According to the Australian Bureau of Statistics (ABS), retail sales exploded by 8.5% in March, significantly up from the 0.5% increase in February.

The result was somewhat expected after the ABS released preliminary figures of 8.2% for the month in April.

ABS Director of Quarterly Economy Wide Surveys Ben James said COVID-19 heavily impacted retail trade in March.

"There was unprecedented demand in food retailing, household goods, and other retailing," Mr James said.

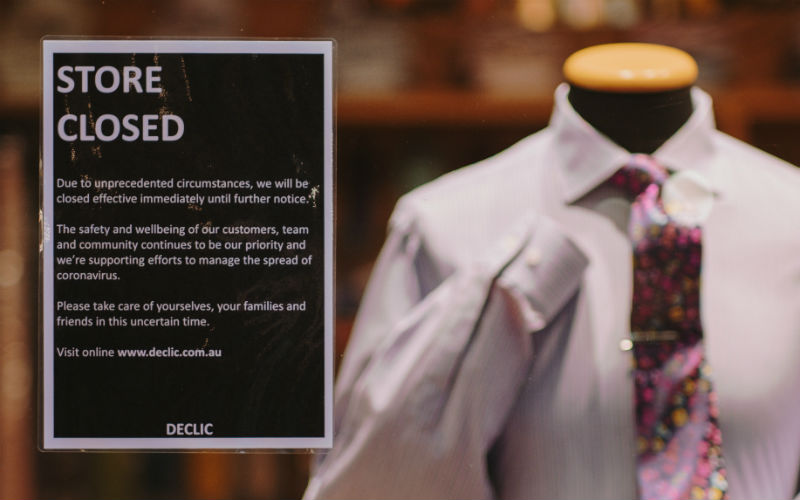

"However the impact of social distancing regulations saw sales fall in cafes, restaurants and takeaway food services, and discretionary spending in clothing footwear and personal accessory retailing, and department stores, was also weak.

"The March month saw both the strongest rise in food retailing, and the strongest fall in cafes, restaurants and takeaway food services, that we have seen in the history of the series."

Food retailing saw an increase of 24.1%, while other retailing rose by 16.6% and household goods were up 9.1%.

These rises were partially offset by a big drop in cafes, restaurants and takeaway food services (-22.9%), clothing, footwear and personal accessory retailing (-22.6%), and department stores (-8.9%).

It marks the strongest rise ever published, surpassing the 8.1% increase in June 2000 when households scrambled to buy goods before the implementation of GST.

Online shopping explodes during isolation

Online retail sales continued spiking in March, jumping by a further 5.6% on a month-on-month seasonally adjusted basis, according to NAB's Online Retail Sales Index.

Department stores recorded the sharpest lift in online spending in March, with spending on homewares and appliances also up sharply.

NAB Chief Economist Alan Oster said consumers are turning to spending online in the wake of the crisis.

"Although online retail still represents an estimated 9.7% of all retail, this share has grown in the past couple of months and indicates that, while broad retail sales have slowed, those consumers still spending are doing so with an increased online focus," he said.

Grocery and liquor sales remained strong, as did categories that might be boosted by self-isolation such as games and toys as well as personal and recreational goods.

"Potentially people have been using this time to replace existing homewares and appliances, with sales for the category, which had been relatively subdued, now growing slightly faster than the overall index," Mr Oster said.

On the flipside, fashion and takeaway food saw big drops in online spend during March.

"Having said that, the latter category is still almost double the sales of a year prior," he said.

"With respect to COVID-19, evidence from overseas online sales monitors suggest that the fall in fashion sales is widespread, with the Australian market performing better than some comparable online retail markets."

According to NAB, sales at international merchants collapsed in March, particularly in their key sales category: Fashion.

Meanwhile, domestic merchants outpaced international merchants in online spend for categories including fashion, games and toys.

"It is likely with these results that concern over stock availability and delivery was elevated in March, and contributed to this spending behaviour," Mr Oster said.

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

William Jolly

William Jolly