Whether you're saving for a house deposit or struggling to make ends meet, doing up a budget and sticking to it is one of the simplest ways to get more money in your pocket.

An InfoChoice savings survey found more than one-in-four of Aussies don't budget at all, while nearly one-in-six have less than $1,000, and one-third have less than $5,000 in savings. Maybe not a coincidence that these numbers are similar

For those that do budget, the most popular method is to whip up a spreadsheet. You might be used to doing up your own Excel spreadsheet or even whipping out a pen and paper, but there are also a bunch of personal finance apps out there you might find can simplify the process for you.

In no particular order, here are some of the most popular budgeting and savings apps available to Australians.

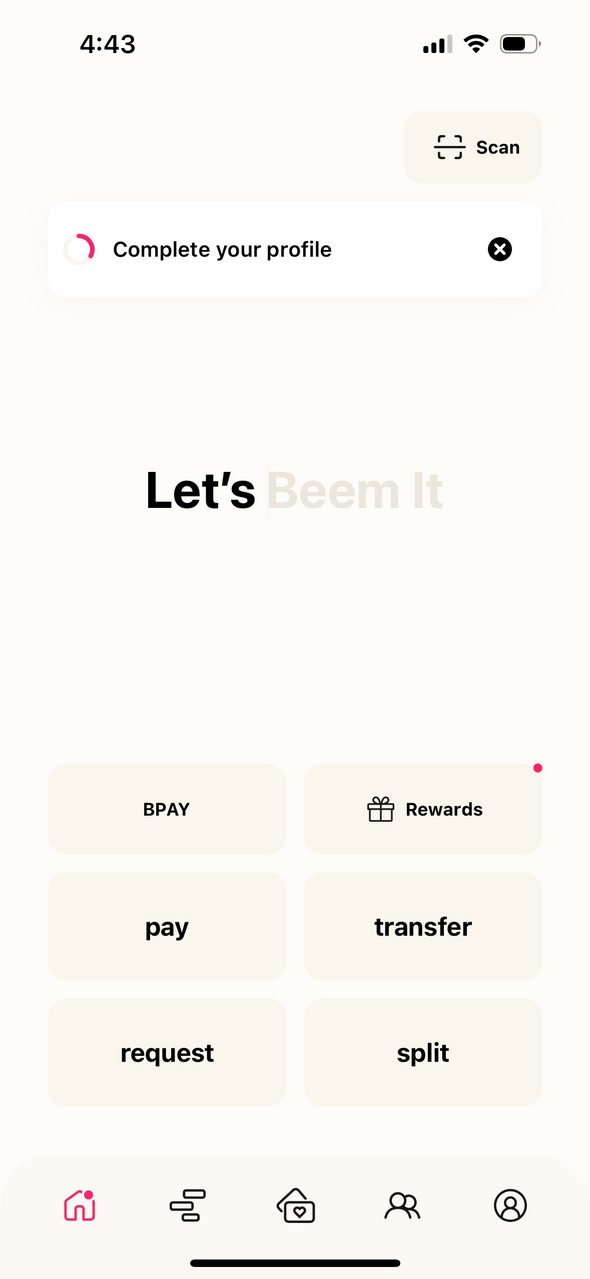

1. Beem

Availability: iOS and Google Play.

App store rating: 4.9 stars

Google Play rating: 4.4 stars

Cost: Free

Beem (owned by Eftpos) is a free-to-download mobile payment app that helps solve awkward "hey-you-owe-me-this-much" moments.

Users can send and request money from one another, and if both parties are with banks that use payment services like Osko that transfer can be instant. The app also comes with a tracking and splitting feature for shared bills or group expenses, perfect for couples, families, or housemates. You can also sometimes earn Beembucks on select purchases which you can withdraw back into your bank account.

Key features of Beem:

-

Split, transfer and get paid instantly - with no added fees.

-

Track and split expenses between mates without any chasing required.

-

BPAY is built-in so you know where your money is going and when it's going to land.

-

Information is encrypted so people can't access it.

2. Buddy

Availability: iOS.

App store rating: 4.6 stars

Cost: Free to download, however users must pay a subscription to unlock full functionality. Buddy Premium costs $4.99 per month or $34.99 per year.

Buddy is a Swedish budgeting app that helps you set up a budget and keep track of your expenses. Individuals can invite their friends, family, and partners into their budgets to keep on top of expenses and get a clear picture on who spends what.

Users can also import all their transactions from their bank accounts to see how their budget is doing.

Key features of Buddy:

-

Sync from Australian bank accounts.

-

Split function allows you to see who paid what and how to settle up the bill.

-

Simple, yet detailed overview of your spending, income, and savings.

-

Users can create their own categories and choose the colour themes of the app.

-

Can set up multiple accounts as well as any debt to see total net worth.

3. Cashrewards

Availability: iOS and Google Play.

App store rating: 4.8 stars

Google Play rating: 4.7 stars

Cost: Free

The main rival to ShopBack is Cashrewards, helping Aussies save at over 2,000 stores nationwide. In similar fashion, shoppers can receive cashback when they shop online or in-store with popular brands such as Myer, The Iconic, Uber Eats, Apple, Amazon, and more.

Once your cashback is approved by a retailer, Cashrewards will pay it straight into your Cashrewards account, which can then be transferred to your PayPal or bank account.

Key features of Cashrewards:

-

Cashback on online or in-store purchases.

-

Partnerships with more than 2,000 stores.

-

Free cashback in your bank account.

-

Push notifications for offers relevant to you.

-

ANZ debit or credit cards unlock Max rewards.

4. Frollo

Availability: iOS and Google Play.

App store rating: 4.0 stars

Google Play rating: 3.1 stars

Cost: Free

Frollo lets you connect your bank accounts, credit cards, loans, superannuation and investments into a single interface where you can monitor your spending. It also lets you take daily, weekly, and monthly challenges to try and save money. Customers can turn on tips and notifications - reminding you of upcoming bills is one example that might be pretty useful.

The budgeting app also has a Financial Passport feature that give users an overview of their income, expenditure, assets and liabilities for the past 12 months. This can help you to get a better understanding of your financial position and borrowing power. You can also share your Financial Passport via PDF which could be useful if you're meeting with a mortgage broker or financial advisor.

Key features of Frollo:

-

Sync from Australian bank accounts using Open Banking - including superannuation and investments.

-

Automatic categorisation for transactions.

-

Set savings goals and challenges.

-

Push notifications and personal insights.

-

A dashboard for tracking your net worth.

-

Bank-level security and encryption.

-

Track tax-deductible expenses.

Looking to put your savings to work for you? Below is a selection of the savings account products available in Australia at the moment, with some of the strongest rates.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

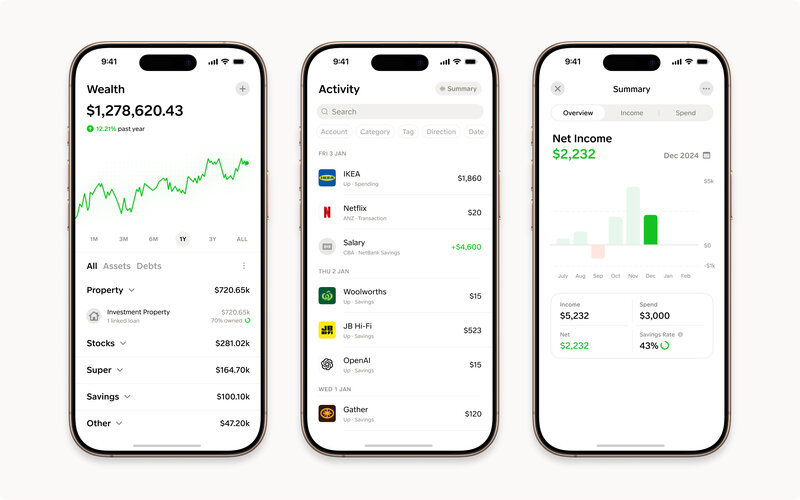

5. Gather

Availability: iOS

App store rating: 4.7 Stars

Cost: Paid plans from $9.99 per month

Gather is another app that combines all your different financial information into one platform. Users can link their bank accounts, loans, stock and even crypto portfolios, then the app combines the information to present you with effectively your own balance sheet, showing your current assets and debts.

One cool feature that differentiates Gather is its tax return assistant. You can use the app to search through your account statements to find potential tax deductions to maximise your savings each year.

Gather began as an invite-only platform in December 2024. By the time it launched in April, it says there was already $181 million in total wealth on the platform, and that 90% of customers report feeling less financially anxious after starting up.

As one of those beta testers, I can confirm that so far I've found Gather helpful - when trying to find tax deductions it has been significantly easier than searching through my statements using the CommBank app.

Key features of Gather:

-

Sync with Australian bank accounts

-

Linkable to stock and cryptocurrency portfolios

-

Breaks down assets and debts

-

Offers quick smart search through your bank statements for past transactions

-

Has a 'tax feature' that helps you find deductions and information to help you figure out what you can and can't claim.

6. Get Reminded

Availability: iOS and Google Play.

App store rating: 4.5 stars

Google Play rating: 5 stars

Cost: Free

GetReminded claims it can help households save thousands per year by reminding them when household contracts and bills such as utility bills, car insurance and registration, and subscriptions are set to expire.

As GetReminded co-founder David Wareing has previously told Savings.com.au, it can also show you cheaper policy options.

"They're [the suggestions] obligation-free, but they're really just there to help consumers to commence the shopping-around process and not leave everything to the last minute," he said.

Alerts are sent to your phone and email with the relevant advertisers' offers so you can start shopping around straight from the app.

Key features of GetReminded

-

Set reminders in multiple categories across all household costs (insurance, health, personal expenses etc.).

-

Annual cost summaries for household contracts.

-

Simple, easy-to-use interface.

-

Multiple automated reminders ahead of time and when you need them.

-

Can recommend cheaper policies.

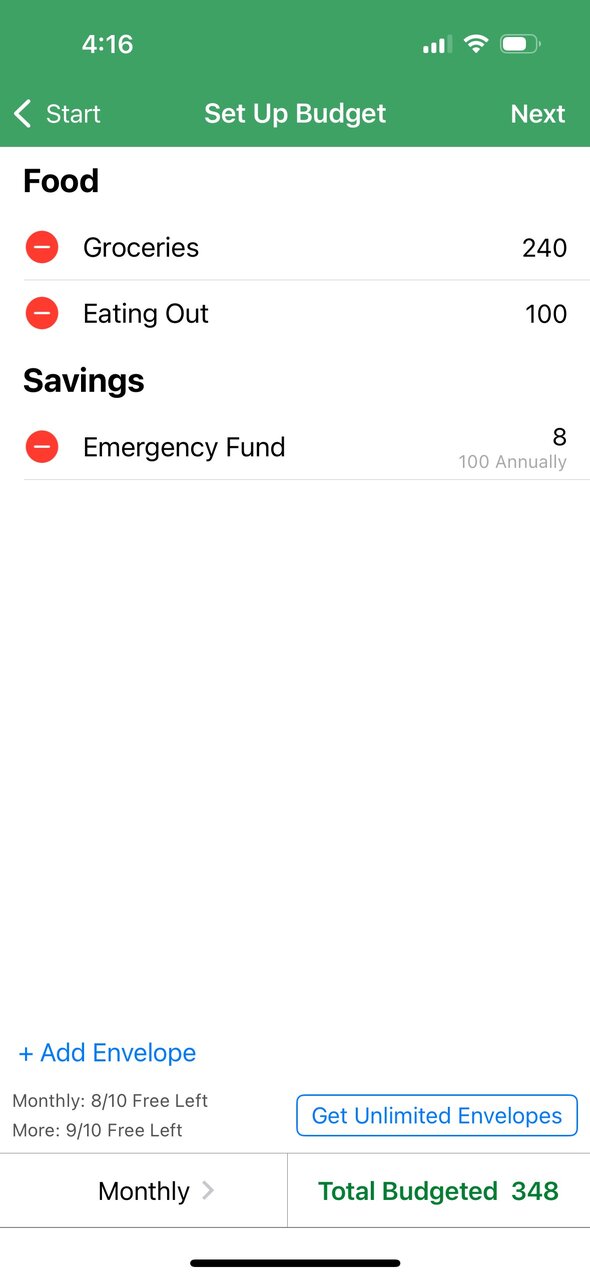

7. Goodbudget

Availability: iOS and Google Play.

App store rating: 4.6 stars

Google Play rating: 4.3 stars

Cost: Free basic plan, with a paid plan costing US$8 per month or US$70 per year.

Goodbudget is an app based on the 'envelope' method of saving, where the cash for each month's expenses is divided into envelopes for different budget categories. You might have one for groceries, one for your home loan, one for your daily coffee, you get the idea. You create your 'envelopes' and set a budget for each - the idea is you then don't spend more on that spending category than is in your envelope over a certain period. You can sync your account up with your partner's as well so you can both see what's going on.

Goodbudget doesn't link to your bank account, or allow you to actually transfer money into the envelopes. You set it all up and then manually put in transactions as you incur them to track your spending. If you overspend the envelope balance goes negative and red.

The free version allows one account, two devices, and up to 10 'envelopes'. Meanwhile, the paid version allows unlimited envelopes and accounts, and up to five devices.

Key features of Goodbudget:

-

Simple way to get started with budgeting

-

Export data to Microsoft Excel.

-

View your spending by category

-

Reports, such as an income vs spending report.

-

Spending analysis for each envelope, including pie-charts.

-

Schedule transactions and automatic envelope fills.

8. ShopBack

Availability: iOS and Google Play.

App store rating: 4.7 stars

Google Play rating: 3.5 stars

Cost: Free

If you like shopping online, ShopBack can help you save money with cashback deals from more than 4,000 stores. Consumers can earn up to 30% cashback on their everyday online shopping with the funds instantly added to your ShopBack account, and you can easily transfer them to your nominated bank or PayPal account.

Alternatively, you can buy some stuff within the app, including gift cards, movie tickets, and dining vouchers.

Using the mobile or web app gives you access to the latest coupon codes and deals from popular brands like Woolworths, eBay, The Iconic, Uber Eats, Myer, Booking.com and more.

Key features of ShopBack:

-

Up to 30% cashback on online purchases.

-

Partnerships with more than 4,000 stores.

-

Free cashbacks to your bank account.

-

Push notifications for offers relevant to you.

9. WeMoney

Availability: iOS and Google Play.

App store rating: 4.5 stars

Google Play rating: 4.5 stars

Cost: Free basic plan, with the paid WeMoney Pro costing $9.99 per month (first 7 days free).

The WeMoney platform allows users to combine all their financial accounts into one place, including:

-

Savings and transaction accounts

-

Credit cards and buy now, pay later

-

Home loans and personal loans

-

Share trading accounts

-

Superannuation funds

As well as tracking net worth, WeMoney also allows users to:

-

Track their credit score

-

Create budgets within the app

-

Receive upcoming bill reminders

-

Connect with other users in the community to receive tips

Through the app, you can automatically categorise your transactions, track your bills and subscriptions, and set monthly budgets and money goals. WeMoney claims the average member improves their credit score by 63 points just 9 months after signing up to their service.

WeMoney doesn't sell your data to third-parties, and comes with Fingerprint, FaceID, and PIN logins.

Bank savings apps

Depending on which bank you're with, you may not even need any of these apps. More banks are opting to roll with the times, bringing out their own budgeting and saving apps to better integrate their product portfolios. All of the big four banks now have some sort of budgeting feature available on their respective apps.

| Budgeting tool | Service | |

|---|---|---|

| CommBank | Money Plan | Tracks spending and saving, allows you to set goals |

| Westpac | Cash flow/Top categories | Tracks expenses by category, trends in cash flow |

| NAB | NAB Spending | Tracks expenses by category |

| ANZ | ANZ Plus | Tracks expenses, offers guidance from financial wellbeing coaches. |

A common feature being rolled out by financial institutions now is the 'roundup' feature, which can round up every debit card transaction to the nearest dollar and direct these 'roundups' to your savings account. Passive saving like this can be a great way to make progress towards your goals every day, usually without even realising it.

Frequently asked questions (FAQs) about budgeting

What is a budgeting app?

A budgeting app is software designed to help users track income, expenses, savings, debt, financial goals and better manage monthly cashflow. Users might be able to better control over their finances, make informed spending decisions, and work towards achieving their saving goals.

Some budgeting apps synchronise with your bank accounts to provide an overview in real-time when finances change.

How to choose a budgeting app

With plenty of options out there, it can be hard to work out which budgeting app is the right one for you. While it will be different for everyone based on priorities, these are some of the most important things to consider.

-

User-friendly interface - Look for a budgeting app with an intuitive and user-friendly interface. You want an app you find easy to navigate and understand, allowing you to input and access your financial data effortlessly.

-

Compatibility - A budgeting app only available on Google Play isn't much use if you have an iPhone.

-

Security and privacy - Since budgeting apps deal with sensitive financial information, security is crucial. Choose an app that implements robust security measures, like Open Banking, data encryption, password protection, and two-factor authentication, to safeguard your financial data.

-

Expense tracking options - Check whether the app allows manual input of transactions or has the ability to connect to your bank accounts for automatic expense tracking. Automatic tracking can save time and provide a more accurate picture of your finances.

-

Goal-setting and tracking - If you have specific financial goals, look for an app that supports goal-setting features. The app should allow you to define goals, track progress, and offer insights to help you stay on track.

-

Reporting and insights - A good budgeting app should present your financial data in charts or graphs, making it easier to analyse your spending patterns and identify areas you can improve.

-

Notifications - Check if the app can send you alerts or notifications to keep you informed about your financial progress, upcoming bills, or when you exceed budget limits.

-

Cost/fees - Some budgeting apps are free, while others may have subscription plans or one-time purchase fees. Evaluate the cost and features to determine if it's worth squeezing into your budget.

But remember, before you select the one for you, be sure to consider what your needs and goals are first. Are you looking to save for a specific goal, track your daily expenses, or pay off debts? This way, you can refine your search to tailor your needs.

Some are for saving, some are for saving money on your shop, while others are for splitting bills or investing. Pick one area that you need a little boost with and go from there. For example, if you're strictly trying to save, it's no use downloading a cash-back app that may encourage you to shop for clothes.

How should I organise my budget?

Budgeting apps can be great for helping you organise your budget, but how you organise it normally remains at your discretion. For some people, budgeting means ruthlessly cutting every bit of unnecessary, living as ascetic a lifestyle as possible in pursuit of long term goals.

Others might hold on to luxuries like a cocktail every now and then, or a Netflix subscription. There really isn't a right answer, and you'll probably need to do a bit of soul searching to figure out what your priorities are.

If you're struggling with this, in The Barefoot Investor, author Scott Pape suggests the 'bucket' strategy, with the following percentage splits:

-

60% to your 'Blow Bucket' - which is for everyday expenses like your rent, home loan repayments, utilities, and food.

-

10% to your 'Splurge Bucket' - which is for things that make you feel good, like socialising or buying new clothes.

-

10% to your 'Smile Bucket' - which is used for savings for fun, longer-term goals like a holiday.

-

20% to your 'Fire Extinguisher Bucket' - which is also for your long-term savings goals, but the less fun ones (house deposit, debt, paying off your mortgage quicker).

Or, in the '50/30/20' method, you spend 50% of your income on your needs and necessities, 20% on savings or debt payments, and 30% on wants like entertainment, eating out, shopping, and travel. Or if you're feeling miserly, swap the last two around.

Read More: How to budget: the ultimate guide to budgeting & saving

First published on July 2022

Image by cottonbro via Unsplash

Harrison Astbury

Harrison Astbury

Emma Duffy

Emma Duffy