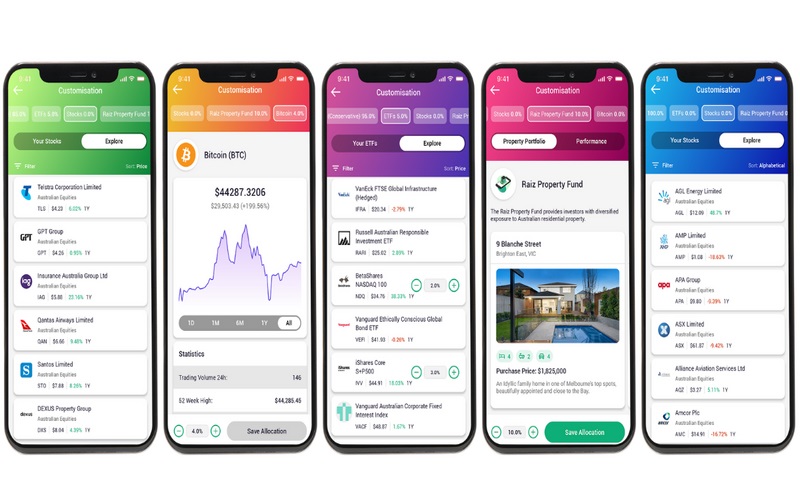

Raiz Plus replaces the previous 'Custom' portfolio, allowing users to fractionally invest in single stocks of top 50 ASX companies for the first time.

It is a similar product to what's available on other microinvesting apps like Sharesies or Stake in that you can buy ASX shares fractionally: you could invest $0.50 in Rio Tinto for example, despite its share price of well over $100.

Raiz is a micro investing platform where users can choose from pre built diversified portfolios.

The original five portfolio options were based on risk, ranging from conservative to aggressive, but several alternatives have been added since.

This includes the Property portfolio, where 30% of the investment goes into the Raiz Property Fund which owns a variety of properties across Australia; the Sapphire portfolio which includes a 5% allocation to bitcoin; and the Emerald option, which sticks to socially responsible investing.

Raiz Plus is a new option where users can incorporate elements of the existing portfolios as well as add fractional investments of top 50 ASX companies and a selection of ETFs.

For example, a Plus portfolio could have 5% allocated to CBA stock, 5% to Wesfarmers, 5% to bitcoin, 30% to the property fund, 20% in ETFs and the remaining 50% invested in the preset 'conservative' portfolio.

Raiz CEO Brendan Malone says Plus allows customers more control over their investments while preserving the accessibility and ease of investing with Raiz.

"Plus brings to the table a product which matches our customers’ growing investing experience while maintaining our easy-to-use design principles," Mr Malone said.

"A key design component of Plus was having the user start with one of our familiar pre-built portfolios as a base, making it a comfortable experience to add as little or as much customisation as they like."

How much does Plus cost?

Raiz differs from the likes of CommSec in that it does not charge brokerage fees per trade.

Instead, there is a monthly fee depending on which portfolio you choose and your account balance.

If you choose the Plus portfolio, you can expect a $5.50 monthly fee if your account balance is below $25,000 (up from $4.50 for the previous Custom option), and an annual charge of 0.275% of your account balance if it exceeds $25,000.

Standard and Sapphire fees also increase

Raiz also announced today rates on some of its other investment options will be increasing from 1 September.

The monthly fee for both Standard and Sapphire portfolios less than $20,000 will increase from $3.50 to $4.50.

Sapphire portfolio holders still also need to pay an annual fee of 0.275% of their balance, regardless of how much is in their account.

In an alert to customers, the Raiz Team said the increases are necessary to ensure compliance with regulations concerning financial products, protect the data and investments of users and continue to meet or exceed expectations.

These rates remain competitive compared to the cost of other micro-investing apps.

| Account fees | Brokerage fees | |

| Bloom | 0.80% per year plus $4.50 per month on balances < $10,000 | None |

| Spaceship Voyager | $2 per month plus annual management fees of up to 0.50% per year depending on your portfolio | None |

| CommSec Pocket | None | $2 per trade up to $1,000, 0.2% of trade value for amounts over $1,000 |

| Sharesies | Can choose between a $5, $10 or $20 monthly plan, which cover trades up to a certain amount | Alternatively, can pay brokerage fees of 1.9% per trade (capped at $5USD for US shares, $6AUD for Aussie shares and $25NZD for NZ shares) |

| Blossom | 1% of initial deposit size once investment has earned at least 5.25% p.a | None |

| Pearler | $1.70 per month to invest in one fund, $2.30 per month to invest in multiple | $6.50 transaction fee to buy or sell Aussie shares plus 0.5% conversion fee between AUD and USD |

| Stake | None | $3AUD for ASX shares up to $30,000, $3USD for US shares to $30,000, 0.01% for trades above $30k for both US and Aussie. 0.7% conversion fee also applies from AUD to USD, minimum $2USD. |

| Dough | $2.99 per month account fee for balances > $50 USD | $4.99 per month for unlimited trading |

Picture by Aidan Hancock on Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

William Jolly

William Jolly