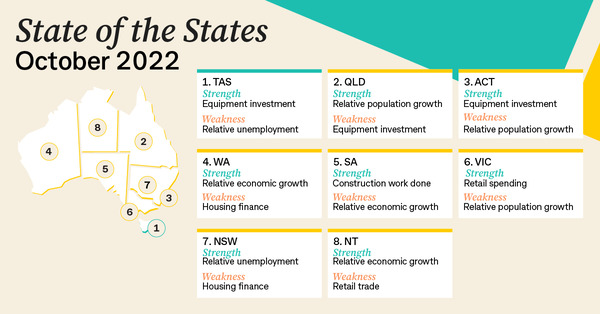

CommSec's quarterly State of the States report has revealed Tasmania nabbed top spot once again following improved rankings on retail spending and housing finance.

CommSec's methodology measures eight economic indicators including economic growth, retail spending, unemployment, and housing finance compared with a region's decade average.

While Victoria relinquished its crown from last quarter and currently sits in sixth position, it still remains top-ranked on retail spending, up 18.7% in the June quarter from its decade-average levels.

NSW’s plunging housing market and low growth in housing finance saw the major city rank ahead of only the Northern Territory.

While previous reports showed little separation between the country’s state and territory economies, CommSec chief economist Craig James said there was now an orderly ranking.

“Tasmania has quickly returned to the top of the economic leader board, courtesy of consistently high rankings for the eight economic indicators,” Mr James said.

“When looking at annual growth to get a guide on economic momentum, Queensland had annual growth rates that exceeded the national average on five of the eight indicators.

“In terms of future economic performance, much will depend on how economies respond to a period of rising interest rates.”

CommBank's rankings are now as follows:

- Tasmania

- Queensland

- Australian Capital Territory

- Western Australia

- South Australia

- Victoria

- New South Wales

- Northern Territory

Source: CommSec State of the States - October 2022

Queensland set to take the crown next survey

Queensland’s second place position is its highest ranking in the 13-year history of the report - lifting from fourth spot last quarter to second place.

The previous best ranking was equal-third in January 2014.

In terms of the leading positions on the economic indicators, Queensland leads the rankings on relative population growth and relative unemployment.

The state enjoyed a population boom during the Covid-19 pandemic as residents abandoned the larger capitals for Brisbane and other regional areas like the Gold Coast.

Unemployment in the Sunshine state is at 3.7% in September, while annual population growth is at 1.81%.

According to the CommSec report, any of the top four contenders could rise to number one on the leaderboard in the next survey.

However, as per the previous two surveys, momentum lies with Queensland taking out the top gong.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Row Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.69% p.a. | 5.70% p.a. | $2,899 | Principal & Interest | Variable | $0 | $0 | 60% |

| Promoted | Disclosure | |||||||||||

5.79% p.a. | 5.83% p.a. | $2,931 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | |||||||||||

5.74% p.a. | 5.65% p.a. | $2,915 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | |||||||||||

5.84% p.a. | 6.08% p.a. | $2,947 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure |

Image by Peter Robinson via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!