This increase has seen household spending lift 11.4% in November from the same period in 2021, down from the 20.7% increase recorded in October and 28% in September.

ABS Head of macroeconomic statistics Jacqui Vitas said this latest rise was less significant than previous months, as COVID-19 Delta variant impacts, such as lockdowns, eased towards the end of 2021.

“The highest increases were in spending in Transport, up 35.8%, and hotels, cafes and restaurants, up 23.8%, but growth slowed in comparison to previous months.“

CommBank's Household Spending Intentions Index comparing month-on-month spending behaviours echoed ABS results from November, with transport costs increasing 6.5% in November as a result of higher petrol prices and spending at service stations.

The ABS revealed all states and territories saw increased household spending in November 2022 when compared to November 2021, yet the impact of consecutive cash rate hikes has taken its toll as spending began to taper.

NSW and ACT saw spending increase dramatically back in August from 2021 figures, recording 41.9% and 45% increases, yet in November that has scaled back to 11.4% and 8.2% respectively.

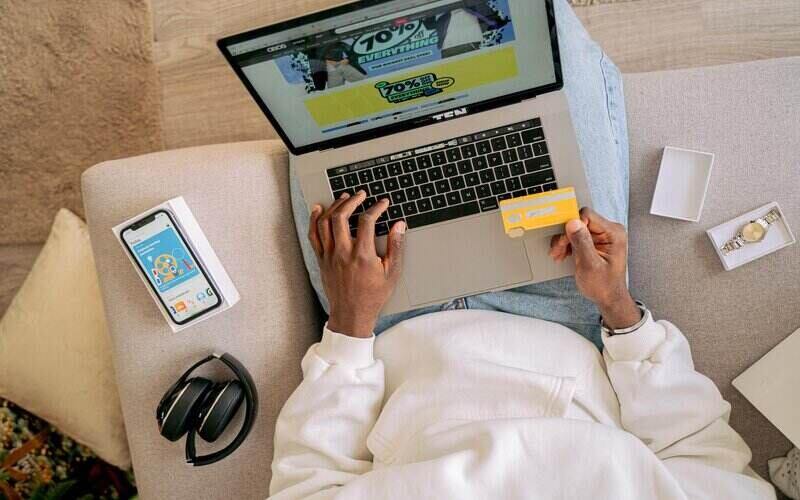

Black Friday boost in household spending

Black Friday retail sales were forecast to break records with a predicted $6.2 billion to be spent by Aussies over the four-day period from November 25 to November 28.

Aussies did in fact open their wallets in the final days of November, with CommBank and ANZ card spending data revealing Aussie consumers focused spending at department stores as well as fashion, footwear and furniture, with retail spending jumping 6.4% in November.

Despite this the ABS data revealed with no lockdowns or restrictions in place currently, spending on clothing and footwear remained on par with previous years, increasing 2.4% in November 2022 from November 2021.

Furnishings and household equipment spending went in the opposite direction despite major bank card purchase figures, declining a significant 7% in November, compared to the same period in 2021.

The tide may turn further in the months to come, with data from NAB revealing 41% of Aussies are willing to sacrifice non-discretionary spending such as eating out in 2023, while 40% also indicated keeping up with the latest fashion will remain on the backburner throughout the year.

Image by Antoni Shkraba via Pexels

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly