevic

Hanan Dervisevic

Rachel Horan

Rachel Horan