However, January 2020's sales had an incredibly low floor, down about 15% from January 2019's sales, according to Federal Chamber of Automotive Industries (FCAI) figures released today.

There are still positive signs in last month's results, after some deep falls last year when the coronavirus took hold from March through June.

In total, 79,666 new cars were sold last month, with SUVs and light commercial vehicles - utes, vans - combining to make up nearly three quarters of all new vehicles sold.

In the market for a new car? The table below features car loans with some of the lowest interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Vehicle Type | Maximum Vehicle Age | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.99% p.a. | 7.12% p.a. | $580 | Variable | New | No Max | $8 | $400 | $34,791 |

| Promoted | Disclosure | ||||||||

6.52% p.a. | 6.95% p.a. | $587 | Fixed | New, Used | No Max | $0 | $350 | $35,236 |

| Promoted | Disclosure | ||||||||

6.28% p.a. | 6.28% p.a. | $584 | Fixed | New | No Max | $0 | $0 | $35,034 |

| Promoted | Disclosure |

Medium SUVs alone made up nearly one-fifth of all new vehicles sold, a class that includes the Nissan X-Trail, Mitsubishi Outlander, and Mazda CX-5.

Four-wheel drive crew-cab ute sales made up nearly all of the light commercial marketshare, too, accounting for one-sixth of total vehicles sold.

This segment includes the popular Toyota HiLux and Ford Ranger, which regularly hold top spot for overall makes and models sold, as seen in the table below.

Light commercial vehicles sold for business purposes outnumbered private sales at a rate of nearly two-to-one, even as incentives such as the increased instant asset write-offs ended.

However, overall, private sales led the charge, up 25.4% on the month, with business sales down 1.3%.

Alternative fuel vehicles continued to lag behind petrol and diesel sales, with just 296 electric vehicles sold in January.

However, this marks a 146.7% increase on January 2020's results, aided by relatively cheap electric vehicles such as the MG ZS (+327.6% on the month) hitting the market.

FCAI chief Tony Weber pointed to a rebound, coinciding with COVID restrictions easing.

"During the past three months sales had increased by 12.4% compared to the corresponding period twelve months earlier," he said.

"The January sales numbers are indicative of positive consumer confidence in the domestic economy. With attractive interest rates and a range of other economic indicators encouraging consumption, we hope to see this trend in new vehicle purchasing continue through 2021."

Top Ten Selling Vehicles, January 2021

|

Rank |

Vehicle |

January 2021 Volume |

January 2020 Volume |

Percentage Difference |

|

1. |

Toyota Hi-Lux |

3913 |

2968 |

31.8% |

|

2. |

Ford Ranger |

3120 |

2624 |

18.9% |

|

3. |

Toyota RAV4 |

3066 |

2290 |

33.9% |

|

4. |

Toyota Landcruiser |

2388 |

1262 |

89.2% |

|

5. |

Mazda CX-5 |

2081 |

1859 |

11.9% |

|

6. |

Toyota Corolla |

2062 |

2370 |

-13.0% |

|

7. |

Hyundai i30 |

1952 |

2038 |

-4.2% |

|

8. |

Mitsubishi Triton |

1908 |

2075 |

-8.0% |

|

9. |

Isuzu Ute D-Max |

1822 |

680 |

167.9% |

|

10. |

Nissan XTrail |

1593 |

1467 |

8.6% |

Source: Federal Chamber of Automotive Industries

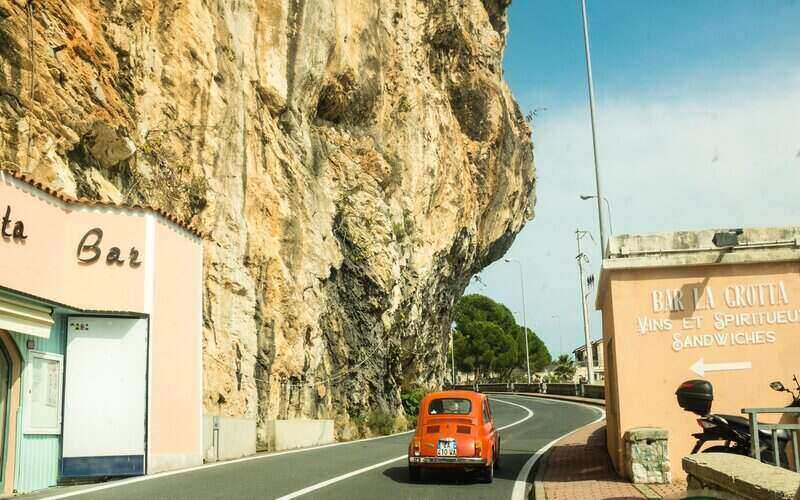

Photo by Dylan McLeod on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury