Fact Checked

Frequently Asked Questions

Credit card interest is charged for borrowing money from a financial institution with your credit card. Ultimately, the amount of interest you will pay depends on the interest rate, the amount of debt owed, the types of transactions made (e.g. purchases or cash advances) and the number of interest free days.

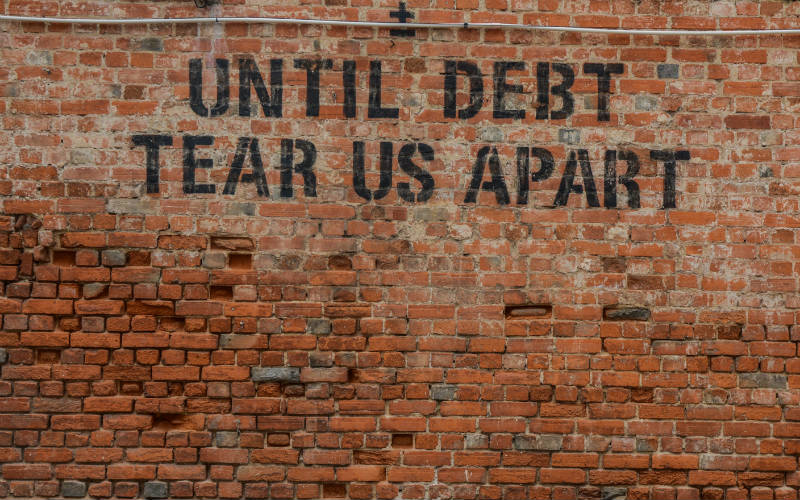

Interest rate, fees and features are just some of the factors that should be front of mind when choosing a credit card. It may be enticing to get a credit card offering multiple rewards or bonuses, yet arguably the most important factor is your ability to be a responsible credit card user. Debt can sneak up on you, and picking an unsuitable card can increase your interest repayments quickly.

To be eligible for a credit card, you are required to be over the age of 18 and meet certain requirements. These include income, identification, Australian residency status and credit history. Generally, you will also need to provide details of your assets, expenses and liabilities in order for the bank to determine if you can meet credit card repayments sufficiently.

In some cases, rewards or platinum credit cards will have further requirements as they are tailored to a specific customer base.

The interest-free period is the maximum number of days that you won’t be charged interest on purchases, provided you pay off your balance in full by the due date.

It’s important to consider your personal financial position before getting a credit card. While credit cards provide easy access to an immediate source of funds, they also have the potential to be an expensive way to borrow money. If you find it difficult to consistently make your repayments, you risk accumulating debt quickly, which will hamper both your financial position and mental health.

Ask yourself the following questions:

- Why do you need it?

- How will you pay it off?

- Will any incentives or rewards on offer justify the cost?

One one hand, a credit card can impact your credit score negatively, yet on the other it can impact your credit score in a positive manner.

Each time you apply for a credit card, it will be recorded on your credit file. If you apply for a credit card and are rejected, this will leave a negative mark on your credit score. Importantly, if you miss repayments, your credit score will also suffer.

If you make regular payments and are responsible with the use of your credit card, this can raise your credit score. In essence, it all comes down to how much you tap or swipe your card and make repayments to pay off accumulated debt.

Harrison Astbury

Harrison Astbury