Described as an industry-first, AMP Bank and Bricklet have launched new shared equity support for first home buyers to help them get onto the property ladder sooner.

While the home loan is provided by AMP, the Bricklet platform puts forward one or more investors that contribute to the remainder of the deposit, receiving an equity stake in the property.

The buyer makes the mortgage repayments in addition to paying an occupancy fee to the investor.

AMP Bank Group Executive Sean O’Malley said the bank is targeting borrowers with appropriate income to service the loan but who don’t have a big enough deposit.

“Owning property is an important part of building long-term wealth and financial security, so we are focused on supporting more Australians to take this important step earlier in life,” Mr O’Malley said.

“This offer provides a different option for those who haven’t yet saved a large deposit but are earning enough to meet the ongoing financial commitment of a home loan.

“AMP Bank is pleased to have partnered with Bricklet to support Australians in realising their home ownership aspirations.”

Investors are expected to hold their equity for around five to 10 years, at which time the borrower can choose to buy out the investor portion of the equity, or even sell the property.

To qualify for the loan, applicants must demonstrate they can meet AMP Bank’s lending and serviceability criteria.

The collaboration acts as a private-market alternative to various government shared equity schemes.

Bricklet CEO Darren Younger said while there are plenty of opportunities for homebuyers, there was a gap that needed to be closed.

“One of the main reasons we created this was because a lot of people don’t qualify for government schemes,” Mr Younger explained.

“They either earn a bit too much, have already owned before, don’t meet the price cap, or miss out because spots are limited.

“We’re enabling people to get a mortgage for their home and then rent the remaining piece from an investor.”

The decision to partner with Bricklet forms part of AMP’s strategy to support the bank’s growth, and follows the launch of the digital home loan with Nano.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

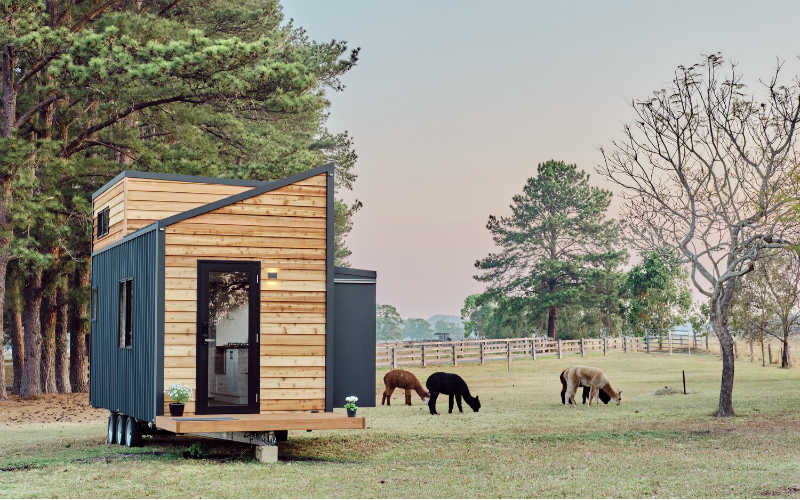

Image by Sebastian Arie Voortman via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Rachel Horan

Rachel Horan

Denise Raward

Denise Raward