To says it’s been a turbulent time for the banking industry in Australia would be an understatement.

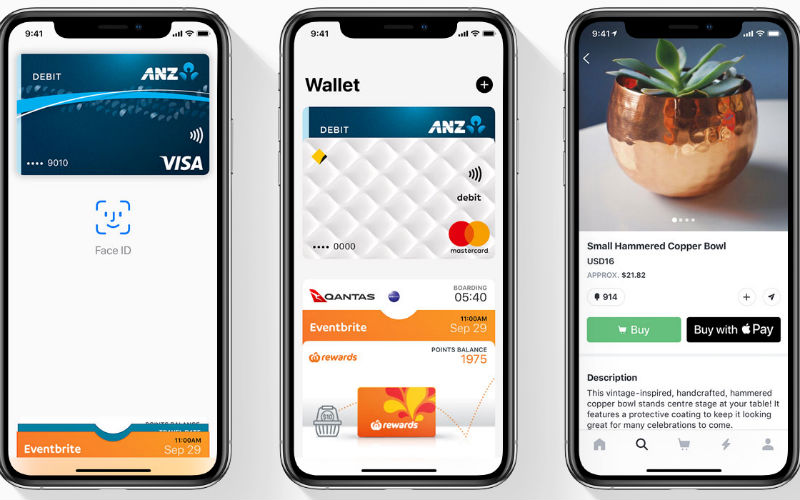

After the fallout from the Hayne royal commission, consumer trust in banks is at an all-time low. As big tech companies like Apple raise the bar and start rolling out their own ideas of what financial products should look like, consumers are looking to their bank expectantly and asking them to step up to the proverbial plate.

Open banking in Australia

In a bid to encourage innovation and increase competition in the finance industry, the Australian government is set to introduce open banking, also known as API banking, as part of the Consumer Data Right scheme (CDR).

In early 2017, the Productivity Commission released a report recommending the federal government introduce a CDR to “improve consumer control over the data which businesses hold about consumers’ use of their products and services”.

And us Australians are not the only ones trying to do something about people's’ data. In Europe, they have recently implemented the GDPR (for General Data Protection Regulation), which aims to achieve similar purposes to those stated above around the CDR.

Our banking sector will be the first industry to have the CDR rolled out. The Energy and Telco sectors will be the next industries to get the CDR treatment. So what is open banking and why should you care about it?

What is open banking?

Open banking starts from the premise that consumers own their own data – not the banks – and they should therefore be allowed to do with it what they please.

It’s essentially designed to give the consumer more control over their financial data and allow them to decide how their data is shared, and with who. Under the current circumstances, this is relatively hard to do. Sure, many of our internet banking tools have made it easy to search for and export into excel sections of our data (eg. transaction histories, etc…), but it is still a relatively clunky and limited affair.

Today is a landmark day for financial services in Australia: a government decision to introduce open banking from July 2019. This is a huge policy win for FinTech Australia, which has been campaigning for this since 2016. Read our media release https://t.co/gmMqamhXu9 pic.twitter.com/9u03RV8rHH

— FinTech Australia (@ausfintech) May 10, 2018

But as of July 2019, customers of the big four will be able to ask their banks to share certain data with other banks or authorised third parties – such as financial planners, and fintechs.

This will apply firstly to transaction and savings accounts, personal loans and credit cards, before expanding to home loans in February 2020. Data on all other financial products will essentially be open slather by July 2021. Smaller banks will be given an extra 12 months on all deadlines to comply.

Open banking isn’t a new thing. It’s already been rolled out overseas in the UK, and across other parts of Europe and Japan in recent years.

Executive General Manager of consumer credit reporting company Experian, Poli Konstantinidis, is in favour of open banking.

Poli Konstantinidis. Image supplied

“The new data sharing ecosystem will see ownership of customer data put back in the hands of Australians – providing the foundation for a fairer, easier and more sustainable financial industry. From fostering new and exciting relationships across companies, to giving you better service, better value and better experiences, open banking is here to implement some long-awaited change,” he told Savings.com.au.

On the surface, open banking seems pretty dull and dry. But the real world effects? They’re anything but.

When launching the report he commissioned into open banking, then Treasurer Scott Morrison said open banking will transform the financial services sector.

“Open banking will revolutionise the financial services sector, completely transforming the way Australians interact with the banking system by giving consumers the right to share data with other banks, other institutions and innovative fintechs, and get themselves a better deal.

“Granting third-party access to your data will allow rival providers to offer competitive deals, products that are tailored to your needs and enhanced services that meet the customers where they are at. Banks won’t be able to afford to take customers for granted, and lock other competitors out.”

Here’s how open banking will change your finances.

Open banking could save you money

Switching banks will be easier

Consumers can switch banks any time they want, but if you’ve ever done it, you’ll know what a time consuming process it can be. Cancelling existing auto-debits, creating new ones, changing which bank account your employer pays your salary into, the list goes on and on. Consumers generally tend to stay with their current bank even when there are better deals out there, simply because it’s such a hassle to make the switch.

But open banking promises to change all that, by making the whole switch and application process as streamlined as possible. You'll be able to share your data instantly, compare alternative products, and make the switch.

It should also be a lot simpler to bring all of your previous data history (think about all of the transactional ‘ins and outs’ data across all of your accounts) with you to your new banking provider. There has even been talk of letting you bring your account numbers with you (like when you ‘port’ your mobile phone number from one telco to the next) so you won’t have to worry about migrating all of those direct-debits you spent considerable time setting up.

It will encourage competition which should drive down prices

Switching banks only makes sense if there’s a better deal on offer, but oh wait. There is!

Perhaps the biggest way open banking could save you money is by encouraging competition between banks and providers, which will, in turn, drive down prices – that’s more money in your pocket.

In order to keep customers who will now be able to easily access the best value financial products on the market, banks will have to work even harder to consistently offer their customers the best deals. As the banks compete with each other to offer you the best deal, lower loan rates, higher savings account rates and more innovative products should be on offer – which is a big win for the consumer.

Another huge plus of open banking is that it opens up the banking scene to a whole host of smaller, up-and-coming financial providers, lenders and fintechs who will all be competing for your business – meaning the big banks will have to work even harder to keep you as a customer by offering better deals on their products.

Highly personalised to your financial situation

Another huge benefit of the open banking scheme is the personalisation of your finances.

In some ways, you can already hunt around for products suited to your personal needs through price comparison sites – but these can return hundreds of results and they won’t all be directly applicable to your unique situation. And many of the products may actually have conditions around them which may restrict you from even qualifying to be eligible for them.

Imagine finding a great product on a comparison site, and then spending several hours (over several days) applying for it, providing detailed documentation, answering a bunch of questions, etc… and then have that product provider come back to you and say that you don’t qualify. Arrgghhh! Personalisation should reduce this from happening.

“By choosing to share rich transactional data with price comparison sites under the open banking regime, you’ll benefit from a much higher degree of personalisation, returning a dedicated selection of fewer, more accurate results,” Mr Konstantinidis said.

“Used right, this data sharing landscape could also make the process of finding and applying for products more secure and more convenient for all Australians through pre-populating data and pre-qualifying them at the point of application. This then makes your product selection process faster, more convenient and more satisfying, reflecting your financial circumstances and ability to meet any requirements.”

Hypothetically, this personalisation could also save you money in other areas – like on your weekly grocery shop.

Most of us tend to buy the same products on a routine basis – whether it’s the same brand of dishwashing tablets, body wash or toothpaste. Under the open banking scheme, retailers and institutions will have access to this transactional data which can help create personalised offers on the products you’re most likely to buy.

Say you visit the same grocery store every week to stock up on avocados and coffee beans. If you enabled (through the sharing of your purchasing data history) a small number of other local retailers with this data, they could price those items lower than their usual price, and win your business.

“Inevitably, this will save you money and improve the customer service you receive, as businesses start truly responding to individual customer needs. In addition, banks can work collaboratively with other industries to bring you similar personalised benefits by sharing transactional data and building a better profile of your wants and needs.”

But MoneyPlace founder, Stuart Stoyan, believes the best innovation will come later, when telecommunications and energy data is included in open banking.

“I think the best uses haven’t even been thought about yet. What is really exciting is when the data becomes available for tech and utilities. If you were to jump forward five years wouldn’t it be great if you could say, ‘Hey Siri, is it worth me getting solar panels on my house?’ and the bot can access your data to pull your energy usage, how the sun shines in your area and calculate the potential savings for you,” he said.

Savings.com.au’s two cents

While open banking has the potential to radically change your finances for the better, the success of it depends on consumers trusting their data will be secure, understanding how it will benefit them, and ultimately utilising it.

“If used to its full potential, the system will help Australians better engage with their finances through inclusive, tailored and aligned services from banking institutions and third parties,” Mr Konstantinidis said.

The key there being “if used to its full potential”.

While open banking has been rolled out in the UK, it’s fair to say it hasn’t exactly taken off in a big way.

According to research from UK-based market research and data company YouGov, an estimated 72% of UK adults hadn’t even heard of open banking.

Even though open banking is set to transform the financial services sector, its success entirely rides on whether or not consumers take it up. And the only way consumers will do that is by knowing what’s in it for them.

Stuart Coleman, chief strategy officer at the Open Bank Project summed it up best when he said:

“Most consumers will find open banking scary – the biggest obstacle is getting people to understand how this can benefit them.”

Take, for example, the iPhone. Trying to explain how it works to someone who’s never used a phone before would be pretty hard. It’s not until you put it in front of them and show them how it works that they can begin to understand it.

It’s the same with open banking. It’s not going to be a case of ‘build it and they will come’. That’s exactly how it was rolled out in the UK and look how well that’s turned out.

For open banking to work in Australia, people need to be shown how it will work and benefit them.

Research by Accenture found that Australian consumers’ biggest concern with open banking centres around the security and privacy of their financial data, with almost two-thirds (64%) of respondents citing that as the main obstacle to sharing their financial data with third parties.

53% of respondents also said they don’t understand the potential benefits of open banking enough to grant third-party providers access to their data, while 47% said they don’t believe open banking will deliver enough value to change their banking behaviour.

Clearly, more consumer education is needed about the benefits open banking will provide. If not, open banking risks becoming another My Health Record debacle – a well-meaning government system that didn’t work because consumers didn’t understand how it would benefit them, didn’t trust their data would be secure, and opted out of the scheme as a result.

But if you do take the time to understand what open banking is and how it can benefit you and your finances, the savings you stand to make could be huge.

William Jolly

William Jolly

Harry O'Sullivan

Harry O'Sullivan