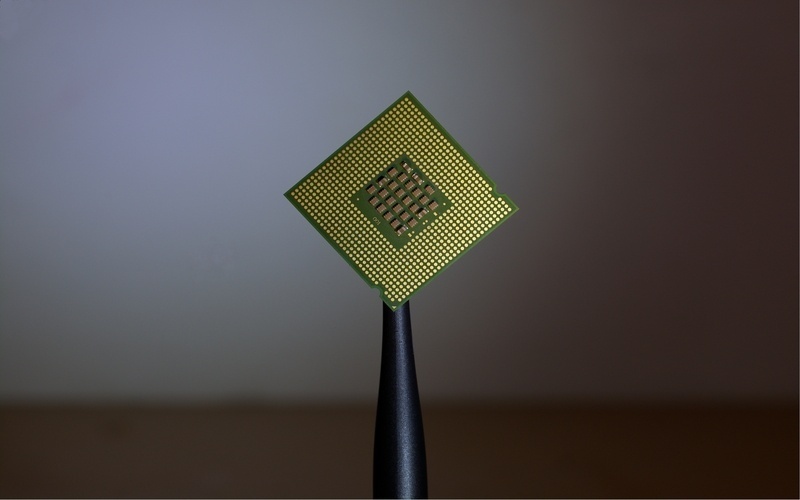

That's according to the Worldpay Generation Pay report, which said as many as 17% of Australians would adopt a microchip in their hand in order to make payments.

This was a much more popular option among the younger generations: 25% of GenZ would accept this option along with 24% of GenY.

Other generations weren't as keen:

- 16% of GenX would use a microchip;

- 7% of Baby Boomers; and

- 8% of people beyond the Baby Boomer age range

Interestingly, Australians were keener on microchip payments than those in the UK and US but far less enthused than those in China.

Only 15% of GenZs in the UK and US said they would use a microchip, compared to 49% of Chinese GenZs.

See also: Cashless reality grows closer, two-thirds of Australians use card payments for everything

Convenience is key

Biometric payment technology is set to rise exponentially, with as many as 69% of global GenZ consumers interested in these payment forms.

Nearly a quarter (23%) of GenZ is interested in making voice payments, and 40% of Aussies are keen to have voice in-car payment solutions to make payments while driving.

This rises to almost 60% for Gen Z and Gen Y consumers.

Mobile wallets like Apple Pay and Google Pay meanwhile are becoming commonplace, as over 70% of GenZ respondents are using or interested in using these payment platforms.

Phil Pomford, General Manager for Global eCommerce APAC at Worldpay said Australia is a leader in terms of adopting new payment technologies, with methods like facial recognition and fingerprint payments already popular here.

"This is really just the beginning and we anticipate that further innovations in this area including, voice-activated commerce, will continue to become more widely adopted by the mainstream public," Mr Pomford said.

“Convenience is king to today’s consumer, particularly the younger generations, who are more likely to adopt new and emerging technologies trends if it means they are rewarded with some level of convenience in return.

"For retailers and merchants to thrive in the future, they need to consider broadening their payment offering in order to appeal to tech-savvy, digitally-driven consumers.”

See also: Contactless payments surge 44% during COVID-19.

Buy now, pay later still popular with younger generations

Buy now, pay later (BNPL) platforms like AfterPay, Zip, and Humm remain highly popular with younger generations, despite recent ASIC analysis finding one in five consumers miss their repayments.

According to WorldPay, 40% of Aussie Millennials said they are likely to purchase something over $1,500 with a BNPL service.

The research also reveals that younger generations are more comfortable with taking financial risks and taking on debt that they can pay over time.

Mr Pomford previously told Savings.com.au that BNPL is so popular with millennials because they became "credit-averse" in the aftermath of the global financial crisis (GFC), so are generally less keen on credit cards.

“There’s a general trend that’s been taking place over a number years away from what we call traditional credit card payments and more towards alternative payments,” Mr Pomford said.

“And I believe these by now pay later products, pretty much a debit card product, are allowing the millennials to move into that space and feel more comfortable around budgeting.”

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

Alex Brewster

Alex Brewster

William Jolly

William Jolly