The number of younger consumers, combined with the abundance of digital payment solutions, has the potential to fundamentally transform the payments landscape, and we’re already seeing this happen.

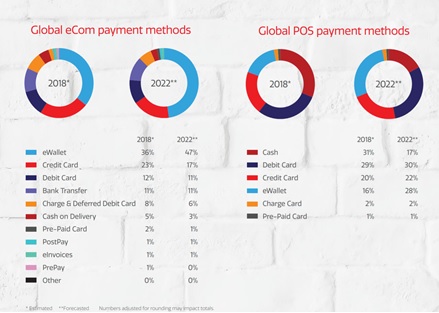

At the point of sale (POS), cash remains the most popular payment method at 31%, ahead of debit cards (29%) and credit cards (20%), according to Worldpay’s 2018 Global Payments Report. But this is unlikely to remain the case, with the report predicting cash use to fall away to 17% of POS transactions by 2022, while debit and credit card usage will “hold steady” at 30% and 22% respectively. Meanwhile, eWallets and other digital payment methods look set to surge in popularity.

Source: Worldpay

At the heart of this transformation to digital payments are the millennial generation - those born between 1981 and 1996 - and to a lesser extent Gen Z. Millennials are a diverse group of people, not necessarily the ‘young reckless spender’ stereotype. The youngest among them is already turning 24 this year, while the oldest is nearly 40, old enough to surpass the assumption of smashed avocado. Globally, 28% of millennials have used a mobile wallet/digital payment at the point of sale, compared to 20% of total respondents.

And it’s these millennials and Gen Zers that are driving the massive growth in buy now, pay later (BNPL) platforms. But what is it about buy now, pay later that’s so appealing to younger demographics?

What is buy now, pay later exactly?

Buy now pay later (BNPL) services are platforms that allow you to pay for something in installments, delaying the full repayment until later. You usually have to make a portion of the payment at the time of purchase, and pay the remainder in scheduled intervals, usually fortnightly, until the entire purchase is paid off. These platforms are primarily available through smartphone apps and can be used either at the point of sale or online, as long as the merchant allows them to be used. Lately, card networks like Visa and Mastercard have partnered with various BNPL platforms to allow more merchants to piggyback off these networks and allow such services to be used.

Buy now pay later adds the ‘now’ to the credit card’s ‘pay later’ mantra, and eliminates much of the friction associated with a purchase. According to Worldpay, friction at checkout arises from many factors including

security concerns, unexpected shipping charges, and cost. BNPL helps alleviate some of this stress by not charging interest, unlike a credit card, and by offering staggered payments allowing customers to ‘try’ something before they commit to a full purchase.

Some of the key BNPL providers in Australia at the moment include:

Why is buy now, pay later so popular with millennials?

BNPL is extremely popular with the millennial crowd in Australia. Roy Morgan research from late 2019 found just under 2 million Australians used a BNPL scheme in the year to September 2019, with more than half of these users aged under 35.

The total number of BNPL users in Australia is likely to be over 2 million now following a surge in sign-ups over the Black Friday and Cyber Monday sales periods. In contrast, credit card use has fallen, with recent Reserve Bank data finding the number of active credit card accounts fell by 8% over the year to December 2019.

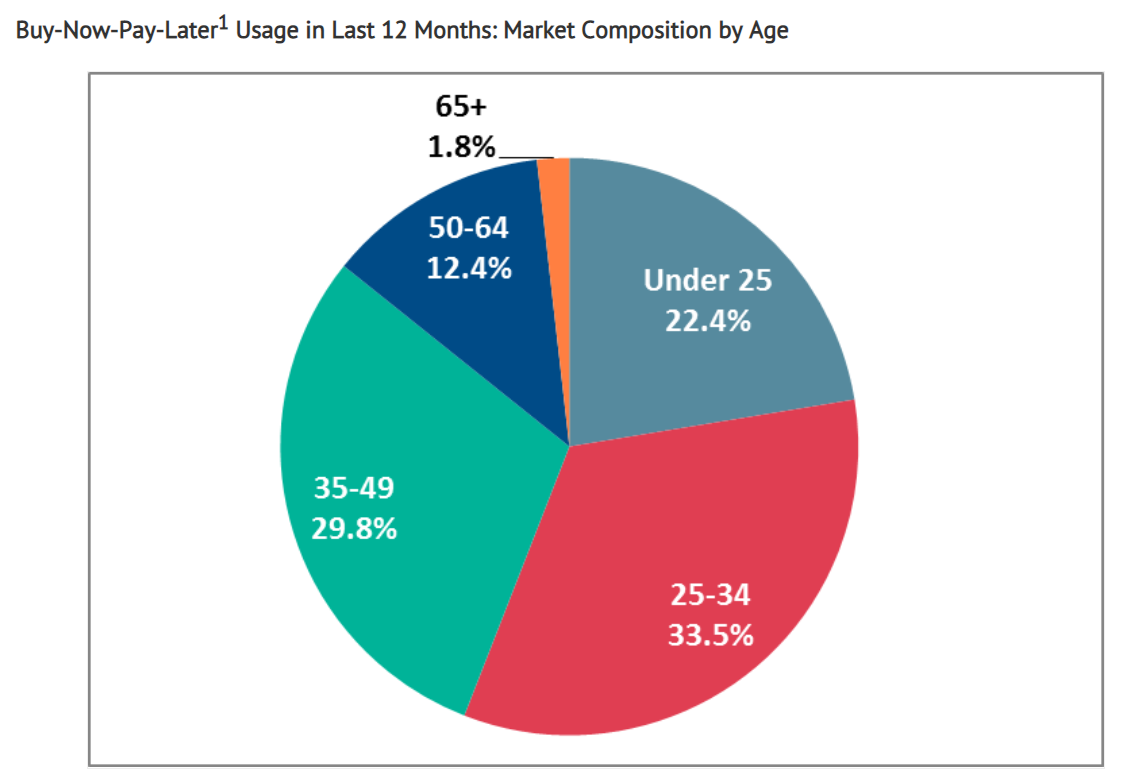

Australians between the ages of 14-34 account for 55.9% of ‘buy-now-pay-later’ users, with those in the 25-34 range making up 33.5%. For context, people in these age groups only make up 18% of Australia’s population.

Source: Roy Morgan

There are several potential reasons why younger age groups are flocking to these new payment platforms.

The GFC made millennials debt-averse

The ease of payments and a focus on technology could indeed be the key driver for the growth in BNPL, but another potential factor is the effect the global financial crisis (GFC) had on the perceptions of millennial and Gen Z consumers.

In the words of the Reserve Bank, the GFC was the period of “extreme” financial stress in global financial markets between mid-2007 and 2009, with millions of people around the world losing their jobs in the worst global recession seen since the Great Depression of the 1930s.

The Australian economy fared better than any other established economy during the GFC, largely thanks to a booming mining sector. In the March quarter 2009, for example, the Australian economy grew by +0.4%. In contrast, all the G7 economies contracted in that period by a combined -2.1%.

Australian businesses and people still experienced some setbacks however, and a reliance on credit was one such setback as people’s savings dwindled. A 2015 Treasury Report outlined how the effective spread of credit card issuers increased sharply during the GFC.

Phil Pomford, General Manager for APAC, Worldpay Merchant Solutions, believes the GFC has played a big role in how millennials view credit.

“There’s a general trend that’s been taking place over a number years away from what we call traditional credit card payments and more towards alternative payments,” Mr Pomford told Savings.com.au.

“You've got the millennial section of the community who grew up with the backdrop of the financial crisis and have a real aversion towards debt and credit. I think it [the GFC] had a big impact on the way people see credit and debt and interest.

“And I believe these by now pay later products, pretty much a debit card product, are allowing the millennials to move into that space and feel more comfortable around budgeting.”

Each BNPL provider in Australia, with the exception of Zip Money, never charges interest. Instead, these platforms charge merchants a fraction of each transaction and also charge late fees, which in Afterpay’s case account for around 20% of its revenue. The lack of interest charges combined with the delayed payment options make BNPL platforms a kind-of midway point between credit and debit, which would suit the debt-averse millennial consumer.

There is a general trend away from credit cards

As stated earlier, the RBA’s data shows credit card accounts fell by 8% over the 12 months to December 2019, while the level of interest-accruing debt on these credit cards fell 10%. Millennials are likely to be the main culprits behind this decline: According to Afterpay’s ‘How Millennials Manage Money’ survey, just 41% of them own a credit card compared to two-thirds (67%) of older generations. They also have 45% less credit debt than their elders, with reasons for not having one including:

-

Wanting to avoid interest and fees (22%)

-

Worries about accumulating debt (18%)

-

Wanting more control overspending (21%)

-

Preferring to use their own money (24%)

Overall, 90% of millennials avoid credit cards by choice, while the remainder might avoid them because they are unable to be approved for one.

Also, one of the main drawcards of credit cards - loyalty points and rewards programs - has cheapened lately, thanks to recent interchange-fee restrictions which drove card providers to scale back the value of their rewards programs.

“When we talk about the credit card, there was an entire population who were hooked on loyalty and loyalty points,” Mr Pomford said.

“Over the last few years, that has weakened as a proposition. Without a shadow of a doubt over time there has been a decline.

“So I think whilst these buy now pay later platforms are very much targeted at the millennial generation, I think you will see the proliferation again across older demographics.

It can help manage finances

Another reason younger people use services like Afterpay or Zip is the fact these platforms can actually help with budgeting, somewhat in spite of the “BNPL is reckless” stereotype. Thirty per cent of millennials use online tools to track their spending, according to Afterpay, and 57% of Afterpay’s customers use it to help them budget. For people who get paid quarterly, as an example, paying for something in installments might be more beneficial to them than paying for something 100% upfront.

Mr Pomford says younger customers want alternative payment options that help with budgeting. BNPL platforms can offer this.

“I think everyone benefits from having budgeting tools, and their ability to be able to spread payments allows people to be able to budget accurately,” he said.

“People just want choice.”

It isn’t yet commonplace for BNPL providers to have sophisticated budgeting tools and services like those offered by some of the top budgeting apps in Australia, but there is movement in this direction. Klarna, for example, can be used in-app by Commonwealth Bank customers, and this app also offers expense categorisation and other in-demand features. This is perhaps the most noteworthy example of a BNPL platform also linking to a banking app with budgeting tools.

They offer smooth, fast payments

Fast, easy-to-use payment options are considered a must for many younger spenders. In the words of Roy Morgan CEO Michele Levine:

“The increasing use of new payment technologies is being aided by the growing proliferation and development of smart phones and wearables with integrated technology such as Apple Pay and Google Pay. Consumers will come to expect the minimum effort when making payments and the industry will need to adapt by providing more innovative and simpler solutions.

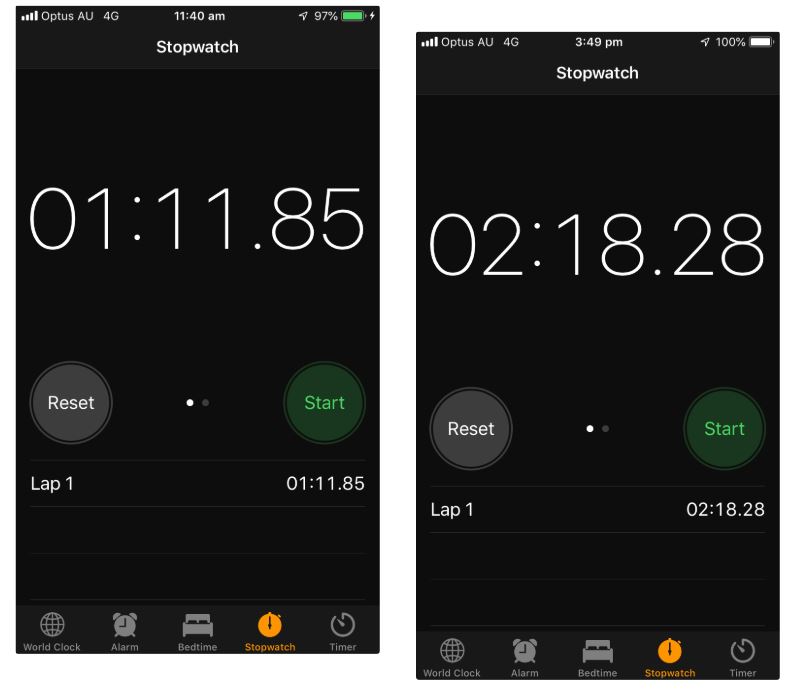

Customers today want instant satisfaction. Merchants that are cash only, have EFTPOS minimums or clunky online payment systems are more likely to get left behind or see customers abandon a purchase at the point of sale. And this is where BNPL thrives. Platforms like Afterpay or Zip offer seamless and quick payments at the press of a button (assuming an account has already been set up). And if an account hasn’t already been set up, you can do it pretty quickly at the counter. I ran a test last year to see how quickly I could create an account, and these are my results:

Afterpay (left) and Zip (right) signup times. Although I was trying to do so as fast as humanly possible.

There really is no comparison between this and the time it takes to get approved for a credit card.

Savings.com.au’s two cents

BNPL platforms are far from perfect. An ASIC review into them in 2018 found the majority of BNPL users admitted to spending more than they otherwise would, while one in six users said they had experienced at least one negative impact as a result of using BNPL services, such as delaying bill payments.

But on the other hand, Afterpay’s financial report showed 93% of transactions incurred no late fees, and even if they did, the late fees charged by BNPL platforms can pale in comparison to the potential interest charges on credit cards or personal loans. Plus, the BNPL options available in Australia don’t charge annual fees, which many credit cards and loans do.

In an increasingly debt-averse society, platforms such as these aren’t as bad as you might have heard they are, as long as they’re used responsibly. Just like a credit card, BNPL isn’t buy now, pay never - you still have to repay everything you buy on time. It can simply offer a more structured and technology-focused approach to repayments, which is something that massively appeals to younger consumers.

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper