The latest car sales results, as per the Federal Chamber of Automotive Industries (FCAI), showed a strong end to 2020, with the second consecutive month of an uptick in sales - 13.5% overall.

The majority of sales went to SUVs and utes, which made up nearly three quarters of all vehicles sold in December.

Despite this, the results were a mixed bag for alternative fuel vehicles throughout the year.

There were just 1,769 electric vehicles sold in 2020, just 246 more than in 2019, in contrast with more than 650,000 petrol vehicles sold in 2020.

This is despite exciting new electric model releases such as the Hyundai Kona and MG ZS, the most affordable electric SUV in Australia.

In contrast, hybrid models sold more than 60,000 units in 2020, an uptick of 93.7%, while plug-in hybrids sold 1,685 units - an uptick of 18.2%.

In October, an FCAI spokesperson told Savings.com.au range anxiety and lack of incentives remained the biggest barriers to electric vehicle entry in Australia.

"EVs do remain more expensive, too, and the lack of government incentivisation – which can take various non-financial forms as well as financial – and the lack of infrastructure can impact on their appeal to the new alternative drive train consumer," they said.

Australia lags in electric vehicle uptake when compared globally - a recent report by The Independent shows in Norway, electric vehicles accounted for 54% of all vehicle sales in 2020.

The Norwegian EV Association estimates electric vehicles could amount to up to two thirds of all cars sold there in 2021.

These figures could largely be due to Norway vowing to ban the sale of petrol and diesel cars by 2025.

The Audi E-Tron was the most popular electric model sold in Norway in 2020, which retails for 599,000 Krone, or about $91,000 Australian dollars.

It retails for more than $150,000 in Australia, and there were just 64 E-Trons sold in Australia in 2020, while more than 9,000 were sold in Norway.

In the Nordic country, there are a variety of incentives to go electric - no import taxes, exemption from the 25% VAT (GST), no annual road tax, no charges on toll roads, and more.

Australia, by contrast, has few incentives - nationwide there is a slightly higher luxury car tax threshold for green vehicles, on top of just a few state-based registration discounts.

In the United States, too, there is a national purchasing credit up to $7,500 for an electric vehicle.

There are also some states with significant incentives, including California where there's a $4,500 tax break up for grabs if a motorist with a maximum income of $150,000 purchases an electric vehicle.

Range anxiety could also be less of a factor in Norway given that the country is only 385,000 sq km in size.

New South Wales alone is more than double that at 800,000 sq km.

From one end of Norway to the other (Oslo to Tromso), it takes 22 hours to drive, or approximately 1,600km.

Brisbane to Cairns takes approximately 19 hours over 1,700km without leaving the state.

In Norway, too, 1.7 million of its 5.3 million population live in the Oslo metropolitan area alone.

To tackle range anxiety in Australia, the Government has plans for better-spaced charging stations on the eastern seaboard, with the aim of having a network of chargers no more than 200km between each other.

Until then, hybrids can remain a decent intermediary vehicle choice, according to the FCAI.

"We can sometimes think of PHEVs and hybrids as a stepping stone to pure electric vehicles. Because they generally have back up ICEs [internal combustion engines], hybrid or PHEVs are more similar to a ‘normal’ drivetrain that consumers are used to," they told Savings.com.au in October.

"They do not have range anxiety issues and are more easily accepted."

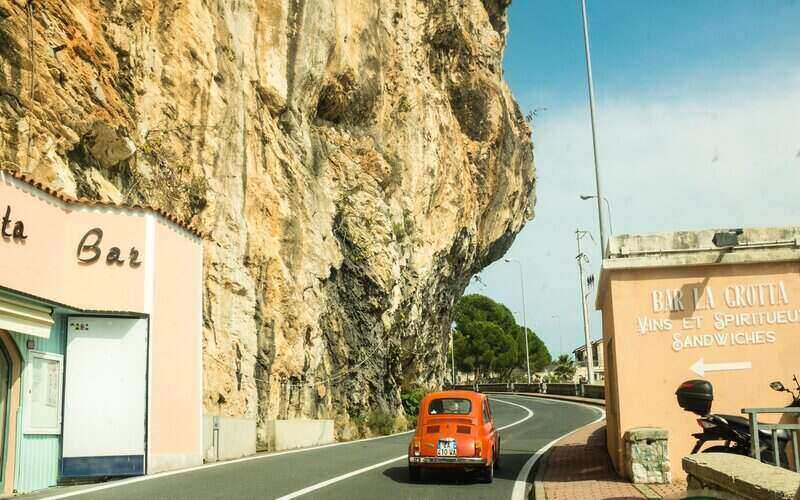

Photo by Thomas Hetzler on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Harrison Astbury

Harrison Astbury