Beem It, owned by Commonwealth Bank, NAB and Westpac, initially launched in 2018 with the purpose of allowing customers to instantly transfer money to other people, similar to the New Payments Platform (NPP).

Since then, it’s been downloaded more than 900,000 times.

Beem It’s new Transfer feature allows users to add up to three debit cards to their own accounts and instantly transfer their own money at will.

Source: Beem It

According to Beem it, it is the first app in Australia to offer consumers an integrated service of instant transfers across banks, regardless of who they bank with.

CEO Angela Clark said adding the instant payments feature was driven by customer feedback.

“Instant transfers to accounts across different banks was the most frequently requested enhancement that our customers wanted added to Beem It. So we added it and it’s the first integrated app service of its kind in this market,” Ms Clark said.

“We’re passionate about taking the hassle out of the way Australians pay and get paid,” Ms Clark said.

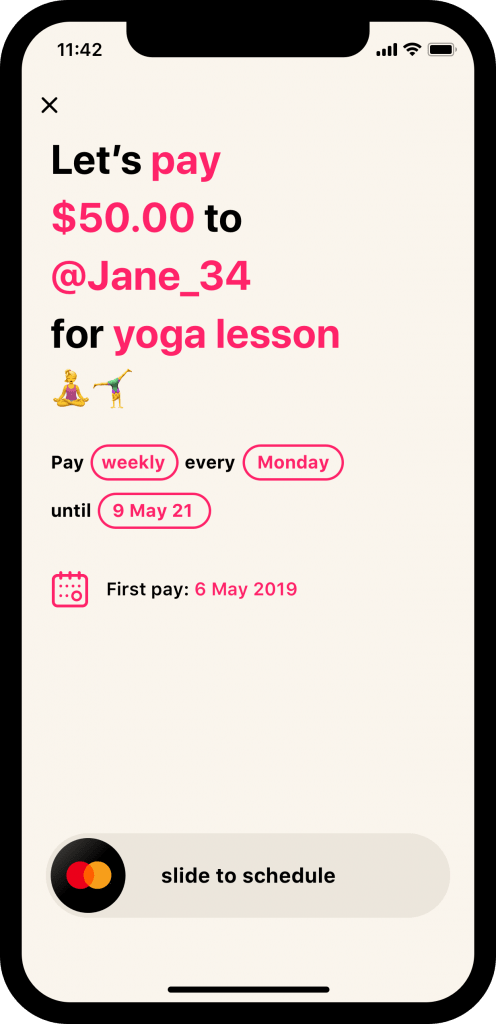

The new scheduled payments feature allows users to schedule these instant transfers whenever they want.

Source: Beem It

“Since launching Beem It in June last year we’ve focused on building the best product to simplify instant transfers and splitting group expenses with friends and family, and now we’ve added more of the capabilities that our customers have asked for,” Ms Clark said.

“We expect the growth in transaction value sent via Beem It to continue as cash loses ground to the ease of instant digital payments that keep a human touch through conversational interfaces.”

Ms Clark also told Savings.com.au that Beem It will continue to add new card options in the future.

“We aim to deliver incredible payments experiences across banks, and we do believe that this is good for consumer banking generally as it enhances your everyday banking experience,” she said.

Reserve Bank to investigate Afterpay and Zip purchases

Speaking of payments, the Reserve Bank of Australia (RBA) announced in its Payment Systems Board annual report that it would be investigating policy issues regarding the growth of buy now, pay later services (BNPL) such as Afterpay and Zip.

According to the report, current BNPL providers charge retailers a merchant fee for their services, but unlike a credit card surcharge, this cost is not passed on by the retailers.

Afterpay, for example, charges as much as 6% on a purchase, which is where most of its revenue comes from.

The idea behind the current BNPL formula is that by allowing the platform to be used in-store a merchant will attract more customers, thus offsetting this higher merchant fee.

But the RBA’s report states:

“This can be problematic for merchants that feel compelled to offer BNPL services as a payment option for competitive reasons, but are unable to recoup the merchant fees from the customers that directly benefit from the service.”

The report says the RBA will be reviewing whether there are policy issues regarding the “no surcharge rule” in 2020.

This could have the potential to impact many people in Australia. According to ASIC’s 2018 review of buy now pay later arrangements, more than two million people used these platforms in the 2017-18 financial year.

More than four in five consumers (86%) who had used a buy now pay later arrangement within a 12 month period planned to do so again, meaning most customers who use them are regulars.

Plus, in the time since the 2018 report was released, several more BNPL providers have launched, including:

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

William Jolly

William Jolly