William Jolly

William Jolly joined Savings.com.au as a Financial Journalist in 2018, after spending two years at financial research firm Canstar. In William's articles, you're likely to find complex financial topics and products broken down into everyday language. He is deeply passionate about improving the financial literacy of Australians and providing them with resources on how to save money in their everyday lives.

Save Smarter.

Join thousands of Aussies getting smarter with personal finance news, guides, expert insights and more in our regular roundup email.

Recent articles for this author

Average term deposit rate drops in March

Retail term deposit interest rates have fallen on average again in March, following several high profile rate drops from major banks.

William Jolly

William JollyNational dwelling values fall 0.6% in March

ATO tax statistics reveal the richest postcodes, occupations

How to secure your children and grandchildren’s financial future

Australian household wealth suffers biggest fall in over seven years

ING makes changes to both fixed and variable home loan rates

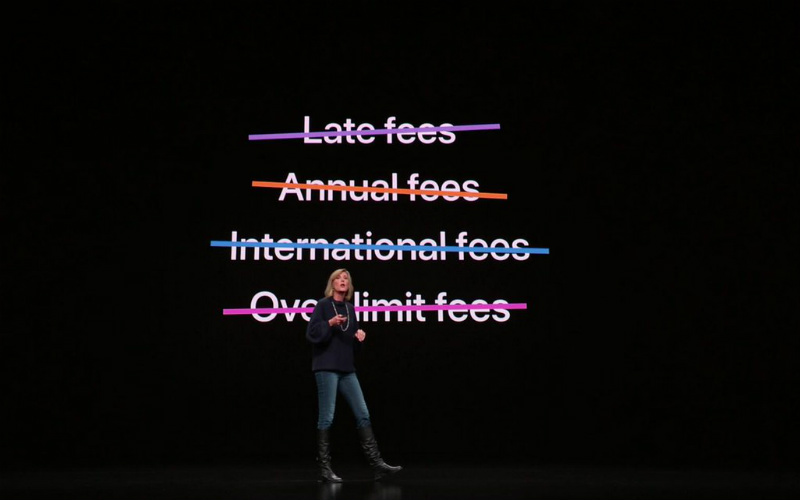

Apple to release its own credit card

Greater Bank changes term deposit interest rates by up to 45 basis points

Loans.com.au lends a hand to first home buyers

Mortgage delinquencies set to rise

What do Australians value the most when choosing where to live?

Home loan, deposit customers flock to mutual banks after royal commission

Spending on flights hits fastest growth in 19 months

March sees abundance of home loan rate changes

Singapore, Paris, Hong Kong: The Economist names the world’s most expensive cities

Young drivers mostly asking parents for first car cash

‘Buy-Now-Pay-Later’ platforms like Afterpay and Zip hit 1.5 million users

‘Bank-xious’: 94% of Australians don’t trust their banks

Intention to purchase new cars declines

ANZ shakes up interest-only home loans

Property buyers expect house prices to continue falling

UBank launches ‘green’ term deposit product

ACTU calls for increase to the minimum wage

Unwanted online purchases costing Australians nearly $400 a year: ME Bank

Australian house values continue to trend lower: CoreLogic

Australian credit card usage falls in January

Macquarie and UBank both drop term deposit rates

Employees could soon choose how often they receive their salary

© 2025 Savings.com.au · AFSL and Australian Credit License Number 515843

The entire market was not considered in selecting the above products. Rather, a cut-down portion of the market has been considered. Some providers' products may not be available in all states. To be considered, the product and rate must be clearly published on the product provider's web site. Savings.com.au, InfoChoice.com.au, YourMortgage.com.au and YourInvestmentPropertyMag.com.au are part of the InfoChoice Group. In the interests of full disclosure, the InfoChoice Group are associated with the Firstmac Group. Read about how InfoChoice Group manages potential conflicts of interest, along how we get paid.

Savings.com.au Pty Ltd ACN 161 358 363 operates as an Australian Financial Services Licensee and an Australian Credit Licensee Number 515843. Savings.com.au is a general information provider and in giving you general product information, Savings.com.au is not making any suggestion or recommendation about any particular product and all market products may not be considered. If you decide to apply for a credit product listed on Savings.com.au, you will deal directly with a credit provider, and not with Savings.com.au. Rates and product information should be confirmed with the relevant credit provider. For more information, read Savings.com.au's Financial Services and Credit Guide (FSCG). The information provided constitutes information which is general in nature and has not taken into account any of your personal objectives, financial situation, or needs. Savings.com.au may receive a fee for products displayed.

Explore the InfoChoice Group network: InfoChoice · Your Mortgage · Your Investment Property

Our company, Savings.com.au, has obtained accreditation as a data recipient for the Consumer Data Right (CDR). You can view our CDR policy by clicking on this link.

Important information

Savings.com.au provides general information and comparison services to help you make informed financial decisions. We do not cover every product or provider in the market. Our service is free to you because we receive compensation from product providers for sponsored placements, advertisements, and referrals. Importantly, these commercial relationships do not influence our editorial integrity.

For more detailed information, please refer to our How We Get Paid, Managing Conflicts of Interest, and Editorial Guidelines pages.

At Savings.com.au, we are passionate about helping Australians make informed financial decisions. Our dedicated editorial team works tirelessly to provide you with accurate, relevant, and unbiased information. We pride ourselves on maintaining a strict separation between our editorial and commercial teams, ensuring that the content you read is based purely on merit and not influenced by commercial interests.

Learn more about our commitment to editorial integrity in our Editorial Guidelines.

Our service is free for you, thanks to support from our partners through sponsored placements, ads, and referrals. We earn compensation by promoting products, referring you, or when you click on a product link. You might also see ads in emails, sponsored content, or directly on our site.

For more details, see How We Get Paid.

We strive to cover a broad range of products, providers, and services; however, we do not cover the entire market. Products in our comparison tables are sorted based on various factors, including product features, interest rates, fees, popularity, and commercial arrangements.

Some products will be marked as promoted, featured or sponsored and may appear prominently in the tables regardless of their attributes.

Additionally, certain products may present forms designed to refer you to associated companies (e.g. our mortgage broker partner) who may be able to assist you with products from the brand you selected. We may receive a fee for this referral.

You can customise your search using our sorting and filtering tools to prioritise what matters most to you, although we do not compare all features and some results associated with commercial arrangements may still appear.

For more details, visit How We Get Paid and Managing Conflicts of Interest.

For home loans, the base criteria include a $500,000 loan amount over 30 years. For car loans, the base criteria include a $30,000 loan over 5 years. For personal loans, the base criteria include a $20,000 loan over 5 years. These rates are only examples and may not include all fees and charges.

*The Comparison rate is based on a $150,000 loan over 25 years. Warning: this comparison rate is true only for this example and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Monthly repayment figures are estimates that exclude fees. These estimates are based on the advertised rates for the specified term and loan amount. Actual repayments will depend on your circumstances and interest rate changes.

Monthly repayments, once the base criteria are altered by the user, will be based on the selected products’ advertised rates and determined by the loan amount, repayment type, loan term and LVR as input by the user/you.

Savings.com.au is proudly part of the InfoChoice Group, which includes InfoChoice.com.au, YourMortgage.com.au, YourInvestmentPropertyMag.com.au, and PerformanceDrive.com.au. The InfoChoice Group is associated with the Firstmac Group.

We may include products and services from loans.com.au, CarLoans.com.au, OnlineAuto.com.au, and YourMortgageBroker Pty Ltd, all associated with the Firstmac Group. Importantly, these brands are treated like any other commercial partner.

Learn more about how we manage conflicts of interest.

The information provided by Savings.com.au is general in nature and does not take into account your personal objectives, financial situation, or needs. We recommend seeking independent financial advice before making any financial decisions. Before acquiring any financial product, obtain and read the relevant Product Disclosure Statement (PDS), Target Market Determination (TMD), and any other offer documents.

Rates and product information should be confirmed with the relevant credit provider. For more information, read Savings.com.au’s Financial Services and Credit Guide (FSCG).

Get rate alerts

Stay up to date with the latest rate movements across home loans, term deposits, savings accounts and more.

By subscribing you agree to our privacy policy.

Save Smarter

Join thousands of Aussies getting smarter with personal finance news, guides, expert insights and more in our regular roundup email.

By subscribing you agree to our privacy policy.

Send me the pod

Never miss an ep! Receive episode alerts plus special invites to have your questions or savings tips read out on the show.

By subscribing you agree to our privacy policy.

.jpg)