The economy is already pretty hot with inflation at 5.1%, the RBA slated to increase interest rates further, and unemployment at record lows.

Let's take a look at some key areas when it comes to personal finances and the household budget:

- Taxes

- Childcare

- Interest rates

- Property prices and policies

- Rents

- Wages

- Fuel

- Superannuation and retirement

- Sharemarkets and investing

- The Labor Budget and debt

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

1. Personal taxes

Labor seems reticent to change anything in regards to personal taxes, according to Mark Chapman - H&R Block's director of tax communications.

"The so-called 'stage three' tax cuts have already been legislated under the previous government and will happen barring some undeclared change in the Labor party’s position," Mr Chapman said.

The tax cuts legislated for 2024-25 include: Lowering the 32.5c tax rate to 30c; eliminating the 37c bracket and having one big 30c bracket from $45,000 and $200,000; and raising the 45c threshold from $180,000 to $200,000.

"This will be particularly effective for higher income earners, with gains of $1,125 per year for an individual on $90,000, rising to $9,075 per year for a person on $200,000 or more," Mr Chapman said.

However with the unwinding of the low-middle income tax offset (LMITO), Mr Chapman said this is effectively a tax hike in disguise from next year.

"There are no announced proposals for the Labor party to reverse Frydenberg’s decision," he said.

"There are no changes to negative gearing or any other taxes on investment property. The general 50% discount for Capital Gains Tax is also safe."

The $18,200 tax-free threshold has remained unchanged for nearly 10 years, with some calling for it to be raised.

Influence of the Greens

The Greens are set to be more of a force in the House and Senate than in previous Parliaments and they do not support the legislated tax cuts.

"There will certainly be pressure within his [Albanese's] own party to ditch the tax cuts. It depends on his attitude to risk - he went to the election saying he would keep them but if he wants to take difficult decisions, his first Budget - two-and-a-half years before the next election - is certainly the time to do it," Mr Chapman told Savings.com.au.

2. Childcare

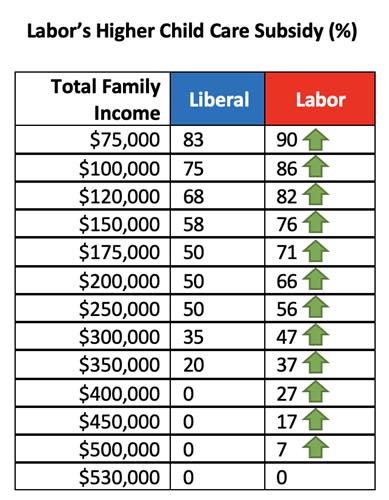

One of the key items in Labor's Budget is the boost to childcare subsidies. Labor will:

- Lift the maximum child care subsidy rate to 90% for families for the first child in care;

- Increase child care subsidy rates for every family with one child in care earning less than $530,000 in household income;

- Keep higher child care subsidy rates for the second and additional children in care;

- Extend the increased subsidy to outside school hours care.

It's estimated the policy will leave 96% of Australian families better off and represents a boost over the outgoing government's policy, as seen below:

Source: alp.org.au

Labor says it will task the Productivity Commission with designing price regulation systems and better transparency around childcare charges.

Julie Price, executive director of the Community Child Care Association, told Savings.com.au subsidies don't address the key reasons as to why childcare is expensive.

"Countless pieces of research and corresponding reports have identified that for many families early childhood education and care in Australia is too expensive," Ms Price said.

"We have worked with some colleagues to develop a six-point plan for education and care that would see a system overhaul, regular rating and assessment, better conditions and pay for workers, and the establishment of more high quality community based services."

Jennifer Richardson, director of Newcastle-based accountants 123 Financial Group, said childcare subsidies help women get back to work sooner.

"The recent win by the Labor Government will allow many young families greater access to childcare places and with increased rebates to help with the skyrocketing costs of returning to work," Ms Richardson told Savings.com.au.

"Returning to work for women is part of closing the gender gap in superannuation which sees women retire with far less in super than men but with a longer life expectancy."

3. Interest rates

The Reserve Bank of Australia sets Australia's base interest rate target - not the government, and it's independent of the government.

Other market forces such as swap rates, bond yields and other highfalutin terms also affect the interest rates on things like mortgages and savings accounts.

There's not much a government can do here to prevent higher interest rates, besides doing its part to curb inflation such as by cutting government spending or hiking taxes.

Savings products and home loan interest rates are generally on the way up, and the RBA is set to increase its cash rate target further in June and beyond.

4. Property prices and policies

The Coalition didn't win the election, and Labor does not support the super-withdrawal home deposit scheme, so that policy is dead and buried.

However Labor has proposed its own 'Help to Buy' scheme providing up to 40% of the property value in exchange for equity.

Does Albo get the living room? Hope he's not up all night playing Call of Duty.

AMP Capital chief economist Shane Oliver said the policy could induce further demand and not assist in affordability, but that its effects would be marginal.

"With only 10,000 places a year the impact is likely to be marginal and it won’t head-off a slump in property prices over the next year in response to rising interest rates," Dr Oliver said.

"Labor policies don’t point to a real fix to housing affordability, although its promises for 30,000 social homes and a National Housing Supply Council may help a bit."

The Help to Buy scheme would effectively support a month's worth of first home buyer home loans, as seen in the graph below.

Dr Shaun Bond, University of Queensland Business School professor, told Savings.com.au properly addressing housing affordability takes considerable time, with many challenges.

"The reality is that no government can quickly solve the affordability challenge without draconian measures that voters would not accept. Just ask Bill Shorten about the political cost of trying to remove negative gearing," Dr Bond said.

"There is a lot of debate about why houses are so unaffordable and housing supply constraints are widely regarded as a significant part of the problem. Unfortunately, there are no quick solutions, as improving supply and building social housing will take time and prove contentious with the electorate."

5. Rents

Many tenants are feeling the squeeze as rents increase and vacancy rates across the country are pushed to record lows.

It is unclear if Labor will support a boost to renter subsidies.

Dr Cassandra Goldie, CEO of the Australian Council of Social Service (ACOSS), said the new government should increase the Commonwealth Rent Assistance rate.

"Regional rents have risen by 18% over the last two years while Commonwealth Rent Assistance hasn’t had a real increase in 20 years," Dr Goldie said.

Rent assistance payments are indexed twice a year to inflation.

The maximum rate currently stands at 75c on the dollar. For a single whose weekly rent is at least $324.80, they could be eligible for up to $145.80 in rent assistance.

6. Wages

In his election campaign, Mr Albanese supported a 5.1% increase to the minimum wage, in line with inflation.

Unions are pushing for more, according to Westpac senior economist Justin Smirk.

"For 2022 the unions have put in an ambit claim for 5.5% which will be the largest increase experience since the establishment of current wage setting arrangements back in 1997," Mr Smirk said.

"To date the largest rise in the minimum wage/awards was the 4.35% increase in 2002. The Australian Retailers Association has countered with an offer for an increase in line with core inflation of 3.7%.

"It is possible that the final decision could settle around 5%."

The minimum adult wage is currently $20.33 an hour and is set by the Fair Work Commission, not necessarily the government.

Last week's ABS wages growth data was more milquetoast than expected, tempering some expectations as to how hard the RBA might push the cash rate in June.

Again, there's not much a government can do about wages growth, especially in the private sector.

"The wage price index, released last week, indicates the RBA is not facing a prices wages spiral anything like what is currently being observed in some other jurisdictions," said Gareth Aird, CommBank's head of Australian economics.

"As a result, the RBA does not have to run hard against wages growth by aggressively hiking the cash rate."

CommBank economists have forecast a "business as usual" 25 basis point hike in June, rather than the more aggressive 40 basis point hike forecast by other economists.

7. Fuel

As part of its Federal Budget, the Coalition Government and then-Treasurer Josh Frydenberg immediately cut the fuel excise in half providing relief for motorists as fuel hit more than $2 a litre.

It's in place until September and Labor does not support extending the tax cut.

Across most capital cities, the average price of 91 unleaded fuel is again comfortably over $2 per litre, according to the competition regulator, which the government unfortunately can't do much about.

This is why the reinstatement of the full fuel excise from September will be an unpopular move according to Dr Oliver.

"The fuel tax cut can easily be overwhelmed by swings in the oil and petrol market," he said.

"Now we have little to show for it. The ATO has lost the revenue it would have raised and it’s going to be really hard to raise it in September."

The Federal Chamber of Automotive Industries has called on governments to repeal most vehicle taxes and instead have one road-user charge.

8. Superannuation and retirement

Labor supports the legislated increases to the Super Guarantee up to 12%, and is currently assessing how it could raise the Guarantee to 15%.

It's currently 10% and is will increase to 10.5% from 1 July.

The work test age will also be increased from 67 to 75, and Labor will maintain the new downsizing contribution policy age, lowering it from 65 to 60.

Founder of AJ Financial Planning Alex Jamieson told Savings.com.au these policies have opened up "tremendous opportunities" for pre and post retirees.

"The turbulent environment has prompted the need for many to review their financial situation and recalibrate where needed to ensure their investments are turbulent proof - as much as possible," Mr Jamieson said.

9. Sharemarket and investing

Sharemarkets and investors are currently pre-occupied with forces other than Australian governance changing hands.

Tightening of central bank monetary policy around the world, including the RBA, takes some heat out of the markets.

"Shares are likely to see continued short term volatility as central banks continue to tighten to combat high inflation, the war in Ukraine continues and Chinese Covid lockdowns impact driving fears of recession," Dr Oliver said.

"Australian shares remain a relative outperformer [compared to other countries' indices] thanks to their commodity exposure despite the plunge in Chinese growth and their low exposure to tech stocks."

Stockspot CEO Chris Brycki told Savings.com.au the small target government is unlikely to disrupt share markets too much.

"Markets move on positive/negative policy changes in areas like capital gains tax, franking credits - like the policies announced by the Opposition during the 2019 Australian federal election - corporate tax changes or perhaps the mining tax in 2010," Mr Brycki told Savings.com.au.

"In 2022, it could be argued that no new major policies had been announced that would have an impact on the markets."

Mr Brycki also said Labor forming government quickly and in majority is looked on favourably by investors.

In 2010 it took the Gillard Government, a minority government, 17 days to form, and the Australian share market was more volatile - diving 2.5% in the first three days but increased 3.3% in the negotiation period as a whole.

10. The Labor Budget and debt

Labor has gone fairly 'small target' this time around, which means there probably won't be any surprises in its October Budget compared to Mr Albanese's budget reply from late March.

Labor's election commitments would add $18.9 billion in extra spending, offset partially by $11.5 billion in some budget savings.

"Unlike in 2019, apart from climate change policies the economic policy platform of Labor is not dramatically different from that of the Coalition," Dr Oliver said.

"Labor policies including more spending on childcare and aged care offset by various savings imply slightly more net spending and slightly bigger deficits of around $1.85 billion or 0.1% of GDP a year.

"There is not a lot in it and spending has already blown out under the Coalition."

The new government has inherited gross debt close to $1 trillion - much of it accrued pre-pandemic.

"The key economic challenges for the new government relate to inflation, interest rates and housing affordability. Higher inflation and rates argue for faster deficit reduction," Dr Oliver said.

UQ's Dr Bond said debt and deficits hamper some of Labor's wishlist policies.

"As with any new government, there is often a big difference between the promises made while in opposition and the policies that are implemented. The new government will also face a significant budget deficit which will curtail some of their more extreme spending plans," he said.

"Trying to fund their key spending promises may also force the government to look at alternative ways to raise revenue."

Currently it's estimated (ATO) someone with a tax bill of $20,000 spends $582 of that on repaying government debt interest.

A higher RBA cash rate also flows onto how much extra interest the government pays on its debt.

Head photo: Anthony Albanese is sworn in as Prime Minister by Governor-general David Hurley. Source: @AlboMP Twitter

.jpg)

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

Brooke Cooper

Brooke Cooper