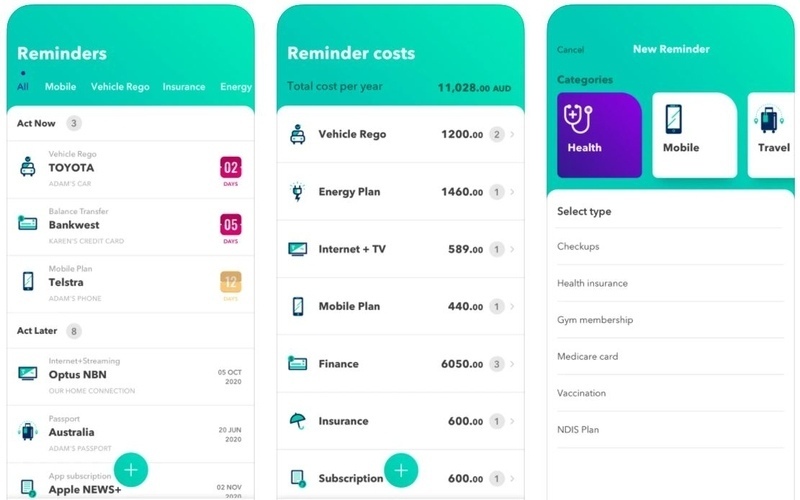

The free app, which reminds customers when they have upcoming bills to pay, found the contracts next likely to be forgotten were insurance, passports, and mobile phone plan renewals.

Tim Nicholas, co-founder of GetReminded, said forgotten bills like registration could not only cost thousands but also disrupt how people live their lives.

“It can be very costly for consumers if they forget to register their car. If caught driving an unregistered vehicle fines are nearly $1400 and they are no longer allowed to drive their car until it has been registered,” Mr Nicholas said.

In January alone, 5,440 New South Wales (NSW) motorists were caught driving an unregistered vehicle, racking up almost $4 million in revenue.

Driving an unregistered or uninsured car in NSW incurs a $697 fine, while truck drivers cop a $1,472 fine and lose four demerit points.

Mr Nicholas said new technology was making it drastically easier for authorities to fine people caught doing the wrong thing.

“Across Australia highway patrol vehicles are now fitted out with registration detection cameras so your car license plate is automatically scanned as you drive past and police are alerted if the rego has expired.”

With car registration stickers scrapped in 2013, motorists only receive an email or letter in the mail, which GetReminded said often ends up being forgotten.

Mr Nicholas said although consumers were also forgetting to renew insurance and mobile phone plans, many were becoming more savvy in shopping around for better deals.

Related: 10 best budgeting and money saving apps

600,000 bills paid through 'Deferit'

Bill payment platform Deferit has surpassed 600,000 bills paid for its customers after launching in 2018, 200,000 of which were processed in the last five months.

In the last 12 months, the platform has seen growth of 150%, and anticipates demand will soar after JobKeeper's expiry as Australians look to alternative solutions for managing tight budgets.

Deferit CEO Jonty Hirsowitz said the platform had over 250,000 users in Australia after experiencing a surge in sign ups since the pandemic.

"What we’ve seen is that more Australians are turning to Deferit as an avenue of support as they are forced to become more strategic about the way they manage their bill payments over each pay period," Mr Hirsowitz said.

"With JobKeeper coming to an end, we expect to see even more people make the proactive decision to sign up and take control of their finances in a way that gives them greater flexibility and peace of mind that they aren’t at risk of getting caught out by late fees.”

Deferit doesn't fund discretionary purchases, marketing itself as a buy now, pay later for bills.

Customers can have household and telecommunication bills or car registration paid by Deferit, which is then paid back in four equal instalments for a fixed monthly fee of $5.99, with no interest or late fees charged.

Photo by Marten Bjork on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

William Jolly

William Jolly

Harry O'Sullivan

Harry O'Sullivan